Asia Pacific (APAC) is pulling forward within the crypto market as a result of coverage is tilting towards readability whereas client rails scale quick.

From late 2023 by way of mid 2025, the area’s on-chain worth obtained rose sharply, climbing from about $81b a month in mid 2022 to a peak close to $244b in Dec. 2024, and holding above $185b per 30 days this yr, in line with a Chainalysis report revealed Wednesday.

Japan is now the standout. On-chain worth obtained rose 120% within the 12 months to June 2025, outpacing South Korea, India and Vietnam. Progress follows rule adjustments that deal with extra tokens as funding devices, deliberate updates to crypto taxation, and the licensing of the primary yen-backed stablecoin issuer.

With stablecoin listings starting to loosen, merchants channeled heavy volumes into XRP, then BTC and ETH, whereas markets watch how USDC and JPYC achieve traction.

In our subsequent preview chapter of the 2025 Geography of Crypto Report, we discover APAC's acceleration because the world's fastest-growing crypto area. From India's market management to Japan's regulatory shifts, see how distinct nationwide pathways are shaping adoption:… pic.twitter.com/TRwXN1wlWB

— Chainalysis (@chainalysis) September 24, 2025

India’s Oversight Tightens With out Choking Fintech, Supporting Sustained Crypto Use

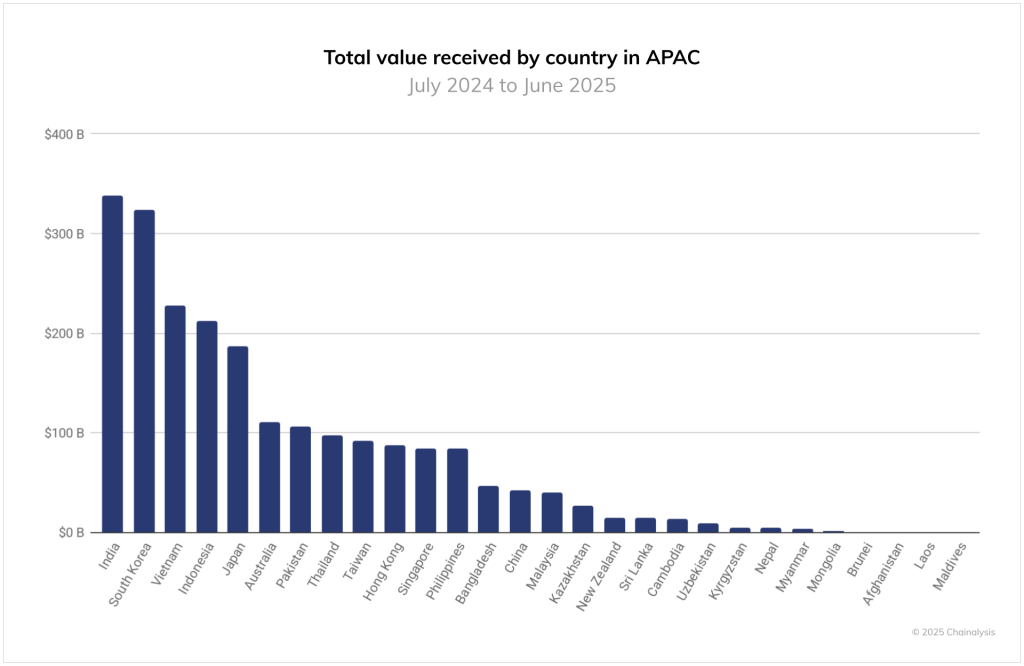

India follows with scale and depth. It leads APAC in whole on-chain worth at about $338b {dollars}, supported by UPI rails, a big diaspora that makes use of crypto for remittances, and younger traders who commerce for supplementary earnings. Trade teams are serving to normalize utilization, whereas authorities construct clearer oversight with out stifling fintech development.

South Korea’s market seems to be distinctly skilled. Almost half of on-chain exercise sits within the $10,000 to $1m band. The 2024 Digital Asset Consumer Safety Act is reshaping trade practices, and rising USDT and KRW stablecoin pairs have lifted volumes.

Picture Supply: Chainalysis

Policymakers are debating KRW-backed stablecoins, with guidelines anticipated to handle issuance, distribution and secondary buying and selling.

Tighter Supervision In Australia Units The Stage For Institutional Entry

Vietnam reveals on a regular basis utility. Crypto helps remittances, gaming and financial savings, reflecting huge grassroots adoption. Exercise has matured, which explains slower proportion development in contrast with Japan, but utilization stays deeply embedded in day by day flows.

Australia is laying foundations. Steps to modernize AML and CFT guidelines and to scrub up inactive trade licences level to tighter supervision and a extra sturdy market construction. That groundwork issues as establishments search clearer counterparties.

Hong Kong and Singapore proceed to form coverage in numerous methods. Hong Kong’s Coverage Assertion 2.0 accelerated native exercise by signalling a path for regulated buying and selling. Singapore’s measured stance has shifted flows towards stablecoins, which now surpass bitcoin pairs as establishments use them for funds, liquidity and hedging.

Throughout APAC, month-to-month on-chain worth obtained climbed from about $81b in July 2022 to that Dec. 2024 peak. Volumes eased afterward however stayed excessive by way of mid-2025. The area ceaselessly ranks second to Europe and at instances outpaces North America, underscoring its rising affect on world flows.

Past Buying and selling, New Use Instances Preserve Volumes Elevated Into 2025

Market triggers had been clear. Late 2023 and early 2024 produced the primary months above $100b as costs recovered. This fall 2024 delivered the highest prints, helped by a worldwide danger rally. The development continued into 2025 whilst costs cooled, pointing to broader use instances past buying and selling alone.

APAC’s range is the driving force. Japan’s reform cycle, India’s digital public infrastructure, Korea’s dealer centric market, Vietnam’s on a regular basis use, Australia’s compliance push, and the dual hubs of Hong Kong and Singapore collectively create a number of paths to adoption.

That blend additionally buffers the area. When buying and selling slows in a single market, remittances, funds or treasury exercise maintain volumes elsewhere. As guidelines proceed to harden, APAC’s position as a bellwether for a way crypto will probably be used at scale seems to be set to develop.

The publish APAC Leads International Crypto Uptick, Japan Information Strongest Progress appeared first on Cryptonews.