Key Takeaways:

- Ethereum transaction charges dropped from a peak of $200 to $0.14.

- The decline is because of a collection of scaling upgrades to the blockchain.

- Ethereum’s Layer 1 community exercise is at an all-time excessive, whilst charges fall.

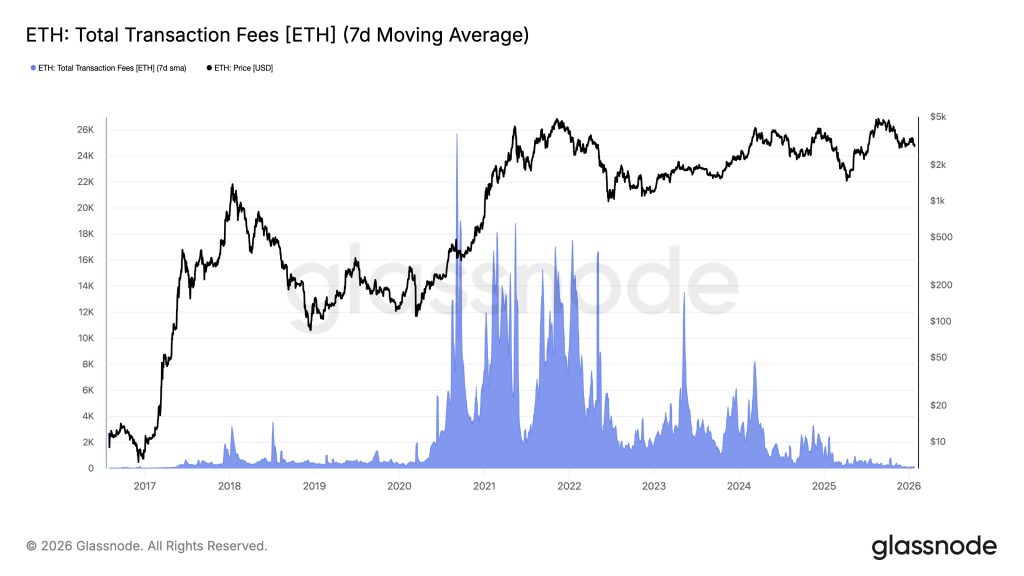

Ethereum community charges have dropped to their lowest stage since 2017, with the common price of sending a transaction over the blockchain falling from a peak of $200 to $0.14 this yr, in accordance with information from Glassnode.

The decline is, partly, because of a collection of upgrades to the blockchain. Since 2021, Ethereum has undergone a number of scaling upgrades, together with the change to Proof-of-Stake (PoS) and the so-called Fusaka and Dencun upgrades, which improved community capability and effectivity.

Extra customers have moved to Layer 2 (L2) networks like Arbitrum and Base, lowering congestion on the underlying Ethereum blockchain, or mainnet. Validators additionally agreed to extend the gasoline restrict per block from 30 million to 36 million, which means that every block can now course of extra transactions.

“Low-cost transactions on mainnet are undoubtedly a internet optimistic for the business,” Ivo Georgiev, cofounder and CEO of Ethereum-focused Ambire Pockets, instructed Cryptonews. “Customers achieve extra confidence within the protocol, they focus extra of their belongings on mainnet, main to raised UX.”

Georgiev added that decrease charges might “even unlock new potentialities resembling new cryptographic protocols that will in any other case be prohibitively costly, for instance, quantum-proof ones.”

ETH transaction charges averaged $50-$200 throughout the NFT increase of 2021-2022 as community exercise shot by way of the roof. Information exhibits that the charges fell sharply in November 2022 to beneath $2 earlier than spiking to $35 in March 2024.

Charges have headed down ever since, with a sustained downturn beginning in February 2025. In complete, the quantity of charges paid to validators – the folks that assist safe the community – has dropped from a peak of about 25,668 ETH (~$77M) 5 years in the past to 153 ETH (~$450K), on a seven-day common, in accordance with Glassnode.

Ethereum Transaction Quantity at ATH as Charges Fall

Validators obtain transaction charges every time they add transactions to a block, with greater charges getting precedence. Low transaction charges typically level to a decline in demand to make use of Ethereum block area, analysts say, which in a approach indicators there may be much less exercise going down on the blockchain.

The metric is risky, and charges can rise dramatically from in the future to the subsequent, relying on ETH worth motion. Volatility spurs buying and selling, which in flip propels on-chain exercise and a rise in transaction charges, analysts say.

“There’s no thriller behind Ethereum’s falling transaction charges,” Georgii Verbitskii, founding father of DeFi crypto service Tymio, instructed Cryptonews.

“It’s fundamental provide and demand. Charges rise when many transactions compete for restricted block area, they usually fall when demand drops. Proper now, we’re merely seeing fewer transactions.”

Verbitskii stated the decline in Ethereum community charges matches the broader “cool-off” part that the crypto market goes by way of. He says exercise tends to gradual after durations of intense hypothesis and hype, as “customers transact much less, builders pause launches, and capital turns into extra selective.”

“Throughout these phases,” Verbitskii avers, “networks like Ethereum look cheaper to make use of, not as a result of the system modified dramatically, however as a result of demand briefly stepped again.”

“As soon as market exercise picks up once more, whether or not by way of new purposes, renewed DeFi utilization, or a broader risk-on atmosphere, transaction volumes will rise, and charges will regulate accordingly.”

It’s notable that Ethereum’s Layer 1 community exercise is at an all-time excessive, whilst charges fall. In keeping with Leon Waidmann, head of analysis at Lisk, Ethereum’s transaction quantity hit greater than 16 million this January.

Ethereum is now processing 3 times the variety of transactions at only a third of the associated fee in comparison with the height of the “fee-driven explosion” in 2021, Waidmann wrote in a publish on X.

“What’s completely different: 2021 was a speculation-driven charge explosion. Now it’s precise utilization at scale. Individuals are paying for actual financial exercise,” he stated.

Might Decrease Charges Influence Validators?

Whereas decrease transaction charges are sometimes a welcome aid for Ethereum customers, there may be some concern which will pose a problem to validators, who depend on transaction charges as a serious supply of earnings.

However Marcin Kaźmierczak, cofounder of crypto information supplier RedStone, poured chilly water on the fears. He instructed Cryptonews that Ethereum’s change to the Proof-of-Stake mechanism in 2022 “eradicated miner income dependency on transaction charges totally.”

“Validators now earn by way of staking yields, making MEV and precedence charges much less essential to community economics,” he stated, including:

“For community safety, that is broadly wholesome. Validator economics stay strong by way of staking rewards (~3% APY), so the community doesn’t rely upon charge spikes for safety.”

Kaźmierczak stated low charges scale back friction for oracle submissions and information aggregation from corporations like RedStone, an infrastructure layer that “advantages from cheaper, frequent state commitments” and updates.

“The true query isn’t safety (which is strong),” he explains, “however whether or not Ethereum’s charge construction now correctly incentivizes information availability to remain aggressive as Layer 2 demand matures.”

As of this writing, ETH is buying and selling at $2,714, down 7.7% on the day. The value has barely moved in comparison with this time a yr in the past, although it soared above $4,770 in August 2025.

Ethereum (ETH)24h7d30d1yAll timeThe publish Ethereum Transaction Charges Hit Their Lowest Stage in 9 yrs. Why It Issues appeared first on Cryptonews.