One thing went flawed with the Bitcoin value, says Galaxy Digital founder and CEO Mike Novogratz, because the seek for the underside grows extra frantic, whereas one other Michael – the Burry variety – sees a “loss of life spiral” forward for the BTC value.

In fact, Novogratz has pores and skin within the recreation, so when he instructed Bloomberg TV yesterday that the underside would type within the $70,000 to $100,000 vary, it’s comprehensible that some would possibly wish to view his reasoning with scepticism.

Nonetheless, an equally quizzical line of assault could be utilized to the musings of Michael Burry, who, in any case, is the king of shorts – he’s at all times looking out for property to promote.

Should you can keep away from the panic button and have the chance tolerance that allows measured evaluation and decision-making, then it’s price pausing to take heed to Novogratz:

Galaxy Digital is seeing its inventory underneath stress. CEO @novogratz tells Bloomberg that Bitcoin’s latest pullback displays a "vendor's virus," pushed by widespread profit-taking. He provides that pessimism throughout crypto markets is excessive, however sentiment might enhance if market construction… pic.twitter.com/kTPlIxe1vp

— Bloomberg TV (@BloombergTV) February 3, 2026

On Monday, Bitcoin fell beneath $73,000, wiping out all the Trump bounce. At these ranges ($75k on the time of writing), they’re minded to maintain an eagle-eyed watch on Technique as its web asset worth flips from premium to low cost.

If the Bitcoin value falls one other 10% to round $65,000, then, based on Burry, Technique will “discover capital markets basically closed.”

As Digital Asset Treasury (DAT) shares tumble (194 public corporations and 72 non-public corporations are holding Bitcoin in treasury), keep in mind that some unrealized losses are extra actual than others. Fears of imminent chapter are most likely overdone.

Subsequent up would be the miners, all including to the loss of life spiral’s velocity. For Burry, there isn’t a backside. There isn’t any valuation mannequin for Bitcoin as a result of “there isn’t a natural use case cause for Bitcoin to sluggish or cease its descent.”

And buzzing away within the background are the ETFs, whose emergence was heralded with nice fanfare however, greater than every other instrument, have made it simpler for retail traders to invest and have tightened the correlation with fairness markets.

On that final level, although, the correlation could be described as selective. When the Nasdaq falls, so does Bitcoin, however when the Nasdaq bounces, Bitcoin goes AWOL.

Is Bitcoin the Final ‘Inside’ and ‘Outdoors’ Cash?

Which brings us to an fascinating notice in Noelle Acheson’s Crypto is Macro Now publication, important studying for the crypto-savvy.

She relates the speculation of Credit score Suisse chief economist Zoltan Pozsar, wherein he pointed to “the basic shift in international worth away from finance and in the direction of bodily items, particularly commodities”, Acheson recollects. Pozsar was creating his principle in response to the Russian invasion of Ukraine.

He dubbed the approaching shift to a brand new international financial order Bretton Woods III (for many who neglect their financial historical past, Bretton Woods was arrange in 1944 on the behest of the US and pegged all main globally traded currencies to the US greenback, which in flip was convertible on the charge of $35/ounce.

Then Bretton Woods II got here alongside in 1971, when it turned obvious that there was simply not sufficient gold on this planet to maintain the gold-backed US greenback functioning because the premier reserve forex that oiled the wheels of booming commerce.

Because of this, US President Richard Nixon took the greenback off the gold customary.

Now we come to the fascinating half, Bretton Woods III, and what it might imply for the way forward for Bitcoin.

As Pozsar would have it, we now have now entered the period of ‘inside cash’, which he outlined as property and debt created by the greenback system, versus ‘exterior cash’, which he described as commodities, notably gold and oil. He didn’t point out Bitcoin, however we are going to.

You’ll have noticed that on Monday, President Trump introduced that the US would begin stockpiling strategic commodities. Higher late than by no means.

