The return of risk-on sentiment has sparked a restoration, however many nonetheless query Ethereum as a “greatest crypto to purchase” contender, with long-term holders offloading at a loss.

As international funding markets rallied on Trump’s 90-day “tariff warfare” pause, the front-running altcoin noticed a 24% surge throughout Wednesday buying and selling to a $1695 peak.

Whereas this coverage shift opened the door to recent liquidity, sentiment shortly cooled. A probable “sell-the-news” occasion has since dragged Ethereum again to $1550.

Now down over 60% from its post-election rally highs, ETH is seeing capitulation trades from holders trying to restrict additional draw back.

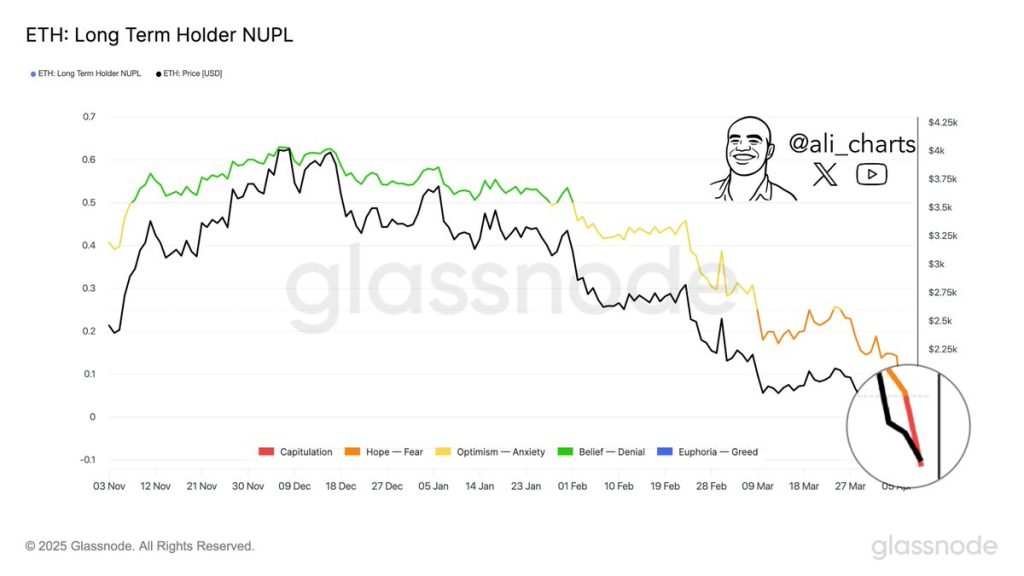

Lengthy-Time period Holders Enter Capitulation Mode

Lengthy-term Ethereum holders have now entered what’s generally known as “capitulation” mode—a stage when even probably the most affected person buyers start to fold beneath stress.

With the multi-month free fall, many buyers have already exited positions, whereas others stay sidelined ready for readability. Nonetheless, some see alternative.

In accordance with common analyst Ali Martinez, this might current a uncommon window for contrarian patrons.

“For these watching risk-reward dynamics, this section has traditionally marked prime accumulation zones,” he shared on X.

ETH Value Evaluation: Time to Accumulate Ethereum?

The buy-the-dip alternative might not be over for Ethereum with the lack of a crucial historic help that marked each main backside since mid-2020.

This breakdown breaches the decrease boundary of an enormous symmetrical triangle sample—a ultimate line of protection earlier than deeper losses set in.

Whereas a lot of those losses have already materialized, the following key help sits at $1,050. That marks a possible 30% slide earlier than substantial shopping for stress is more likely to return.

Whereas a lot of the draw back has already performed out, the following key help lies at $1,050, leaving room for a possible 30% slide earlier than significant demand returns.

This situation holds weight, with the MACD line accelerating its transfer away from the sign line, underscoring dominant promoting stress.

Whereas the Relative Power Index (RSI) has hit the oversold threshold at 30—an indication of vendor exhaustion—a pronounced reversal appears slim with out conviction from patrons.

As an alternative, a short-term consolidation across the fast $1,525 help degree—appears probably the most possible end result with none recent market catalysts.

Preserve Your Eyes on This New ICO Earlier than the Bull Market Returns

Any dealer hedging their threat probably options Bitcoin (BTC) as a serious a part of their portfolio, particularly because the altcoin market continues to fall.

Whereas Bitcoin gives steady positive factors, it typically sacrifices upside potential—that’s the place Bitcoin Bull (BTCBULL) is available in, providing a recent method to capitalize on BTC tailwinds.

True to its title, Bitcoin Bull ties its tokenomics to Bitcoin’s worth progress in a deflationary mannequin.

The mission burns tokens and distributes BTC airdrops every time Bitcoin reaches key milestones—beginning at $125,000 and triggering new rewards for each $25,000 climb thereafter.

With some analysts forecasting BTC highs of $1 million by 2030, BTCBULL may change into a Bitcoin Maxi’s greatest pal.

With over $4.5 million raised in its preliminary few months, the mission is already gaining robust momentum—doubtlessly credited to its 91% APY on staking that rewards early buyers.

You may sustain with Bitcoin Bull on X and Telegram, or be part of the presale on the Bitcoin Bull web site.

The put up Are Ethereum Whales Giving Up? Lengthy-Time period Holders Begin Promoting as Value Recovers appeared first on Cryptonews.