Bitcoin Money (BCH) fell 7.8% this week as $BCH crashed by means of $485, simply as futures open curiosity pumped 24%, exposing a harmful hole between speculative bets and a six-year low in community exercise.

The altcoin’s 20% rally in June now seems to be constructed on quicksand. Whereas derivatives merchants piled in, every day energetic addresses cratered to 2018 ranges. With RSI flashing bearish divergences, BCH should maintain $400 help to keep away from surrendering all latest positive factors.

Can $BCH Maintain Its Speculative Rally Right into a Actual Bull Run?

Launched in August 2017 as a Bitcoin fork, Bitcoin Money ($BCH) was designed to facilitate sooner and cheaper transactions by rising the block measurement restrict from 1 MB to eight MB.

BCH is a peer to look digital money system.

BTC is just not. pic.twitter.com/0L3xtKN1sX— Roger Ver (@rogerkver) September 16, 2018

The community, secured by a proof-of-work consensus mechanism, presently has roughly 19.8 million $BCH in circulation, with a most provide capped at 21 million $BCH.

A serious improve on Might 15, 2025, launched focused virtual-machine limits, high-precision arithmetic, and an adaptive block-size algorithm to enhance scalability and reliability.

Whereas these enhancements are supposed to help extra advanced on-chain functions, adoption stays low—every day energetic addresses just lately hit six-year lows, indicating that latest worth actions could also be pushed extra by hypothesis than utility.

Regardless of muted on-chain exercise, institutional engagement has elevated.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, simply because the golden cross hits on the BCH/BTC pair.

Quantity surged 3x, however right here’s the catch: on-chain exercise is at a 6-year low.

Speculators are partying, however the fundamentals? Nonetheless on trip.

