By the tip of 2025, a nook of the market most Ethereum merchants hardly ever watch had constructed a place giant sufficient to matter for everybody else.

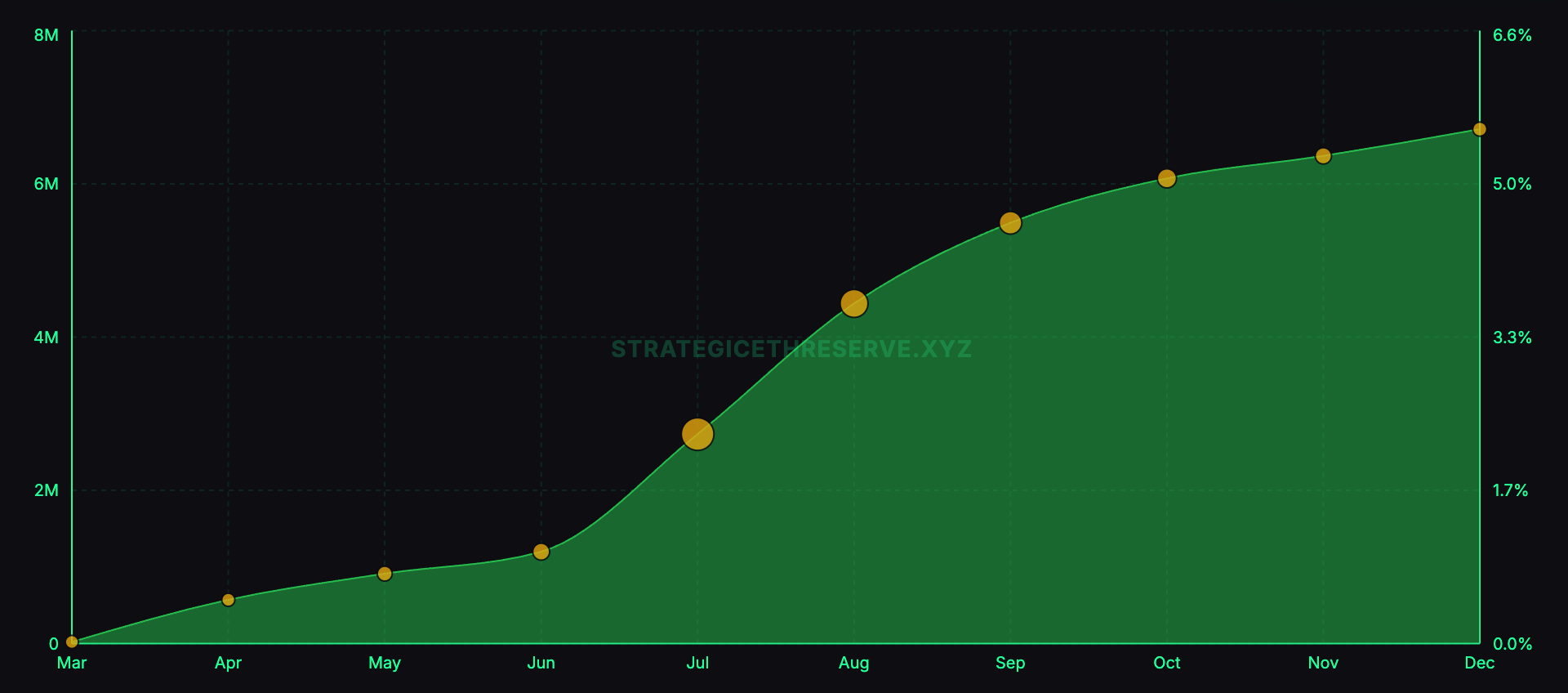

Everstake’s annual Ethereum staking report estimates that public firms’ “digital asset treasuries” collectively held roughly 6.5–7.0 million ETH by December, which is greater than 5.5% of the circulating provide.

The quantity is large, however the extra essential half is why these firms selected ETH within the first place.

Bitcoin’s corporate-treasury playbook is constructed round shortage and reflexivity: purchase cash, let the market re-rate the fairness wrapper at a premium, then difficulty inventory to purchase extra cash.

Ethereum provides a second leg that Bitcoin can’t. As soon as ETH is acquired, it may be staked, that means it could possibly earn protocol-native rewards for serving to safe the community. Everstake frames that reward stream at roughly 3% APY for treasury-style operators.

