The panorama round bitcoin after the final FOMC assembly for 2024 within the US turned the other way up, with native buyers pulling funds out of the ETFs and the Coinbase Premium Index declining to yearly lows.

Nonetheless, on-chain information reveals that US buyers are again on the BTC entrance, with large accumulations.

ETFs Demand Returns

In the course of the aforementioned assembly on the highest ranges within the US central financial institution, Fed Chair Jerome Powell warned that there may be fewer and even no fee cuts in 2025 resulting from rising inflation. US buyers reacted instantly and began pulling funds out of riskier belongings like BTC and crypto.

Throughout the subsequent 4 buying and selling days, they withdrew greater than $1.5 billion out of the US-based Bitcoin exchange-traded funds. December 26 was the one day nicely within the inexperienced, as December 27, 30, and January 2 noticed extra internet outflows. Even BlackRock’s IBIT, the world’s largest Bitcoin ETF, was posting unfavorable data.

Nonetheless, this modified on Friday, January 3. The full internet inflows for the day shot as much as $908.1 million, based on FarSide information. IBIT was truly second with $253.1 million, trailing behind Constancy’s FBTC with $357 million. Ark Make investments’s ARKB additionally had a powerful presence, attracting $222.6 million. This grew to become one of the best day by way of internet inflows since November 21.

Coinbase Premium Index

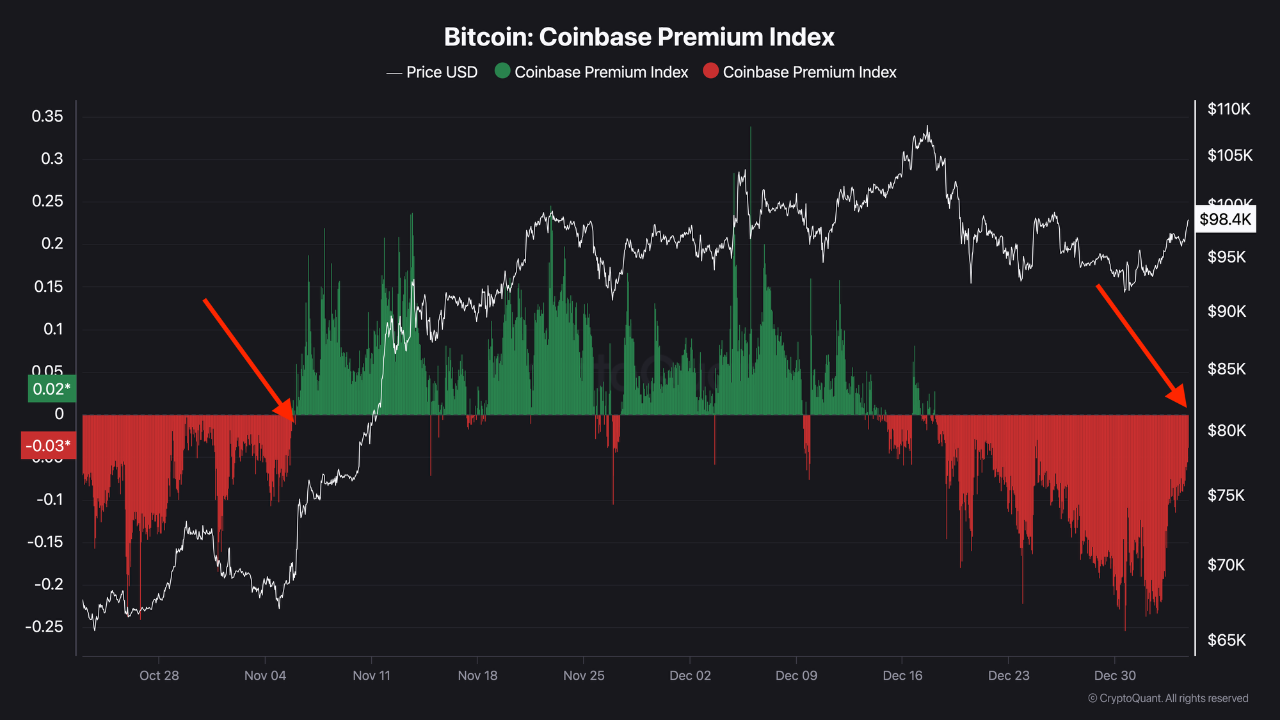

The opposite metric that showcases US buyers’ general habits towards bitcoin and crypto is the Coinbase Premium Index, which measures the BTC worth distinction between Coinbase and Binance. When it shoots up into constructive territory, because of this US-based buyers are accumulating closely, and vice versa.

The metric lately plunged to a yearly low, as reported, which coincided with the rising ETF outflows after the FOMC assembly. Now, although, CryptoQuant information reveals that it has returned to impartial territory virtually instantly after posting that low. This reveals that “sentiment by the US and institutional buyers is again.”

SPECIAL OFFER (Sponsored) Binance Free $600 (CryptoPotato Unique): Use this hyperlink to register a brand new account and obtain $600 unique welcome supply on Binance (full particulars).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this hyperlink to register and open a $500 FREE place on any coin!