Bitcoin and Ethereum exchange-traded funds (ETFs) recorded a mixed $244 million in outflows on September 23, marking the second consecutive day of investor withdrawals.

This follows a pointy $439 million exit the day past, as buyers repositioned across the Federal Reserve’s current charge minimize and upcoming U.S. inflation knowledge.

ETF Flows Spotlight Investor Warning With Bitcoin and Ethereum Going through Every day

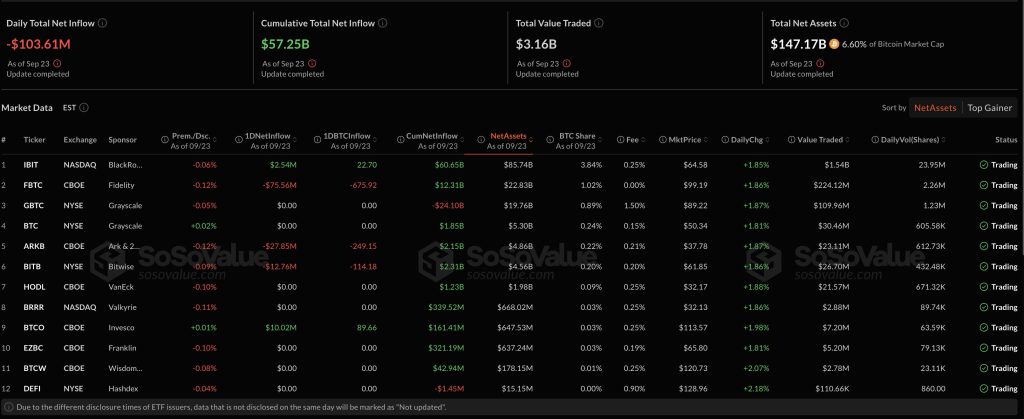

In response to knowledge from SoSoValue, Bitcoin spot ETFs noticed web outflows of $103.6 million on Monday.

Constancy’s FBTC led the withdrawals with $75.6 million, adopted by ARK 21Shares’ ARKB, which shed $27.9 million.

In distinction, BlackRock’s flagship IBIT managed to safe a modest $2.5 million influx, whereas Invesco’s BTCO recorded the very best influx of the day at $10 million.

Grayscale’s GBTC, together with VanEck’s HODL and Valkyrie’s BRRR, reported no main web flows.

Ethereum ETFs, however, skilled even sharper redemptions, with $140.7 million flowing out in a single day. Constancy’s FETH accounted for the majority of losses with $63.4 million in outflows, adopted by Grayscale’s ETH fund, which misplaced $36.4 million.

Bitwise’s ETHW additionally noticed heavy withdrawals of $23.9 million, whereas Grayscale’s ETHE posted $17.1 million in redemptions.

BlackRock’s ETHA and VanEck’s ETHV remained flat, whereas smaller funds from Franklin, 21Shares, and Invesco confirmed no notable modifications.

A day prior On September 22, Bitcoin merchandise had misplaced $363 million in a single session, led by Constancy’s FBTC with $276.7 million in redemptions.

Ethereum funds noticed $76 million withdrawn the identical day, led once more by Constancy’s FETH, alongside redemptions from Bitwise and BlackRock’s ETHA.

As of September 23, Bitcoin spot ETFs maintain $147.2 billion in web belongings, representing 6.6% of the cryptocurrency’s whole market capitalization. Cumulative inflows stand at $57.25 billion.

Ethereum spot ETFs now maintain $27.5 billion in web belongings, representing 5.45% of the entire ETH market, with cumulative inflows reaching $13.7 billion.

The outflows come only one week after digital asset merchandise recorded practically $1.9 billion in inflows, in response to CoinShares knowledge.

That surge adopted the Federal Reserve’s first rate of interest minimize of 2025, which drew renewed investor demand for crypto publicity regardless of cautious indicators from policymakers.

Bitcoin funds had attracted $977 million through the week, whereas Ethereum merchandise recorded $772 million, setting a year-to-date report of $12.6 billion for Ether-backed merchandise.

Market knowledge reveals that investor positioning stays delicate to macroeconomic indicators.

Analysts observe that ETF flows and derivatives leverage stay key indicators to observe as markets soak up each the Fed’s coverage outlook and upcoming inflation readings.

BlackRock’s Bitcoin ETFs Lead $260M Income Surge, Ethereum Provides $42M

Bitcoin and Ethereum ETFs have gained widespread success prior to now few years.

BlackRock’s Bitcoin and Ethereum exchange-traded funds are actually producing greater than $260 million yearly, displaying that digital asset merchandise have change into a significant revenue engine for the world’s largest asset supervisor.

BlackRock generates $260 million yearly from Bitcoin and Ether ETFs as Wall Avenue institutional adoption reaches new heights.#Bitcoin #Ethereumhttps://t.co/0dAGyws3jZ

— Cryptonews.com (@cryptonews) September 23, 2025

In response to Leon Waidmann, head of analysis on the Onchain Basis, BlackRock’s Bitcoin ETFs account for $218 million of that determine, whereas Ethereum merchandise contribute $42 million.

“This isn’t experimentation anymore,” Waidmann stated, noting that the agency has turned crypto ETFs right into a income stream on par with established monetary merchandise.

Analysts recommend that BlackRock’s success will set a benchmark for pension funds, sovereign wealth funds, and insurance coverage firms contemplating publicity to digital belongings.

Bloomberg’s senior ETF analyst Eric Balchunas highlighted the structural benefits of crypto ETFs, which mix prompt entry, low prices, and yield potential with regulatory safety and anonymity, advantages not usually related to direct token possession.

ETFs have all the pieces tokens supply: prompt entry, miniscule prices, flexibility, yield (you’ll be able to completely lend out ETFs). However with added advantages that tokens don't have: regulatory protections (big), anonymity and a 1-800 quantity *instantly mutes dialog lol* https://t.co/5wpM79aEmw

— Eric Balchunas (@EricBalchunas) September 24, 2025

Market circumstances stay blended. Bitcoin traded at $113,717 on Monday, up 0.9% prior to now 24 hours however transferring inside a decent vary between $111,369 and $113,301.

Ethereum slipped 0.4% to $4,173.88, marking a 7.1% decline over the previous week. Regardless of short-term volatility, some trade leaders see rising institutional demand as a long-term worth driver.

Technique’s Michael Saylor informed CNBC that ETFs and firms are collectively shopping for way more Bitcoin than miners produce day by day, creating sustained upward strain. Citigroup, nevertheless, is cautious on Ethereum, projecting a year-end goal of $4,300, effectively under its $4,953 all-time excessive reached in August.

The publish Bitcoin and Ethereum ETFs Undergo Huge $244M Outflow Amid Second Straight Day of Outflows appeared first on Cryptonews.