Nonetheless, it is a sign that when the world goes darkish (the computer systems are turned off), some issues, like gold, silver, copper, oil, palladium, and an assortment of uncommon earths, will stay.

However absolutely no computer systems means no Bitcoin, no crypto, proper? Not so quick: though it’s a theoretical risk, if the world did go darkish, the complete worth curve would collapse.

Bitcoin Sits Someplace Between ‘Inside’ and ‘Outdoors’ Cash

Let’s put this one other method. With out computer systems, and more and more, with out synthetic intelligence, getting stuff achieved (made, serviced) turns into problematic.

Or, at a step eliminated, relying on a debased greenback to underpin the working of the true financial system and the precise circulation of bodily issues, is dangerous.

Maybe we should always consider ‘inside’ and ‘exterior’ cash in a method much like how plastic air pollution is depicted within the Disney/BBC sci-fi mini-series The Battle Between the Land and the Sea (disclaimer: my brother Colin performs the character Common Pierce).

In a well-known scene, not less than on TikTok, we see Homo Aqua returning human-created air pollution to its level of origin via a rain of plastic upon the land.

The skin cash is knocking some sense into the within cash by raining down gold and silver ingots on these inflated property and burdensome money owed.

Stick with me. Bitcoin isn’t pure inside cash, though it has, of late, change into far more built-in into the legacy monetary system, and therein lies a lot of its present issues.

Neither is it pure exterior cash, in that, though it’s so-called onerous cash due to its movement restrict, it might, not less than theoretically, collapse ought to the world go darkish in a digital sense.

But in actuality, Bitcoin is someplace between the 2 cash poles (inside-outside) of Bretton Wooden III, as imagined by Pozsar.

Take into consideration Iran, when the theocracy turned off the web. Sure, you couldn’t purchase tokenized gold or tokenized {dollars}, however your holding of these property was nonetheless secure for an additional day, as a result of finally the theocracy has to allow commerce within the trendy world.

And with regards to the opposite finish of the spectrum, the hegemon of worldwide finance, the US, the within/exterior dichotomy expresses itself in a different way, however in an equally supportive method for Bitcoin.

Because the administration seeks to ease the ache of the supposedly ‘rip-off’ affordability disaster, it should search to undertake an expansive financial coverage.

It’s one wherein its One Huge Lovely Invoice Act of 2025 opens the spigots of tax cuts, on prime of plans to cap bank card rates of interest at 10% and, unconvincingly, to drive Huge Tech hyperscalers to bear extra of the burden of hovering electrical energy prices ensuing from knowledge heart load.

If you wish to get me a birthday reward, purchase some bitcoin for your self. pic.twitter.com/ZbaIdIpj10

— Michael Saylor (@saylor) February 4, 2026

On this context, Bitcoin is exterior cash, whose worth is secured by the world financial system’s Most worthy commodity – the crystallization of power as a monetized knowledge package deal with the property of common equivalence, albeit nonetheless topic to the vagaries of speculative flows.

‘Speculative flows’ is an enormous caveat, however not when you think about the latest outsized actions within the valuable metals markets, particularly that 37% intraday crash within the silver value.

As traders rotate out of Huge Tech, an Ii bubble imposition looms and ‘Promote America’ gathers tempo towards the backdrop of macro and geopolitical uncertainty urgent in and US governance norms shattering, Bitcoin continues to be the good cash, inside and outside.

Now contemplate the next commentary from José Torres, Senior Economist at Interactive Brokers:

“The return of ‘Purchase America’ sentiment is poised to proceed weighing on valuable metals’ efficiency on steadiness. Certainly, gold and silver are more likely to decline additional following a ferocious rally that was initially sparked by fundamentals however has since indifferent from the driving themes of ‘Promote America’ and a give attention to comparatively accommodative international central banks that allow extreme fiscal deficits and generate forex debasement.”

These feedback didn’t age effectively. Gold is buying and selling above $5,000 once more, and silver is up 7% immediately. The greenback has proven indicators of life, however on a year-over-year view, it’s nonetheless trending decrease.

