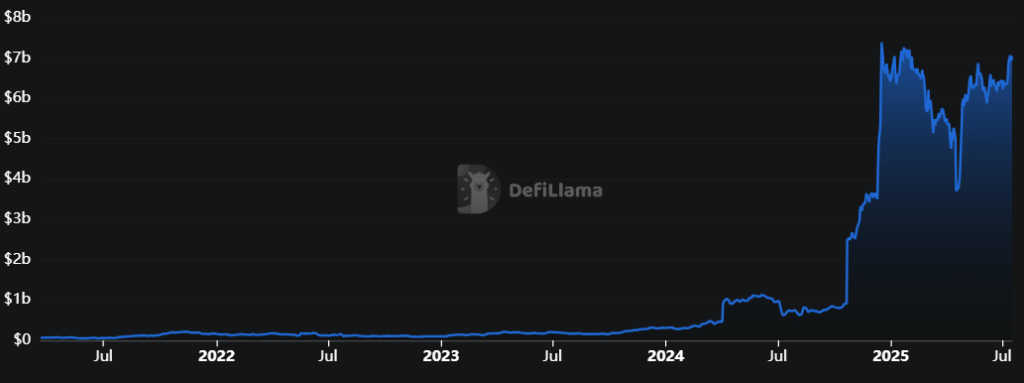

Bitcoin decentralized finance (DeFi) has seen a large 1,971.7% rise in complete worth locked (TVL) over only a yr and a half, based on the most recent report by Arch Community.

Per the report, Bitcoin DeFi has recorded a large TVL surge over an 18-month interval between January 2024 and July 2025.

Extra exactly, it elevated from $307 million in January 2024 to $6.5 billion by December 2024. It then settled at $6.36 billion as of early July 2025.

On the time of writing, TVL stands at $7.049 billion. This is able to mark a whopping 2,196% rise for the reason that December 2024 quantity.

The report famous that the surge was fueled by a number of key elements. These embody protocol launches, novel token requirements, rising institutional inflows, a rally pushing BTC to an all-time excessive, and the rise of liquid restaking.

Furthermore, Ethereum has been the undisputed DeFi chief for years now, because of sensible contracts and a robust developer ecosystem. But, “the narrative is evolving,” Arch Community claims. “A brand new wave of builders is bringing DeFi to Bitcoin.”

These builders are attracted by Bitcoin’s safety, untapped liquidity, institutional curiosity, and rising consumer demand for composable monetary instruments. Moreover, Layer 1 improvements and protocols are unlocking Bitcoin’s native programmability.

“Many view Bitcoin as the following DeFi frontier, set to even outpace Ethereum,” it claims. “As this momentum grows, Bitcoin’s position as a foundational layer for DeFi is changing into more and more plain.”

In response to Arch Community CEO and co-founder, Matt Mudano, “Bitcoin’s true potential lies past being a passive retailer of worth. As a $2 trillion asset, unlocking its liquidity to construct a really open and permissionless monetary system on its base layer is the following frontier. Bitcoin DeFi is the best alternative not just for crypto, however for monetary innovation as an entire.”

You may additionally like: Matt Mudano, CEO of Arch, on Bitcoin Momentum, Programmability on Bitcoin, and the Way forward for Bitcoin DeFi | Ep. 443 Matt Mudano, CEO and Co-founder of Arch, joined the Cryptonews Highlight podcast to elucidate how Bitcoin can evolve from a static reserve asset into the spine of a world monetary system. From on-chain sensible contracts to miner incentives and real-world DeFi, Mudano outlines a imaginative and prescient of Bitcoin that’s greater than “digital gold” – it’s programmable capital. Bitcoin Is Turning into a Strategic Reserve Asset “Bitcoin is changing into essentially the most profitable ETF launch in human historical past……

36% of Respondents Maintain BTC in Chilly Storage, Favoring Self-Custody Over Yield and Bitcoin DeFi

Amongst many findings within the report, Arch famous that 36% of respondents maintain BTC in chilly storage. 33% commerce on CEXs, and 31% use it for funds. Additionally, 29% use BTC as DeFi collateral, 22% for bridging, 20% in Bitcoin-native DeFi, and 28% as liquidity provision. 7% aren’t actively utilizing their cash.

Furthermore, amongst those that don’t use BTC in DeFi, 36% cited lack of belief, and 25% stated threat and worry of loss. Different causes embody technical boundaries (poor tooling and low liquidity), UX, and regulation.

Additionally, 16% merely want to HODL. The identical quantity waits for higher infrastructure. “Solely 11% don’t see clear advantages, suggesting that almost all considerations could be addressed fairly than indicating a scarcity of curiosity in leveraging Bitcoin extra actively,” the report argues.

In the meantime, amongst those that use Bitcoin DeFi, there are each veterans and newcomers, the researchers discovered. Nearly all of respondents are in Asia (61%) and Africa (17%).

55% of respondents are concerned in lending and borrowing protocols, whereas 51% are in decentralized exchanges (DEXs) and 40% in stablecoins.

Most builders (44%) selected Bitcoin DeFi for its safety and decentralization, and 27% are in it for rising liquidity and ecosystem growth.

Different causes embody Bitcoin’s long-term imaginative and prescient and group (26%), the chance for Layer 2 innovation (20%), ecosystem development (17%), censorship resistance (12%), and privateness (8%).

Nevertheless, regardless of its benefits, Bitcoin wasn’t constructed for advanced sensible contracts, the report notes. For 43% of the respondents, that is the primary problem. Lack of developer instruments (22), poor documentation (15%), low composability (16%), and liquidity (12%) are different causes. These present “that Bitcoin DeFi remains to be early.”

As options to many of those points, respondents named higher infrastructure (45%) and broader L2 adoption (43%).

Many builders additionally work on Ethereum (63%), Solana (47%), and Base (44%), with 60% preferring different chains for sensible contract flexibility and 33% for developer instruments.

That stated, 49% of responding builders engaged on different chains plan to modify totally to Bitcoin. 39% will keep multichain, and 12% haven’t determined but.

You may additionally like: Bitcoin DeFi Explodes: Bull Run Locks 2,000 BTC – Is $115K Subsequent? Bitcoin (BTC) is on a bullish trajectory. The cryptocurrency hit a brand new all-time excessive of $111,970 on Might 22 earlier than shortly retracting to $110,700. The value of BTC is presently hovering round $108,000, but metrics counsel that Bitcoin is on an upward development. Bitcoin bulls predict that the worth of BTC could quickly rally to $115,000. Bull Run Advances Bitcoin DeFi Whereas traders eagerly await one other BTC all-time excessive, trade specialists level out that this bull run is completely different from…

The submit Bitcoin DeFi TVL Surges from $307 Million to $6.4 Billion in Simply 18 Months appeared first on Cryptonews.