Michael Saylor, the billionaire co-founder and govt chairman of Technique (previously often known as MicroStrategy), has disclosed one other substantial Bitcoin acquisition value over $500 million, persevering with his firm’s aggressive cryptocurrency accumulation technique.

In response to a June 30 submitting with the U.S. Securities and Change Fee (SEC), Technique bought 4,980 Bitcoin for $531.1 million through the week ending Sunday, at a median worth of roughly $106,801 per bitcoin.

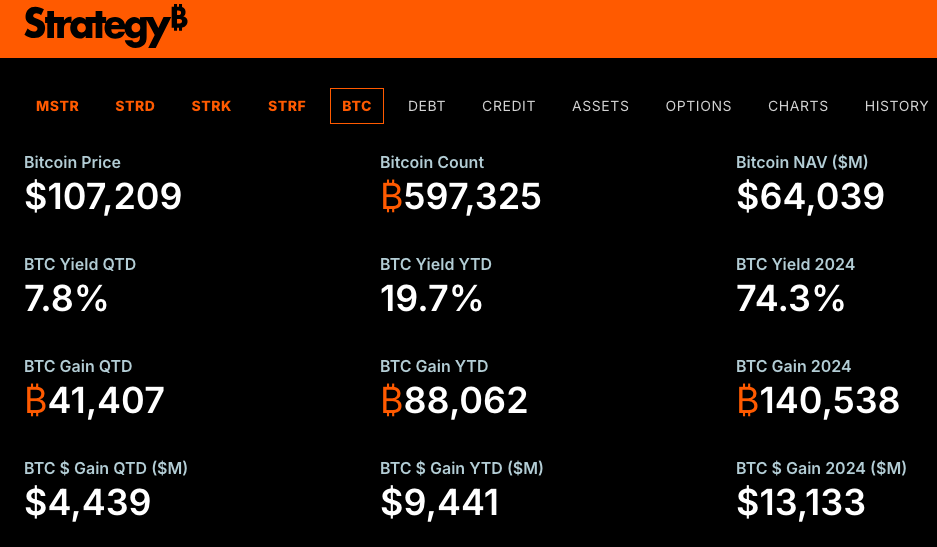

Following this newest acquisition, MicroStrategy now holds 597,325 BTC valued at over $64 billion, bought at a median value of $70,982 per bitcoin for a complete funding of roughly $42.4 billion, together with related charges and bills.

Technique has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 $BTC acquired for ~$42.40 billion at ~$70,982 per bitcoin. $MSTR $STRK $STRF $STRD https://t.co/xvWnSkfukS

— Michael Saylor (@saylor) June 30, 2025

MicroStrategy Now Controls 2.8% of All Bitcoin Ever Created

MicroStrategy’s Bitcoin holdings signify greater than 2.8% of the cryptocurrency’s whole provide cap of 21 million cash, producing unrealized positive factors of roughly $21.6 billion primarily based on present market costs.

This yr alone, MicroStrategy has collected 88,062 BTC value $9.8 billion, in comparison with 140,538 BTC valued at $13 billion in 2024, in accordance with firm knowledge.

The enterprise intelligence agency’s Bitcoin yield has reached 19.7%, with 7.8% gained within the second quarter alone, transferring nearer to its focused year-to-date yield purpose of 25% by year-end 2025.

The purchases aligned with market expectations, as Saylor has developed a sample of asserting Bitcoin acquisitions on Sundays via social media hints.

On June 29, Saylor up to date his Bitcoin portfolio tracker with the message: “In 21 years, you’ll want you’d purchased extra,” referencing his current BTC Prague keynote presentation, during which he predicted that Bitcoin might attain $21 million per Bitcoin inside 20 years.

In 21 years, you'll want you'd purchased extra. pic.twitter.com/s1I607RVda

— Michael Saylor (@saylor) June 29, 2025

Bitcoin Treasury Shift: 134 Firms Now Following Saylor’s Playbook

Knowledge from Bitcoin Treasuries signifies that 134 publicly traded firms have now integrated Bitcoin into their company treasury methods.

Latest adopters embrace Twenty One, Trump Media, and GameStop, following the mannequin by Saylor and MicroStrategy.

Japanese funding agency Metaplanet introduced on Monday that it acquired a further 1,005 BTC, increasing its whole holdings to 13,350 BTC.

Equally, The Blockchain Group, described as Europe’s first Bitcoin treasury firm, bought 60 BTC, bringing its whole to 1,788 BTC valued at roughly €161.3 million.

The Blockchain Group has acquired 60 BTC for ~€5.5 million at ~€91,879 per bitcoin and has achieved BTC Yield of 1,270.7% YTD, 69.3% QTD. As of 6/30/2025, $ALTBG holds 1,788 $BTC for ~€161.3 million at ~€90,213 per bitcoin

@_ALTBG Europe's First Bitcoin Treasury Firm… https://t.co/BmcqZzvfoz

— Alexandre Laizet

(@AlexandreLaizet) June 30, 2025

The pattern has additionally gained momentum in the UK, the place a minimum of 9 corporations throughout numerous sectors, from net design startups to mining operations, introduced Bitcoin buy plans or disclosed current acquisitions for his or her company treasuries through the previous week.

London-listed firms are leaping on the Bitcoin bandwagon, aiming to spice up share costs and mirror the success of Saylor’s Technique. #Bitcoin #UKhttps://t.co/vPje86rNRI

— Cryptonews.com (@cryptonews) June 29, 2025

Cryptocurrency exchanges are growing new merchandise to capitalize on this company Bitcoin pattern.

On June 28, Gemini launched a tokenized model of MicroStrategy (MSTR) inventory for European Union traders, marking the change’s first tokenized fairness providing within the area.

Technique’s shares have responded positively to the Bitcoin accumulation, climbing 4.92% over the previous month to commerce at $390.58, in accordance with Google Finance knowledge.

Bitcoin Eyes $109K Breakout That May Set off $48.7M Liquidity Squeeze

Bitcoin skilled modest weekend positive factors, rising as a lot as 3% to achieve $108,798 on Sunday, pushed by the broader momentum within the cryptocurrency market.

Following the strategy to the $108,000 degree, merchants, together with Michael van de Poppe, founding father of MN Capital, advised that Bitcoin may expertise a quick pullback earlier than trying to interrupt via to new all-time highs.

The inevitable breakout to an ATH on #Bitcoin may even occur through the upcoming week.

Such a bullish setup. pic.twitter.com/VQfT2A2GSR— Michaël van de Poppe (@CryptoMichNL) June 28, 2025

Technical evaluation signifies that $109,000 is a key resistance degree on Bitcoin’s four-hour timeframe. “That is the realm we have to break with the intention to have upward momentum,” van de Poppe famous.

Knowledge from CoinGlass revealed concentrated buying and selling curiosity round key worth ranges, with substantial bid exercise beneath present costs and resistance clustering above $109,000.

Over $48.7 million in liquidity was positioned at $109,500.

If Bitcoin efficiently breaks via liquidity ranges between $110,000 and $112,300, the ensuing brief squeeze might push the cryptocurrency again into worth discovery mode, probably setting new report highs.

The publish Billionaire Michael Saylor Broadcasts New Bitcoin Buy Value $500 Million – What’s Going On? appeared first on Cryptonews.