Bitcoin merchants are glued to 1 value proper now: $50,000.

After a brutal dip that noticed costs flash beneath $60,000 for a sizzling minute, everybody’s questioning if we’ve lastly hit all-time low.

Sure, Bitcoin value bounced again above $70,000 briefly, however right here’s the factor, no one’s actually satisfied that is “the underside” simply but.

Key Takeaways

- Analysts warn the latest bounce to $71,000 could also be a “bull lure” designed to liquidate shorts earlier than a retest of $50,000 help.

- JPMorgan knowledge signifies Bitcoin has traded beneath the estimated miner manufacturing value of $87,000, a historic sign for capitulation.

- Technical patterns spotlight essential help at $67,350, with a breakdown doubtlessly opening the door to the $43,000 area.

Weekly Shut Reveals Fragility Regardless of $70K Rebound

Bitcoin discovered its manner again to $71,000 because the week kicked off. Nevertheless, most discover this rally trying sketchy.

Positive, we noticed a 7% bounce from final week’s $60,000 massacre, however there’s principally no volatility across the weekly shut. And when issues look too calm after a crash, merchants get suspicious.

Dealer CrypNuevo mentioned on X: this entire transfer up seems like a calculated play to search out quick positions stacked between $72,000 and $77,000.

If this “restoration” seems to be faux, bears have one goal of their crosshairs: $50,000.

Miner Prices and Stablecoin Flows Sign Warning

Right here’s a quantity that ought to make you nervous: $67,000. That’s what it prices miners to supply one Bitcoin.

BTC could be buying and selling beneath that quickly. Traditionally, the miner manufacturing value acts like a security internet, costs often don’t keep beneath it for lengthy.

Avg. Bitcoin mining value was ~$67,704 in accordance with MARA.

Bitcoin is reasonable right here. pic.twitter.com/DvuT8aw13N— CryptoGoos (@cryptogoos) February 8, 2026

if this continues, miners begin going broke. And when miners capitulate? They dump their Bitcoin to remain alive, which creates much more promote stress. It’s a vicious cycle.

Whereas the basics look grim, there’s an enormous pile of money sitting on the sidelines. Stablecoin inflows simply doubled to $98 billion.

They’re prepared to purchase… they’re simply ready for the precise second.

Subsequent Steps: Bitcoin Value Technical Ranges to Watch

Bitcoin (BTC)24h7d30d1yAll time

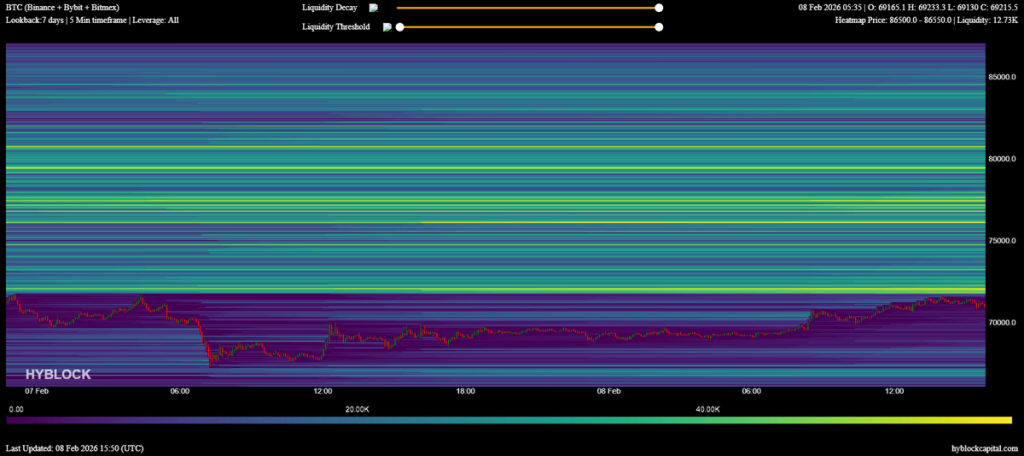

Merchants are staring down at an attention-grabbing second as inflation knowledge drops this week. Proper now, all eyes are on $67,350, that’s the help degree holding this entire factor collectively.

If Bitcoin breaks beneath that? We’re taking a look at bearish flag patterns that might drag costs all the way down to $50,000. Yeah, a possible 30%+ dive.

There’s a bullish situation too. The magic quantity is $74,434. If BTC can reclaim and maintain above that degree, it kills the bearish setup and doubtlessly opens the door again to $80,000.

The submit BTC Merchants Eye $50K as Doable Backside: Key Metrics to Watch This Week appeared first on Cryptonews.