A flood of contemporary money may about to land in crypto. Roughly $150 billion in tax refunds will hit U.S. shopper accounts by the top of March.

Some analysts suppose a part of that cash may drift straight into danger property. Together with crypto. Wells Fargo strategists say this refund wave, boosted by 2026 tax incentives, might quietly gas retail participation once more.

And the timing is fascinating. Markets are sitting at key technical ranges. If even a fraction of that capital rotates into digital property, the retail bid may present up proper when it issues most.

Key Takeaways

- $150B Liquidity Wave: Wells Fargo analysts undertaking roughly $150 billion in refunds can be distributed by late March.

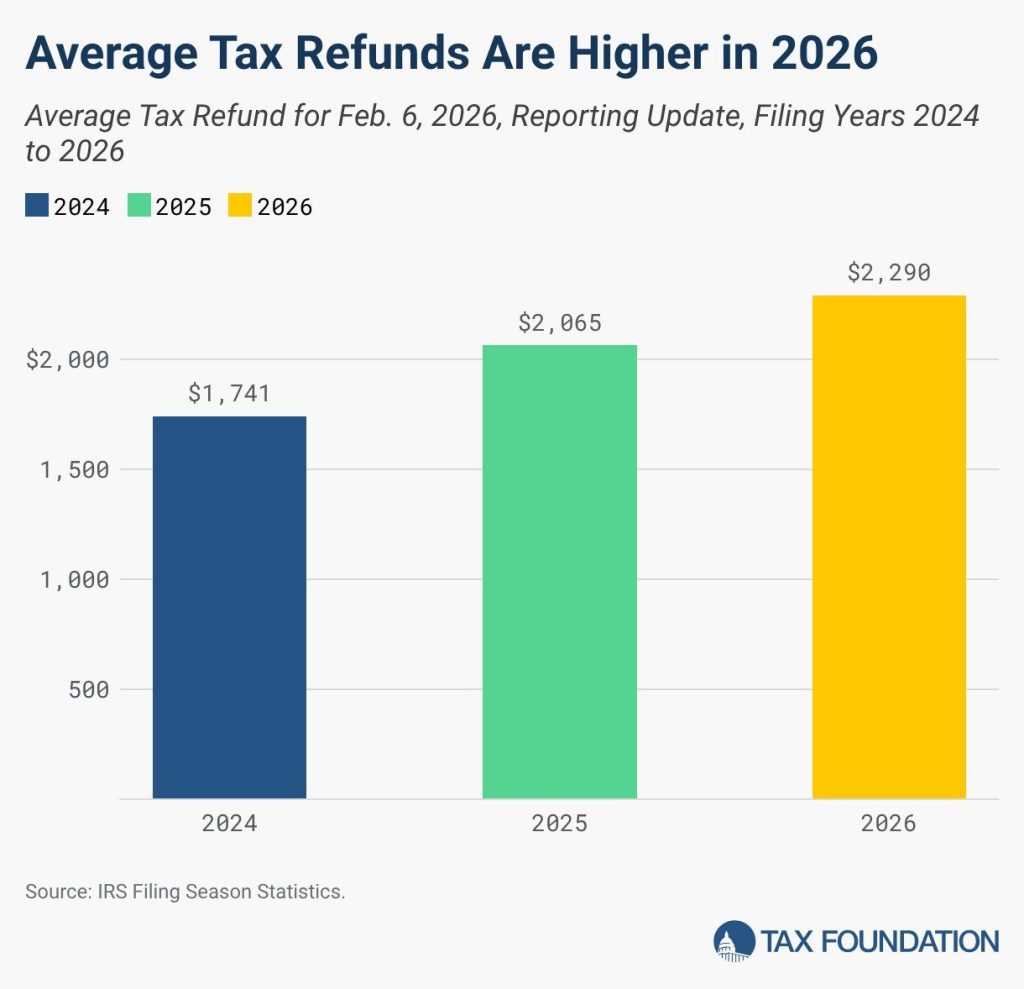

- Refunds Are Up 11%: Early IRS information reveals the typical refund dimension has jumped to $2,290, growing retail buying energy.

- Retail Catalyst: Historic information suggests the “refund impact” correlates with elevated inflows into retail-heavy crypto property.

Why Does Refund Season Matter for Crypto?

Liquidity strikes markets. And proper now, the U.S. Treasury is about to inject a wave of it. After the One Huge Lovely Invoice handed in July 2025, tax cuts boosted refund sizes for lots of Individuals.

Treasury Secretary Scott Bessent has already hinted that refunds this season might be “very giant.” Which means extra disposable money touchdown in financial institution accounts.

Common tax refunds are projected to leap by $1,000 this 12 months — returning $91 BILLION again to the American individuals.

The most important tax refund season in U.S. historical past is right here due to @HouseGOP’s Working Households Tax Cuts.

Extra money again in your pocket.pic.twitter.com/U3hktiKsq7

— Congressman Gabe Evans (@repgabeevans) February 7, 2026

Traditionally, lump sum payouts like this don’t simply go towards payments. A slice usually flows into investments. And in latest cycles, that has included digital property. Retail participation tends to rise when individuals really feel flush.

Refund averages normally peak round mid February. That timing strains up with the present surge in exercise throughout a number of altcoins. When contemporary money meets technical breakout zones, the response could be sharper than most anticipate.

The Information: Greater Checks, Quicker Deposits

The early numbers for the 2026 submitting season are already coming in scorching. By February 6, the IRS had processed greater than 20.6 million returns and despatched out practically $16.954 billion in refunds.

The common test is now round $2,290, up roughly 10.9% from final 12 months.

Direct deposits are even larger, averaging about $2,388. And the cash strikes rapidly. Most e filers see funds inside about 21 days, which signifies that money is able to be deployed nearly instantly.

One other wave is coming too. As soon as PATH Act restrictions carry after February 15, refunds tied to the Earned Earnings Tax Credit score begin flowing. Traditionally, that second wave is bigger and hits later in February.

Contemporary liquidity coming into an already concentrated alternate atmosphere can have an outsized impact. Particularly if even a small slice finds its method into danger property.

Will This Set off the Subsequent Leg Up?

Tax refund season hitting similtaneously bettering regulatory tone will not be random timing. It creates a powerful backdrop for danger property. Funding charges are already flashing extremes, which tells you shorts are crowded.

If even a fraction of retail refund cash rotates into spot crypto, that purchasing stress may set off a quick brief squeeze.

Bitcoin (BTC)24h7d30d1yAll time

The macro tone provides gas. Political alerts round clearer crypto laws are bettering sentiment. When retail feels regulatory danger is fading, confidence returns faster.

Over the subsequent six weeks, roughly $150 billion will transfer into shopper accounts. Not all of it would hit crypto, however it doesn’t have to. Even a small proportion can shift momentum in a leveraged market.

Control the weekly IRS updates towards the top of February. That information will present whether or not the liquidity wave is constructing or already peaking.

The publish $150B in US Tax Refunds May Gas Contemporary Crypto Inflows, Historic Information Suggests appeared first on Cryptonews.