Bitcoin’s current momentum is displaying indicators of stabilization, however a significant rebound in demand has but to materialize, in keeping with on-chain analytics agency CryptoQuant.

Whereas the contraction in Bitcoin’s spot demand has slowed, demand metrics stay weak, and broader market indicators counsel continued hesitation amongst traders.

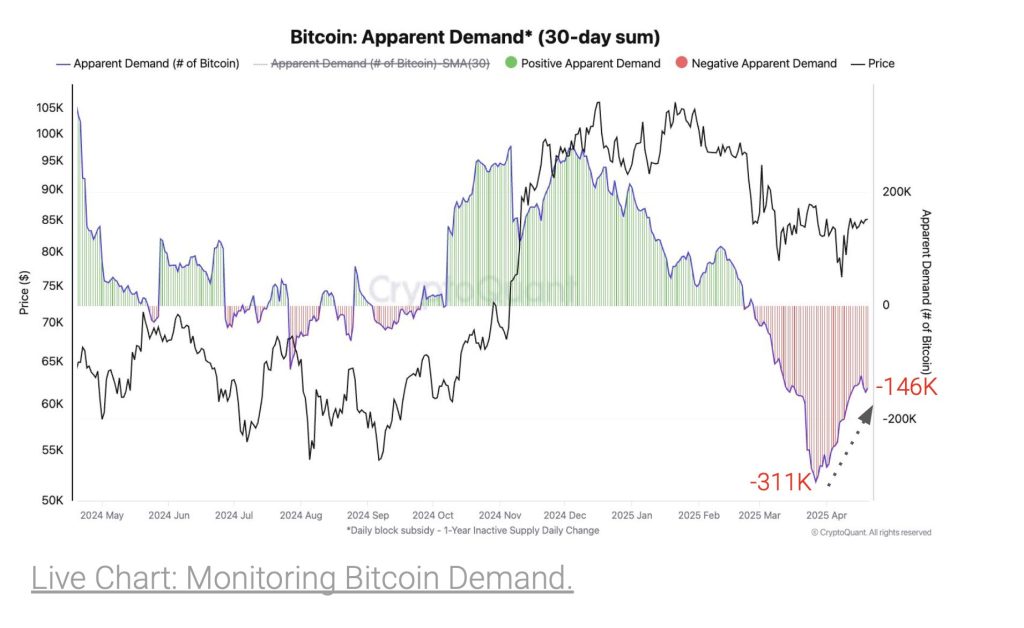

Over the previous 30 days, Bitcoin’s obvious demand has declined by 146,000 BTC, a visual enchancment from the sharper 311,000 BTC drop recorded on March 27.

Nevertheless, demand momentum—which tracks the extent of shopping for by new traders relative to long-term holders—has deteriorated additional. It’s now down by 642,000 BTC, marking essentially the most unfavorable studying since October 2024.

Analysts warn that for Bitcoin to renew a sustainable rally, each demand and momentum should not solely stabilize however return to constant constructive progress.

ETF Inflows Flatline Amid Weakened Institutional Curiosity

Institutional participation via U.S.-based spot Bitcoin ETFs has additionally plateaued, indicating a broader cooling in urge for food.

Since late March, web purchases by these ETFs have fluctuated between -5,000 and +3,000 BTC per day—effectively beneath the highs of 8,000+ every day inflows recorded throughout the bullish surge of November–December 2024.

Comparative knowledge additional reveals the dimensions of this slowdown: U.S. Bitcoin ETFs have bought a web 10,000 BTC thus far in 2025. That is in stark distinction to the identical interval in 2024, once they had bought a web 208,000 BTC.

Market analysts counsel that elevated ETF participation is a key part for reigniting upward value momentum, which stays missing.

Including to the warning, giant Bitcoin holders have begun to cut back their positions. Their collective holdings have decreased by roughly 30,000 BTC over the previous week, and their month-to-month accumulation fee has dipped from 2.7% in late March to simply 0.4%—the slowest tempo since February 20.

Liquidity Progress Nonetheless Lags Market Wants

Whereas crypto market liquidity is increasing modestly, it’s doing so beneath development. USDT market cap, a extensively used proxy for crypto liquidity, has grown by $2.9 billion during the last two months.

Nevertheless, this improve falls in need of the $5 billion benchmark usually related to sturdy Bitcoin rallies. It additionally stays beneath the 30-day transferring common, emphasizing ongoing liquidity constraints.

Value-wise, Bitcoin is dealing with technical resistance across the $91,000–$92,000 vary, corresponding with the dealer’s on-chain realized value stage.

This metric can function both assist or resistance, relying on market sentiment. For now, prevailing bearish situations counsel it’s performing as a ceiling, additional capping upside potential.

The put up Bitcoin Demand Momentum Drops 642K BTC as ETF Inflows Dry Up: CryptoQuant appeared first on Cryptonews.