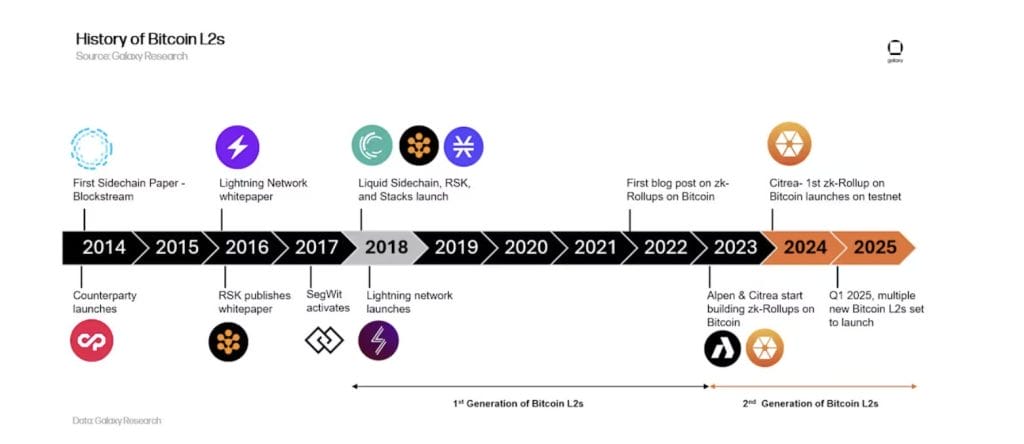

Bitcoin Layer-2 (L2) initiatives skilled substantial progress, significantly as decentralized finance (DeFi) use instances expanded inside the Bitcoin ecosystem.

A November 2024 report by digital asset platform Galaxy revealed that Bitcoin L2 networks elevated from simply 10 in 2021 to 75 in 2023.

The report additional said that over 36% of all Bitcoin Layer-2 enterprise funding had been raised in 2024. It additionally projected that greater than $47 billion price of BTC might be bridged into Bitcoin L2s by 2030.

Early Bitcoin Adopters Have But to Totally Embrace L2s

Regardless of rising curiosity, trade specialists imagine Bitcoin L2s stay missed.

Willem Schroé, CEO and co-founder of L2 community Botanix Labs, instructed Cryptonews that many early Bitcoin adopters have held onto their BTC for years with out using its on-chain potential.

“Bitcoin ‘hodlers’ can earn passive, low-lift yield with out promoting their BTC,” Schroé stated. “L2 programmability permits Bitcoiners to take part in DeFi-like ecosystems – whether or not by means of lending, staking, or offering liquidity – whereas nonetheless securing their property on Bitcoin’s base layer.”

Regardless of its potential, the Bitcoin L2 idea stays advanced for a lot of customers.

Rena Shah, chief working officer of Bitcoin developer ecosystem Belief Machines, instructed Cryptonews that the Bitcoin group should first deal with what Layer-1 (L1) customers want earlier than selling L2 adoption.

“Many have spent years in ‘hodl’ mode, believing their Bitcoin was the very best hedge towards issues like inflation,” Shah stated. “However what the Bitcoin L2 area has now finished is spotlight that Bitcoin shouldn’t be missed as a productive asset.”

Bitcoiners Will Put Their BTC to “Work” This 12 months

In line with DeFiLlama, the present complete worth locked (TVL) in Bitcoin is $6.618 billion. Business specialists imagine that as L2 options mature, Bitcoin holders will start using their BTC extra actively.

“For years, Bitcoin has largely been considered as a retailer of worth, with most holders merely HODLing, leaving trillions of {dollars} in dormant capital,” Schroé remarked. “Nevertheless, Bitcoin L2s are altering that by introducing programmability and monetary utility with out compromising safety.”

As Layer 2 options turn out to be extra extensively used, we will anticipate:

A rise in Bitcoin customers

Recent Functions for Bitcoin

Bitcoin integrating into more moderen monetary methods

Sooner or later, these modifications would possibly enhance the use and recognition of Bitcoin.— CryptoAlpha (@PushAlt88) February 14, 2025

Schroé added that quite than requiring customers to wrap Bitcoin onto Ethereum or different chains, new Bitcoin-native options will enable BTC to generate yield instantly on Bitcoin infrastructure by means of lending, staking, and liquidity provisioning.

“This opens the door for Bitcoiners to place their property to work with out shedding publicity to the asset they belief most,” he stated.

Bitcoin L2s Advance to Enhance Safe DeFi

New requirements are rising to enhance Bitcoin Layer 2 options. Kevin Liu, co-founder of the Bitcoin L2 agency GOAT Community, instructed Cryptonews that the introduction of BitVM good contracts represents a key milestone for Bitcoin’s scalability and programmability.

