Aave founder Stani Kulechov is going through renewed scrutiny from elements of the crypto group following a $10 million buy of AAVE tokens made shortly earlier than a carefully watched governance vote.

Critics allege the transfer was supposed to extend his voting energy relatively than sign long-term alignment with token holders.

The allegation surfaced publicly this week after Robert Mullins, a decentralized finance strategist and liquidity specialist, stated on X that the acquisition appeared timed to affect an upcoming vote.

I’m stunned that nobody is speaking about the truth that Stani purchased $10M of AAVE, claimed it was bc he’s aligned with the token but in precise reality it was to extend his voting energy in anticipation to vote for a proposal instantly towards the token holders finest pursuits

This…— Robert (@0xluude) December 23, 2025

Mullins argued that the transaction highlights structural weaknesses in token-based governance methods, the place massive holders can shortly accumulate affect with out long-term commitments.

He questioned whether or not related conduct would happen below governance fashions that require tokens to be locked for prolonged durations.

Aave Governance Turmoil Exposes Fault Traces Over Energy and Transparency

These issues have been echoed by outstanding crypto consumer Sisyphus, who pointed to blockchain information suggesting Kulechov might have bought thousands and thousands of {dollars}’ value of AAVE between 2021 and 2025.

On AAVE:

I fail to know why Stani, who should have dumped a whole bunch of thousands and thousands of {dollars} of worthless governance tokens from 2021 to 2025, would rebuy $10 million {dollars} of tokens so as to attempt to take a <$10 million greenback income stream— Sisyphus (@0xSisyphus) December 24, 2025

Whereas no wrongdoing has been established, critics questioned the financial rationale of promoting massive quantities over a number of years earlier than making a large buy forward of a contentious vote.

The talk has unfolded towards a broader governance dispute throughout the Aave ecosystem over management of the protocol’s model and related belongings.

On December 22, Aave Labs submitted a proposal to Snapshot regarding possession of key model belongings, together with the aave.com area, social media accounts, GitHub organizations, and naming rights.

Aave Labs unilaterally pushed a model possession proposal to vote with out writer notification, escalating governance tensions over protocol asset management and worth extraction.#Dao #Aavehttps://t.co/2uRM8QM6Jy

— Cryptonews.com (@cryptonews) December 22, 2025

The proposal had been authored by Ernesto Boado, co-founder of BGD Labs, however Boado publicly rejected the choice to push it to a vote, saying he had not been notified and didn’t assist the model submitted.

Boado stated the transfer broke belief throughout what he described as a productive discussion board dialogue and argued that the proposal was supposed to switch model belongings right into a DAO-controlled authorized wrapper with sturdy protections towards seize.

Tensions Rise Round Aave Over Model Use, Charge Flows, and Whale Voting

The initiative adopted mounting issues from contributors that model belongings have been getting used to assist non-public merchandise with out the DAO being the primary beneficiary.

Latest examples cited by critics embrace Aave Labs changing Paraswap with CowSwap, a change estimated to redirect round $10 million per yr in charges away from the DAO, and the Horizon market launch, which generated roughly $100,000 in income whereas utilizing about $500,000 in DAO incentives.

Marc Zeller of the Aave Chan Initiative stated the DAO had successfully paid a number of instances for these belongings by way of the unique LEND token sale, dilution, liquidity mining packages, and repair supplier charges.

Kulechov defended the rushed vote, saying dialogue had already taken place and that submitting proposals exterior prolonged processes was not unprecedented. He stated the problem ought to in the end be resolved by way of voting.

Those that surprise, sure the vote is respectable

– The dialogue has been going over the previous 5 days already with varied of opinions and takes, a timeline set on the ARFC temp examine (see extra https://t.co/KovomHiB6H)

– The Snapshot is in compliance of the governance framework

-… https://t.co/nZoixZvbwl— Stani.eth (@StaniKulechov) December 22, 2025

Nonetheless, a number of observers, together with crypto educator Duo 9, raised issues about conflicts of curiosity when founders retain affect by way of non-public corporations whereas additionally shaping DAO outcomes.

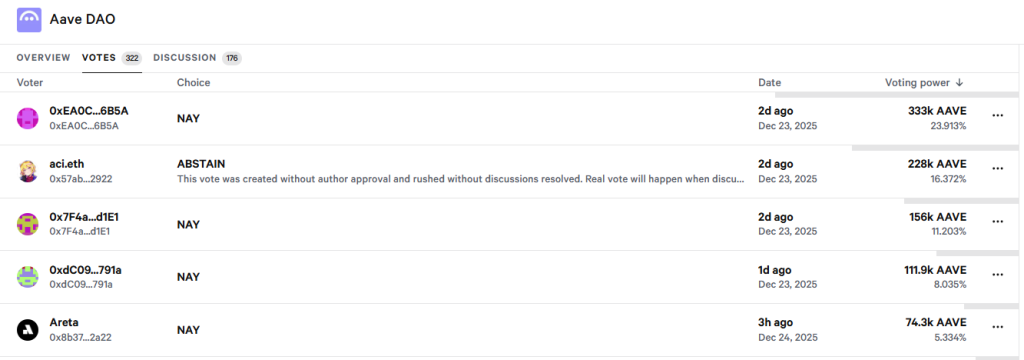

Voting information has additional fueled the controversy. Samuel McCulloch of USD.ai famous {that a} small variety of massive holders account for a big share of voting energy.

Snapshot information reveals the highest three voters management greater than 58% of the vote, with the most important pockets holding over 27%.

The controversy comes shortly after regulatory strain on Aave eased.

On December 16, Kulechov disclosed that the U.S. Securities and Trade Fee had concluded its multi-year investigation into the protocol with out recommending enforcement motion, ending almost 4 years of uncertainty.

Aave Labs has additionally secured MiCA authorization in Europe and is getting ready for the launch of Aave V4.

The submit Aave Founder Accused of ‘Governance Assault’ After $10M Purchase Earlier than Essential Vote appeared first on Cryptonews.