Bull entice? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

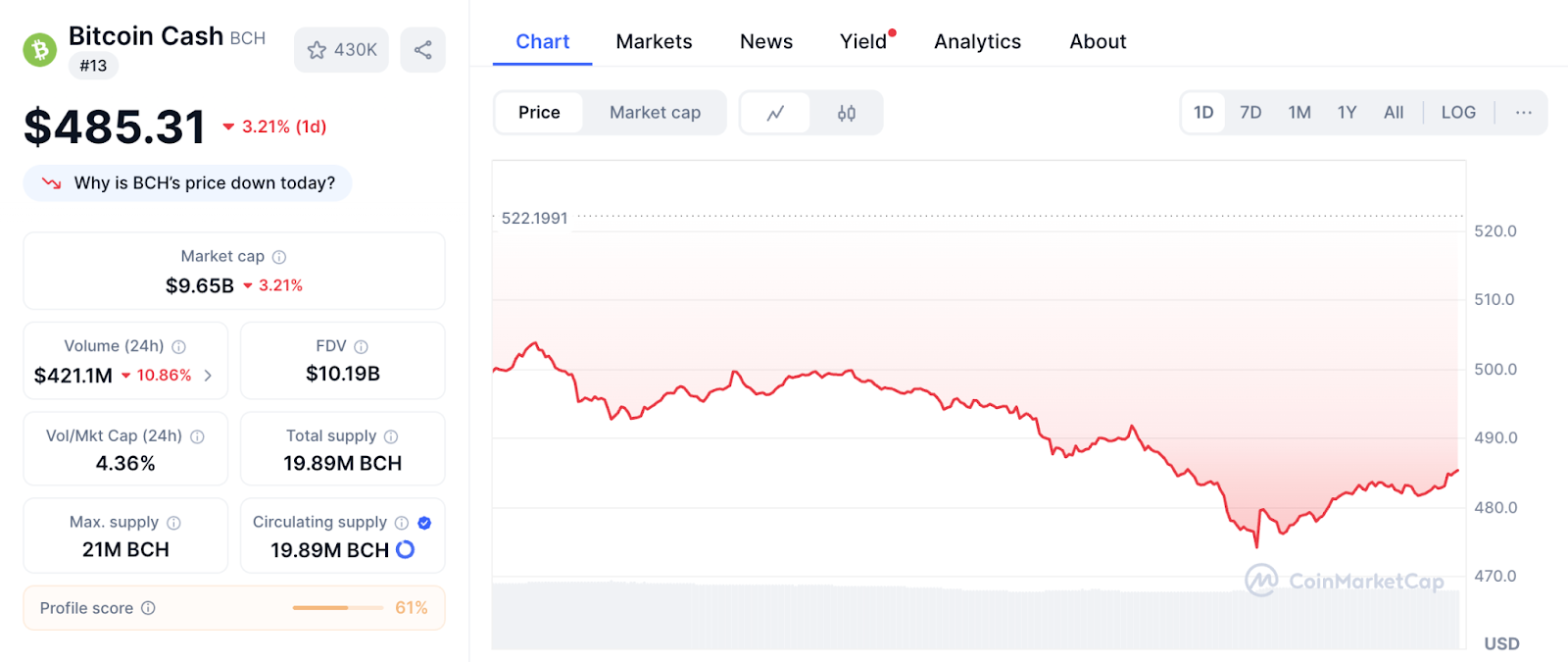

Open curiosity in $BCH futures rose by over 24% in June, whereas buying and selling quantity greater than doubled after $BCH surpassed $500 on June 27. This briefly pushed its market capitalization above $10 billion, rating it twelfth, although it has since slipped to thirteenth with a $9 billion valuation.

Analysts level to $BCH’s scalability and stability above $400 as key bullish components however warn that bearish RSI divergences may curb additional positive factors.

$BCH zoooomed out view, dates again to late 2022, weekly tf, the spotlight of this chart is discover the wave counts, early levels of a macro third wave, worth presently early stage wave 1 of a bigger third diploma wave…not accustomed to elliot wave? Ask GPT or Grok about third waves… pic.twitter.com/JWzHNcxfVR

— Disrupt Your self (@EasychartsTrade) June 28, 2025

Bitcoin Money’s DeFi ecosystem reveals potential however struggles for traction. Regardless of $BCH’s low charges and excessive throughput—benefits that appeal to area of interest builders—the chain’s $7.9 million whole worth locked (TVL) and meager $13,841 every day DEX quantity reveal scant real-world utilization.

This disconnect grows starker when inspecting latest worth motion. Whereas $BCH rocketed 20% in June, on-chain exercise hit six-year lows, confirming the rally was fueled by derivatives hypothesis fairly than natural development.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, simply because the golden cross hits on the BCH/BTC pair.

Quantity surged 3x, however right here’s the catch: on-chain exercise is at a 6-year low.

Speculators are partying, however the fundamentals? Nonetheless on trip.

Bull entice? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

BCH should convert its technical strengths (like Might’s scalability upgrades) into service provider adoption and developer incentives for sustainable adoption. The 24% improve in futures open curiosity means that market confidence exists; now, the community must ship corresponding on-chain utility.

For $BCH to maintain long-term development, it should strengthen service provider adoption and developer incentives. Whereas latest upgrades and rising futures curiosity present a basis, broader adoption will rely on whether or not the community can translate technical enhancements into real-world utilization.

BCH/USDT Chart Evaluation: From Bullish Breakout to Bearish Retracement and Potential Reversal

The BCH/USDT chart displays a transparent transition by means of a number of market phases, starting in late June and persevering with into early July.

Initially, the worth exhibited a robust uptrend, characterised by a steep breakout and enormous inexperienced candles with substantial quantity help. This fast rally propelled BCH from round $475 to simply underneath $510.

This bullish momentum stalled as the worth entered a sideways consolidation section, forming a range-bound sample between roughly $500 and $510. Throughout this era, quantity declined, and MACD flattened, indicating indecision and weakening shopping for stress.

As consolidation broke to the draw back, BCH entered a gradual downtrend, making a sequence of decrease highs and decrease lows. Worth declined constantly with minor reduction bounces, ultimately breaking beneath the $480 help area. The downtrend was accompanied by rising purple quantity bars, suggesting rising promoting stress.

Most just lately, the chart reveals indicators of a bullish bounce, with a pointy reversal from the $472–$474 zone. This was confirmed by a bullish MACD crossover beneath the zero line, indicating that bearish momentum has slowed and patrons are stepping in. The amount additionally picked up barely, reinforcing the short-term bullish reversal.

Nevertheless, for this restoration to be sustainable, BCH must reclaim the $488–$490 resistance zone and preserve momentum above the MACD baseline. If rejected, the worth dangers retesting the $474 help.

The submit Bitcoin Money Futures Leap 24% as Energetic Addresses Hit Six-Yr Low – Danger Forward? appeared first on Cryptonews.