A company ETH treasury is making an attempt to be a listed car that holds ETH, earns further ETH by staking, and convinces fairness traders to pay for that packaged publicity. The principle wager is that the wrapper can compound its underlying holdings over time, and that public markets will finance the expansion part when sentiment is favorable.

Ethereum aims to stop rogue AI agents from stealing trust with new ERC-8004 – but will it?

Three on-chain registries promise portable identity, reputation, and validation. Yet, the validator power grab is the twist.

Jan 29, 2026 · Gino Matos

The essential mechanics of staking

Ethereum runs on proof-of-stake. As an alternative of miners competing with computer systems and electrical energy, Ethereum makes use of “validators” that lock ETH as collateral and run software program that proposes and attests to blocks.

When validators do the job appropriately, they obtain rewards paid by the protocol. After they go offline or misbehave, they will lose a part of their rewards and, in additional extreme instances, a portion of the locked ETH by slashing.

Staking is enticing to establishments as a result of the rewards are native to the protocol, not depending on lending property to a borrower. It nonetheless carries operational threat, however that’s dampened by the truth that the core supply of yield is the community itself.

Everstake’s report says that by the tip of 2025, about 36.08 million ETH was staked, which it describes as 29.3% of provide, with web progress of greater than 1.8 million ETH over the yr.

That issues for treasuries as a result of it reveals staking has develop into a big, established market reasonably than a distinct segment exercise.

TheDAO’s leftover rescue money sat for a decade now it’s becoming Ethereum’s permanent $220M security budget

Veterans want to stake 69,420 ETH from leftover 2016 recovery funds, generating millions yearly for smart contract security.

Jan 30, 2026 · Gino Matos

The ETH treasury flywheel: premium financing plus protocol yield

Everstake describes two levers that treasury firms are attempting to tug.

The primary is mNAV arbitrage. If an organization’s inventory trades at a premium to the market worth of its underlying property, it could possibly difficulty new shares and use the proceeds to purchase extra ETH.

If the premium is giant sufficient, that may enhance ETH per share for present shareholders even after dilution, as a result of traders are successfully paying extra for every unit of Ethereum publicity than it prices to accumulate ETH immediately.

The loop works so long as the premium holds and capital markets keep open.

The second lever is staking rewards. As soon as the ETH is held, the corporate can stake it and obtain further ETH over time.

Everstake frames the staking leg as roughly 3% APY, with the important thing level being low marginal prices as soon as infrastructure is in place. A treasury that stakes needs to compound in token phrases, not simply trip value appreciation.

Collectively, the pitch for treasury staking is simple. The premium funds progress when markets are optimistic, and staking produces regular accumulation when markets are quieter.

Each mechanisms goal on the identical output: extra ETH per share.

Ethereum’s hidden ‘death spiral’ mechanic could freeze $800 billion in assets regardless of their safety rating

The Bank of Italy warns of systemic risk as Ethereum's collapsing price could pave the way for network hijacking and asset manipulation.

Jan 12, 2026 · Oluwapelumi Adejumo

The three treasury staking playbooks

Everstake’s report concentrates the sector into three giant holders and assigns every a task within the story.

It estimates BitMine holds about 4 million ETH, the determine that dominates Everstake’s “hockey stick” chart. Everstake additionally says BitMine is shifting towards staking at a fair greater scale, together with plans for its personal validator infrastructure and disclosures that “a whole bunch of 1000’s of ETH” had been staked through third-party infrastructure by late December 2025.

SharpLink Gaming holds about 860,000 ETH, staked as a part of an energetic treasury strategy the place staking rewards are handled as working earnings and stay on the steadiness sheet.

The Ether Machine holds about 496,000 ETH, with 100% staked. Everstake cites a reported 1,350 ETH in web yield throughout a interval as proof of what a “absolutely staked” mannequin seems to be like.

These numbers are proof that the technique is being institutionalized. These aren’t small experiments for the businesses. Their positions are giant sufficient that staking venue, operational posture, disclosure follow, and threat controls develop into a part of the product.

Ethereum faces a dangerous 40-day deadlock after BitMine’s aggressive staking forces a historic liquidity squeeze

Ethereum faces a $5 billion stress test, what are the three scenarios for 2026?

