Key Takeaways:

- AI firms at the moment are utilizing extra knowledge heart energy to mine Bitcoin.

- The transfer may assist stabilize electrical energy grids and enhance power effectivity, in keeping with analysts.

- Mara Holdings and Riot Platforms are a few of the first firms to mine Bitcoin utilizing AI knowledge heart electrical energy.

AI firms at the moment are utilizing extra knowledge heart energy to mine Bitcoin — a transfer that would assist stabilize electrical energy grids, enhance power effectivity, and enhance the economics of each sectors, in keeping with trade analysts.

In June, Bitcoin miner Mara Holdings launched a venture that leverages idle energy from a synthetic intelligence (AI) knowledge heart to mine Bitcoin (BTC).

Earlier, rival Riot Platforms introduced it spent $1 billion on power infrastructure that shall be used for each Bitcoin mining and AI operations.

“Vastly important,” Daniel Batten, local weather tech investor and a distinguished analyst on Bitcoin’s environmental footprint, mentioned of Mara’s initiative. “The convergence of AI and Bitcoin mining is occurring,” he instructed Cryptonews.

AI strikes quick, and the grid should hold tempo. Immediately, at @Reuters World Vitality Transition 2025, we introduced a brand new partnership with @TAE Energy Options to ship a first-of-its-kind grid effectivity platform. Be taught extra: pic.twitter.com/uLDTdwADUG

— MARA (@MARA) June 25, 2025

Till now, it’s largely been Bitcoin mining firms diversifying into AI compute providers to faucet new income streams, Batten says. However Mara’s transfer modifications issues: AI corporations at the moment are changing into Bitcoin miners.

“The convergence is occurring in each instructions,” he mentioned, noting that synthetic intelligence firms are being pushed by a must monetize unused power and optimize their energy procurement methods.

“AI firms squander plenty of wasted power as a result of they need to ahead buy energy, and plenty of that will get wasted. It’s not a bodily waste, however an financial waste as a result of they’ve bought greater than they will make the most of. Bitcoin mining is ideally suited to soak up that surplus.”

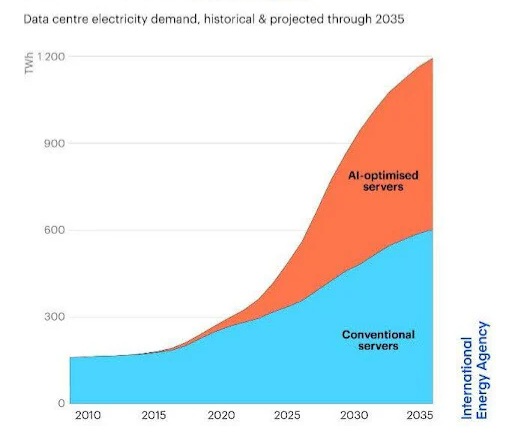

Working giant language fashions (LLMs) like OpenAI’s GPT or coaching picture recognition methods at hyperscale ranges calls for enormous quantities of computing energy — and by extension, power.

For instance, coaching the GPT-3 mannequin was estimated to make use of slightly below 1,300 megawatt hours (MWh) of electrical energy final 12 months — roughly equal to the annual electrical energy utilized by about 130 households within the U.S.

Coaching the extra superior GPT-4, in the meantime, is estimated to take 50 occasions extra power, researchers say. A lot of this power is consumed by knowledge facilities, that are used to coach and function AI fashions.

Synthetic intelligence firms typically over-purchase energy capability to keep away from pricey downtimes and guarantee seamless operation of their power-hungry knowledge facilities. However not all that power will get used on a regular basis.

Fixing the ‘Spiky’ Demand Dilemma

In keeping with Batten, the AI/Bitcoin mining nexus is addressing long-term inefficiencies in knowledge heart energy dynamics, turning extra power into a brand new supply of worth.

For AI firms spending hundreds of thousands each day on compute, the flexibility to mine Bitcoin throughout off-peak hours may scale back working prices.