Each Bitcoin L2 solely earns that standing when it inherits native Bitcoin safety. Meaning adopting BitVM for its bridge.

Many are constructing. Somewhat than working behind closed doorways, we wished a enjoyable method for everybody to strive it out.

Welcome to GOAT Community's BitVM2 Playground! pic.twitter.com/NhsWRKc3JR— GOAT Community

(@GOATRollup) January 21, 2025

“The BitVM customary seeks to advance good contract capabilities on the Bitcoin community,” Liu stated. “A Layer 2 community that builds its canonical bridge with BitVM expertise goals to inherit native Bitcoin safety, the identical method a number one Ethereum Layer 2 community equivalent to Arbitrum builds its bridge on a sure customary to inherit native safety from the Ethereum mum or dad chain.”

Liu added that GOAT Community just lately launched its BitVM2 Playground, permitting customers and builders to check an MVP model of BitVM2 expertise.

“A full testnet model of GOAT Community’s BitVM2 product will go reside within the subsequent few weeks, with full mainnet deployment deliberate for later this 12 months,” Liu stated. “Our objective is to rework two of essentially the most worthwhile and standard digital currencies – BTC and DOGE – from passive property that you could solely purchase and maintain into lively, yield-bearing property that ship actual BTC returns.”

In the meantime, Bitlayer’s Finality Bridge is about to launch a testnet implementation of the BitVM protocol.

The bridge leverages BitVM good contracts, fraud proofs, and zero-knowledge proofs, permitting Bitcoin funds to be securely locked in addresses ruled by a BitVM good contract.

This technique operates below the premise that no less than one participant will act truthfully, decreasing the belief necessities historically related to third events overseeing BTC funds.

Schroé emphasised that Bitcoiners prioritize safety and decentralization over speedy growth.

“In contrast to Ethereum’s DeFi sector, which relied on new capital inflows, Bitcoin’s monetary layer is tapping into present Bitcoin holders who’ve been ready for a option to activate their BTC with out promoting it,” he stated. “For this reason trust-minimized approaches are gaining momentum.”

As these options turn out to be extra accessible and well-integrated, Schroé expects Bitcoin L2s to bridge the hole between passive holding and lively participation in on-chain monetary alternatives.

Worth Will Be Gained From Bitcoin This 12 months

Lengthy-time Bitcoin holders have been cautious about DeFi, however 2024 may provide new incentives for engagement.

Brian Mahoney, co-founder of full-stack Bitcoin resolution Mezo, instructed Cryptonews that the Layer-2 area has matured to the purpose the place builders can start constructing decentralized functions (dApps) targeted on Bitcoin liquidity.

Bitcoin-native is our promise.

Borrow mUSD utilizing your BTC wallets now obtainable on @unisat_wallet, @pockets, and @XverseApp.

Uncover testnethttps://t.co/CBXE2TR3JX pic.twitter.com/5uFKyV2ynE

— Mezo (@MezoNetwork) February 13, 2025

For instance, Mahoney famous that Mezo is reshaping the Bitcoin mortgage mannequin by permitting customers to earn yield on Bitcoin by staking it as collateral. Customers may also withdraw funds immediately when wanted.

“As extra establishments categorical curiosity in providing Bitcoin lending as a service, L2s will play a important function within the safety and scalability of Bitcoin inside a monetary ecosystem the place conventional finance (TradFi) and DeFi interoperate,” Mahoney stated.

Bitcoin staking platforms, equivalent to Solv Protocol, are increasing Bitcoin liquidity throughout a number of chains. Shah identified that retail traders are more and more searching for methods to build up extra Bitcoin.

“We’re seeing a brand new consumer persona – the ‘accumulator’ who will take reasonable threat to accumulate extra Bitcoin, ” she commented.

Shah believes that borrowing stablecoins towards BTC by means of platforms like Granite will likely be a development this 12 months.

“Customers will then leverage these stablecoins for farming in different avenues (memecoins, restaking, yield vaults), taking income, and finally buying extra BTC,” Shah stated.

Nevertheless, Schroé believes that the following wave of adoption received’t come from retail hypothesis.

Somewhat, he thinks it will come from Bitcoiners discovering methods to make their BTC work for them – with out compromising on safety, decentralization, or sovereignty.

Bitcoin maximalists have lengthy considered DeFi with skepticism, however 2025 might be the 12 months they take a re-assessment.

With security-first options gaining traction, BTC holders could lastly have the instruments to place their property to work whereas sustaining the ideas that made Bitcoin dominant within the first place.

If the Layer-2 sector delivers on its promise, this 12 months may mark a quiet however main shift in how Bitcoin is used.

The submit Bitcoin Layer-2 Sector Is Neglected: Why and What to Count on Transferring Ahead appeared first on Cryptonews.