Former BitMEX CEO Arthur Hayes accrued $995,000 price of Ethena (ENA) tokens over 48 hours forward of Hyperliquid’s essential USDH stablecoin validator vote scheduled for September 14.

His aggressive shopping for spree included 578,956 ENA tokens price $473,000 within the ultimate buy, bringing whole holdings to five.02 million tokens valued at $3.91 million.

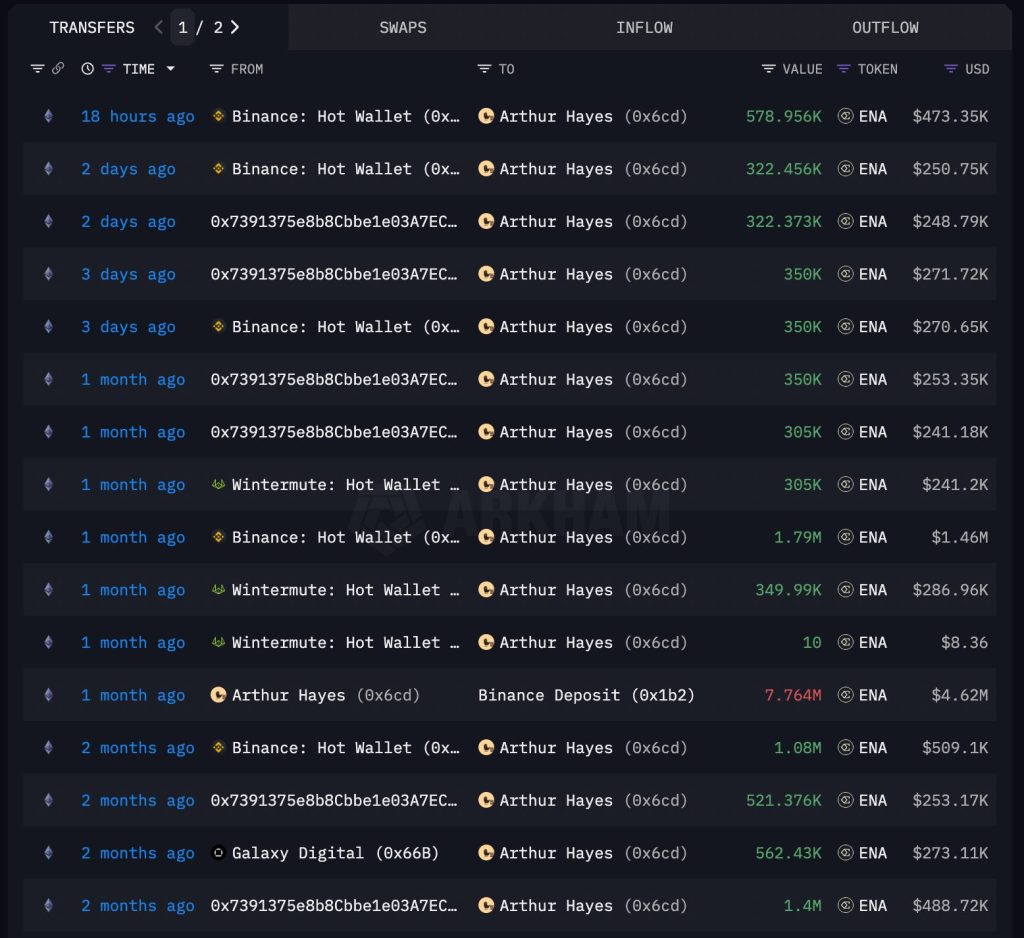

Arthur Hayes (@CryptoHayes) has purchased 578,956 $ENA, price $467.7K, from #Binance.

Arthur now holds a complete of 5.02M $ENA, price $3.91M.

Handle: 0x6cd66DbdFe289ab83d7311B668ADA83A12447e21

Knowledge @nansen_ai pic.twitter.com/VNxKgX0zxg— Onchain Lens (@OnchainLens) September 11, 2025

Ethena May Win the Hyperliquid Stablecoin Conflict?

Hayes’ timing coincides with Ethena’s aggressive bid to concern Hyperliquid’s native stablecoin utilizing USDtb collateralized via BlackRock’s BUIDL fund.

The proposal guarantees 95% income sharing with Hyperliquid whereas overlaying prices for buying and selling pair migrations from USDC to USDH.

