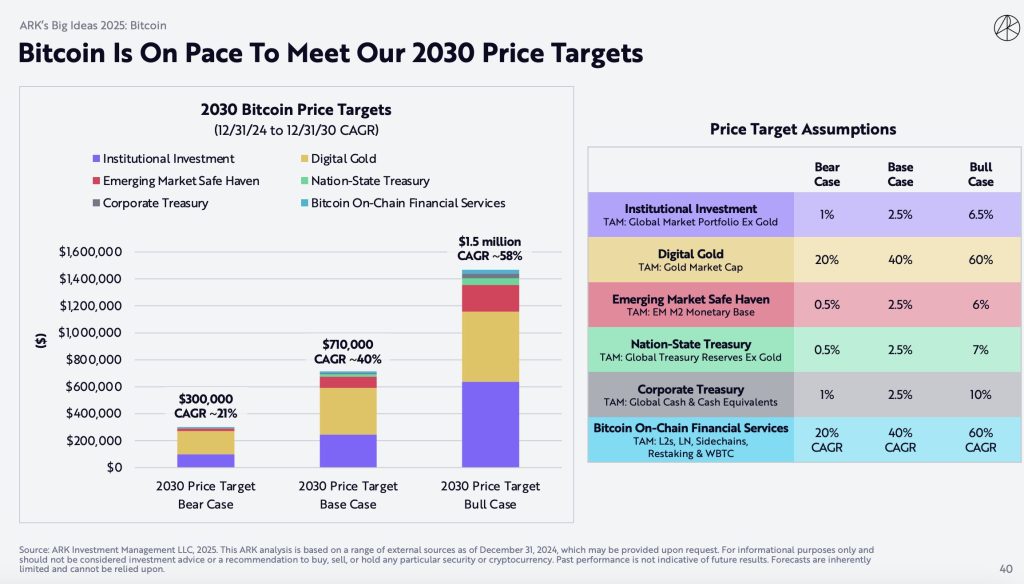

Bitcoin may hit $1.5m by the tip of this decade, in accordance with ARK Make investments, which laid out its bull case within the newest Big Ideas 2025 report launched Thursday.

The funding agency’s base case pegs Bitcoin at $710,000, whereas its bear case nonetheless forecasts a sizeable enhance to $300,000.

The funding agency attributes its projections to a number of accelerating tendencies, together with rising institutional allocation, adoption of Bitcoin as a retailer of worth, demand from rising markets, and the expansion of on-chain monetary providers. The report additionally factors to a rising urge for food amongst nation-states and companies so as to add Bitcoin to their reserves.

We’ve printed our bitcoin worth forecast by way of 2030. Learn our analysis from @dpuellARK and share your ideas.https://t.co/CH7y5EyUjY

— ARK Make investments (@ARKInvest) April 24, 2025

Bitcoin May Seize 60% of Gold’s Market Cap by 2030: Ark

On the time of the report’s launch, Bitcoin traded round $93,958, having not too long ago recovered from a interval of market volatility. ARK’s most optimistic situation implies an almost 15-fold enhance from present ranges, pushed by what it sees as a structural transformation in world finance.

The agency expects institutional buyers to allocate as much as 6.5% of their portfolios to Bitcoin in probably the most bullish situation, with 2.5% as the bottom case. It additionally believes Bitcoin may finally command 60% of gold’s present market worth, reinforcing its digital gold thesis.

Picture Supply: Ark Make investments

Bitcoin May Hit $2.4M With Rising Market and Treasury Adoption: ARK

Rising markets are one other key focus. ARK estimates that Bitcoin may seize as much as 6% of the financial base in such economies, the place inflation and foreign money instability proceed to erode belief in conventional monetary techniques. It additionally sees significant upside from elevated use by companies and governments, which may allocate as much as 10% and seven% of their reserves, respectively.

The report additional factors to the enlargement of Bitcoin’s utility past storage, notably by way of Layer 2 networks, restaking protocols and tokenized property. These developments are anticipated to contribute to a 60% annual development price in on-chain monetary providers.

Whereas ARK’s official bull case targets $1.5m per Bitcoin by 2030, the agency additionally introduces a refined mannequin that adjusts for dormant or misplaced provide. Below this adjusted provide situation, the bull case worth may climb as excessive as $2.4m, reflecting Bitcoin’s excessive shortage and accelerating institutional demand.

The report stops wanting calling Bitcoin a assured winner however positions it as a number one asset in a maturing digital financial system that continues to achieve mainstream traction.

The publish ARK Make investments Sees Bitcoin Hitting $1.5M By 2030 On Rising Institutional Demand appeared first on Cryptonews.