And the Nasdaq is off 0.71% at 23,089 after Tuesday’s 1.43% sell-off in what could possibly be the beginning of the good rotation out of tech.

The $BTC vs $SILVER Ratio truly went virtually completely to the FTX lows after which bounced after the massive drop in Silver.

Going to be fascinating conserving monitor of this chart and whether or not we will see some relative power once more from BTC any time quickly.

The volatility on Gold and… pic.twitter.com/WfEIihrxlF— Daan Crypto Trades (@DaanCrypto) February 1, 2026

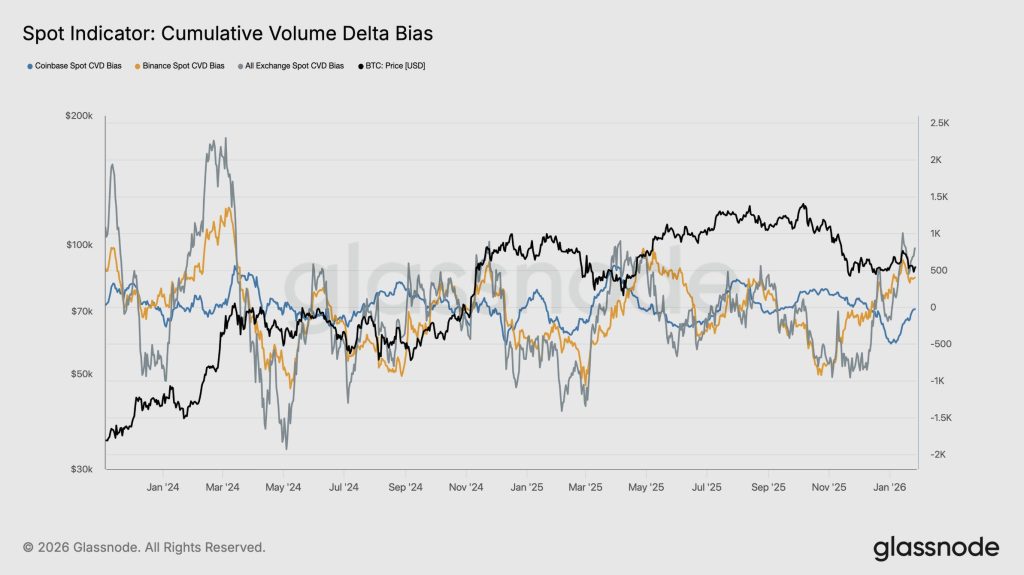

Cumulative Quantity Delta Knowledge Suggests Bitcoin Worth Stabilization Round $70,000

Admittedly, Bitcoin is down 0.56% at $75,995, so there’s no definitive signal of a backside but, with every tried lukewarm bounce met with renewed bailing.

What does this all imply for the Bitcoin in your digital pockets? Bitcoin’s safe-haven anti-debasement properties could also be screened out by the frenzy of blood to the pinnacle represented by the opening up of the sluice gates to massively leveraged institutional cash.

That unwinding shall be damaging, however Bitcoin will reside on. Certainly, there are tentative indicators that the decrease finish of the Novogratz band could possibly be the underside.

Our associates at Glassnode identified a number of days in the past the pickup within the spot Cumulative Quantity Delta (CVD), which measures the web distinction between shopping for and promoting by market takers. A optimistic bias (shopping for) so as movement could also be rising.

Supply: Glassnode

Glassnode analysts concluded that, “If this buy-side dominance persists, it could assist additional value stabilisation and a possible push greater.” Since that end-of-January trace of stabilization, Bitcoin, as famous above, briefly fell beneath $73,000.

Nonetheless, a flooring could possibly be forming round present ranges. Whether or not you purchase the within or exterior principle, and our novel interpretation of it, the good cash could be beginning to DCA in.

The publish Why the Bitcoin Worth May Backside Quickly appeared first on Cryptonews.