Jan 14, 2026 · Oluwapelumi Adejumo

The place establishments stake, and why “compliance staking” exists

Essentially the most sensible perception in Everstake’s report is that staking is splitting into lanes.

Retail typically stakes by exchanges for simplicity, and DeFi-native customers chase liquidity and composability by liquid staking tokens.

Establishments typically need one thing nearer to conventional operational separation: outlined roles, a number of operators, auditability, and a construction that matches present compliance expectations. Everstake factors to Liquid Collective as a compliance-oriented staking answer and makes use of its liquid staking token LsETH as a proxy for institutional migration.

The report says LsETH grew from about 105,000 ETH to round 300,000 ETH and hyperlinks that progress to outflows from Coinbase trade balances as an indication of enormous holders shifting away from trade custody whereas nonetheless preferring “enterprise-grade” staking constructions.

It provides an trade snapshot that reinforces the purpose. Everstake says Coinbase’s share fell by roughly 1.5 million staked ETH, from 10.17% to five.54%, whereas Binance elevated from 2.02 million to three.14 million ETH, with the share rising from 5.95% to eight.82%.

The figures matter much less as a verdict on both venue and extra as proof that staking distribution modifications meaningfully when giant gamers reposition.

For treasury firms, that staking-lane query is structural.

If the technique is determined by staking rewards to help compounding, then operator diversification, slashing safety, downtime threat, custody structure, and reporting practices cease being back-office particulars and develop into core components of the funding case.

The rails beneath the commerce: stablecoins and tokenized Treasuries

Everstake doesn’t deal with company treasuries as a standalone phenomenon, however ties them to Ethereum’s institutional pull in 2025: stablecoin liquidity and tokenized Treasury issuance.

On stablecoins, Everstake says complete stablecoin provide throughout networks surpassed $300 billion, with Ethereum L1 plus L2s holding 61%–62%, or about $184 billion. The argument is that Ethereum’s safety and settlement depth hold attracting the on-chain greenback base that establishments truly use.

On tokenized Treasuries, Everstake says the market was approaching $10 billion and places Ethereum’s ecosystem share at about 57%. It frames Ethereum L1 as a safety anchor for main issuers and cites merchandise corresponding to BlackRock’s BUIDL and Franklin Templeton’s tokenized cash fund.

This context is essential for the treasury commerce.

A public firm making an attempt to justify a long-term ETH place and a staking program wants a story that goes past crypto hypothesis.

Tokenized money and tokenized Treasuries are simpler to defend as structural adoption than most different on-chain classes, and their progress makes it easier to elucidate why the asset securing the ledger may matter over an extended horizon.

The dangers that may break the Ethereum staking mannequin

Everstake features a warning about focus and correlated failures.

It cites a Prysm shopper outage in December 2025, saying validator participation dropped to round 75% and 248 blocks had been missed, and makes use of the occasion to argue that shopper herding can create network-wide fragility.

That threat issues extra if giant public treasuries consolidate into related infrastructure decisions, as a result of their staking selections can affect focus. It additionally issues as a result of staking returns are solely clear when operations are resilient.

Whereas downtime, misconfiguration, and slashing may sound summary to firms, they’re as a lot a part of the enterprise as staking is.

The second threat is capital markets, as a result of mNAV arbitrage is an efficient mechanism solely when markets are sturdy. If the fairness premium compresses, issuing inventory turns into dilutive reasonably than accretive, and the loop stops working.

Staking yield doesn't repair that by itself, as a result of yield is incremental whereas fairness financing is the expansion engine.

A 3rd threat is governance and regulation.

Treasury firms function inside disclosure and custody regimes that may tighten rapidly. The technique is determined by sustaining a construction that auditors, boards, and regulators can tolerate, particularly if staking turns into a cloth contributor to reported earnings.

The ETH treasury commerce is constructed on a easy proposition: accumulate ETH, stake it to develop holdings in token phrases, and use public-market entry to scale quicker than a personal steadiness sheet may.

Whether or not it survives as a sturdy class will depend upon two measurable issues: how effectively these firms operationalize staking with out creating hidden fragility, and the way persistently their fairness wrappers can maintain premiums that make the financing loop work.

The submit A sudden shift in Ethereum staking is draining billions from exchanges towards a brand new company elite appeared first on CryptoSlate.

Related Reading

Related Reading  Related Reading

Related Reading  Related Reading

Related Reading  Related Reading

Related Reading