Mara Holdings is an early mover on this respect. The Florida-based firm’s use of AI infrastructure to mine Bitcoin not solely cuts waste but in addition brings in new income whereas making a responsive power shopper for the grid.

“Assembly the calls for of at this time’s compute infrastructure isn’t nearly including extra power, it’s about making higher use of the facility we now have,” mentioned Fred Thiel, CEO of Mara, in a current press assertion.

“In Mara’s versatile knowledge facilities, unused, underutilized or in any other case stranded power sources are tapped to safe the world’s preeminent blockchain ledger, changing clear power that may in any other case go to waste into financial worth,” he added.

His feedback have been echoed by Brian Morgenstern, head of public coverage at Riot, who instructed a Reuters power convention in June that “Bitcoin mining generally is a first mover on websites appropriate for AI knowledge facilities to construct energy infrastructure and monetize capability.”

BVP Board Member @MorgensternNJ explains how Bitcoin mining firms like @RiotPlatforms assist America win the worldwide AI race by optimizing power consumption and monetization. pic.twitter.com/ZMosoYCrQr

— Bitcoin Voter Undertaking (@BitcoinVoter) June 25, 2025

Morgenstern mentioned Riot Platforms had invested $1 billion in power infrastructure and energized a 400MW energy plant in Corsican, Texas, that’s utilizing 40% of its capability to mine Bitcoin.

“We’re monetizing that energy…we’re shopping for land, [and] we’re bringing in AI knowledge heart improvement specialists,” he mentioned.

However the implications for fashions resembling Mara or Riot’s lengthen far past company revenue, says Batten. It’s the influence they’ve on grid stability. Synthetic intelligence knowledge facilities are likely to create erratic, hard-to-predict energy demand.

This “spikiness” is a “nightmare” for grid operators, he mentioned, particularly as extra renewable power like photo voltaic or wind, which is by nature intermittent, comes on-line. Batten defined in a voice message to Cryptonews:

“Spiky energy demand is actually unhealthy for the grid, significantly when grid operators are already scuffling with the intermittency of variable renewable power. When you then have an intermittent energy person, it’s an absolute nightmare.”

Bitcoin Mining Stabilizes Energy Grids

Batten mentioned Bitcoin mining can stabilize surprising spikes in AI energy demand. That’s as a result of, in contrast to most industrial processes, Bitcoin mining will be dialed up or down in seconds, responding to real-time grid wants.

When there’s an excessive amount of power or AI demand drops, miners can use that extra energy. Likewise, they will swiftly shut off their machines when demand spikes — “making the grid operator’s job of stabilizing the grid a lot easier.”

“It means that you may put extra variable renewable power on the grid [without risking blackouts or brownouts],” says Batten. “In any other case, they [grid operators] have to reply by simply giving baseload power.”

In keeping with the setting analyst, “there is no such thing as a modular, scalable, interruptible, load balancing expertise that exists on the planet at this time than Bitcoin mining.”

In his presentation on the Reuters power convention, Morgenstern, the Riot head of public coverage, mentioned Bitcoin’s decentralization means mining amenities can “curtail energy use when the grid wants them to.”

“It’s 100 levels in August, no drawback. We curtail when grid stress rises. At some websites, we will even promote grid stability providers so the grid operator can use us like a thermo change to steadiness provide and demand.”

The convergence of AI and Bitcoin, two energy-intensive sectors, can be essential for slicing carbon emissions. Specialists say with higher grid stability and fewer power waste, renewable power integration could be extra possible. As Batten notes:

“It’s going to be good for grid stability, and it’s going to be good for the AI knowledge facilities in addition to be good for renewable power era.”

The large query, although, is whether or not the Mara mannequin can scale.

“Completely,” Batten declared. “Any AI firm forward-purchasing giant quantities of power, so, mid-sized to hyperscalers can profit from this mannequin. Just about everybody aside from the small operators.”

The submit AI Corporations Pivot to Bitcoin Mining with Information Middle Energy appeared first on Cryptonews.