Arkham Intelligence knowledge reveals systematic accumulation patterns with a number of purchases from Binance, Wintermute, and Galaxy Digital over current months.

Hayes beforehand deposited 7.764 million ENA tokens price $4.62 million to Binance two months in the past earlier than starting contemporary accumulation cycles.

The purchases comply with Hayes’ August prediction that ENA might obtain 51x returns by 2028 as stablecoin adoption reaches $10 trillion.

His evaluation facilities on Ethena’s “money and carry” buying and selling technique, producing yields above Treasury charges via crypto derivatives.

Ethena at the moment operates the third-largest stablecoin with $13.5 billion in USDe deposits, positioning it behind solely Tether and Circle.

Hayes tasks Ethena might seize 25% market share as stablecoin infrastructure absorbs trillions in world deposits.

The validator vote now contains six main contenders: Native Markets with Stripe’s Bridge proposal, adopted by Paxos, Sky Protocol, Frax Finance, Agora’s coalition backed by VanEck, with Ethena being the sixth.

Hayes’ 126x HYPE Prediction Drives Strategic Positioning

Hayes revealed his boldest crypto forecast in August, predicting Hyperliquid’s HYPE token might surge 126x by 2028 as Treasury Secretary Scott Bessent’s insurance policies create the most important DeFi bull market in historical past.

The evaluation assumes Hyperliquid turns into the dominant crypto buying and selling venue, processing day by day volumes similar to Binance’s present $73 billion.

The previous BitMEX government believes stablecoin adoption will attain $10 trillion via compelled migration of Eurodollar deposits and International South banking holdings into U.S. Treasury-backed digital property.

His “Buffalo Invoice” Bessent thesis tasks capturing $34 trillion in world deposits via weaponized stablecoin insurance policies.

For ENA, Hayes fashions Ethena reaching $2.5 trillion in USDe provide as speculators pay above Treasury charges to borrow {dollars} for crypto leverage.

The protocol’s 20% price construction on curiosity revenue creates sustainable income streams whereas offering larger yields than conventional banking options.

Hayes’ private positioning via ENA accumulation aligns along with his institutional funding technique via the Maelstrom fund, which has invested in Ethena.

The timing suggests confidence in Ethena’s USDH proposal end result regardless of Native Markets’ dominant prediction market positioning.

https://t.co/K8EdOWSDz7

— Ethena Labs (@ethena_labs) September 9, 2025

Aggressive USDH Race Intensifies Earlier than Validator Resolution

Paxos revised its proposal on Tuesday, asserting main PayPal integration, together with USDH assist in checkout infrastructure, Venmo compatibility, and HYPE token itemizing.

The partnership contains $20 million in ecosystem incentives and zero-cost on/off-ramps via PayPal’s fee rails.

The up to date Paxos proposal commits all USDH income to Hyperliquid’s Help Fund till reaching $1 billion whole worth locked, with income sharing capped at 5% even past $5 billion TVL.

Equally, Sky Protocol’s entry promised 4.85% yields and $25 million ecosystem growth funding via its $8 billion infrastructure managing USDS and DAI stablecoins.

The proposal provides immediate $2.2 billion USDC liquidity entry and plans to relocate $250 million annual buyback techniques from Uniswap to Hyperliquid.

Because it stands now, Native Markets has the best prediction market odds of successful regardless of coalition opposition led by Agora and VanEck, warning in opposition to Stripe’s Bridge conflicts of curiosity.

The Stripe partnership proposal incorporates a GENIUS-Act-compliant construction with BlackRock off-chain and Superstate on-chain reserve administration.

Frax Finance pitched frxUSD backing via BlackRock’s BUIDL fund whereas Agora’s coalition pledged full internet income sharing and claimed neutrality benefits.

General, every proposal targets totally different points of stablecoin infrastructure, from regulatory compliance to yield optimization.

Nonetheless, Ethena’s BlackRock partnership offers institutional credibility with $23 billion cumulative mints and redemptions processed with out safety incidents.

Hyperliquid validators will start voting September 14, with Basis neutrality to be maintained all through the choice course of.

The end result will decide USDH’s infrastructure spine serving the platform’s $106 million month-to-month income and $383 billion buying and selling quantity.

The put up Arthur Hayes Buys Almost $1M ENA Forward of Hyperliquid USDH Stablecoin Vote – What Does he Know? appeared first on Cryptonews.