Japan’s Monetary Providers Company has unveiled strict collateral necessities for stablecoin reserve belongings, setting a remarkably excessive threshold that would restrict which bonds qualify as backing for digital yen devices.

The proposed guidelines mandate that foreign-issued bonds should carry top-tier credit score rankings and are available from issuers with at the least 100 trillion yen ($650 billion) in excellent debt, a bar few world entities can meet.

The draft requirements emerged Monday as a part of regulatory notices implementing the 2025 Cost Providers Act amendments, establishing how stablecoin issuers could make investments “specified belief beneficiary pursuits” underneath Japan’s evolving digital forex framework.

Japan opens public session on stablecoin reserves, looking for suggestions on which bonds can again yen-pegged tokens.

Deadline Feb 27, 2026.

The message is evident: stablecoins are transferring from experiment to regulated cash. pic.twitter.com/iUhbGdUlQs— Roxom TV (@RoxomTV) January 27, 2026

Japan Units 100 trillion Yen As Minimal Bond Collateral

The proposed FSA discover restricts eligible backing belongings to international bonds that meet twin standards, favoring solely the world’s largest sovereign and company issuers.

Qualifying bonds should obtain a credit score danger ranking of “1–2” or greater from designated businesses whereas originating from entities whose complete bond issuance reaches the 100 trillion yen minimal.

Past collateral requirements, new supervisory pointers goal banks and insurance coverage subsidiaries providing cryptocurrency intermediation providers.

Monetary establishments should now explicitly warn prospects to not underestimate digital asset dangers just because merchandise carry a standard banking model.

The FSA additionally launched screening necessities for companies dealing with international stablecoins, demanding affirmation that abroad issuers won’t instantly solicit Japanese retail prospects.

Regulators plan to coordinate cross-border with international authorities to observe these devices and their originators.

The session interval runs by means of February 27, 2026, implementing Act No. 66 of 2025 that revised Japan’s settlement and digital fee framework final June.

After public feedback shut, the foundations will bear closing procedures earlier than taking impact.

Stablecoins Reshape Japan’s $9 Trillion Bond Market

Whereas the FSA tightens oversight, Japan’s rising stablecoin sector is doubtlessly set to remodel the nation’s sovereign debt panorama, with implications for the Financial institution of Japan’s (BOJ) affect over its $9 trillion Japanese authorities bond (JGB) market.

JPYC, the Tokyo-based issuer of Japan’s first yen-pegged stablecoin, means that digital asset corporations might change into important holders of presidency bonds as reserve necessities broaden.

The corporate launched its yen-backed stablecoin on October 27 underneath Japan’s revised Cost Providers Act, marking the nation’s inaugural authorized framework for stablecoins.

Founder and CEO Noritaka Okabe informed Reuters that stablecoin issuers would possibly assume roles historically occupied by the BOJ, which has been lowering bond purchases following years of aggressive financial easing.

“With the BOJ tapering bond shopping for, stablecoin issuers might emerge as the largest holders of JGBs within the subsequent few years,” Okabe said, including that whereas authorities might affect bond period, controlling complete holdings would show difficult.

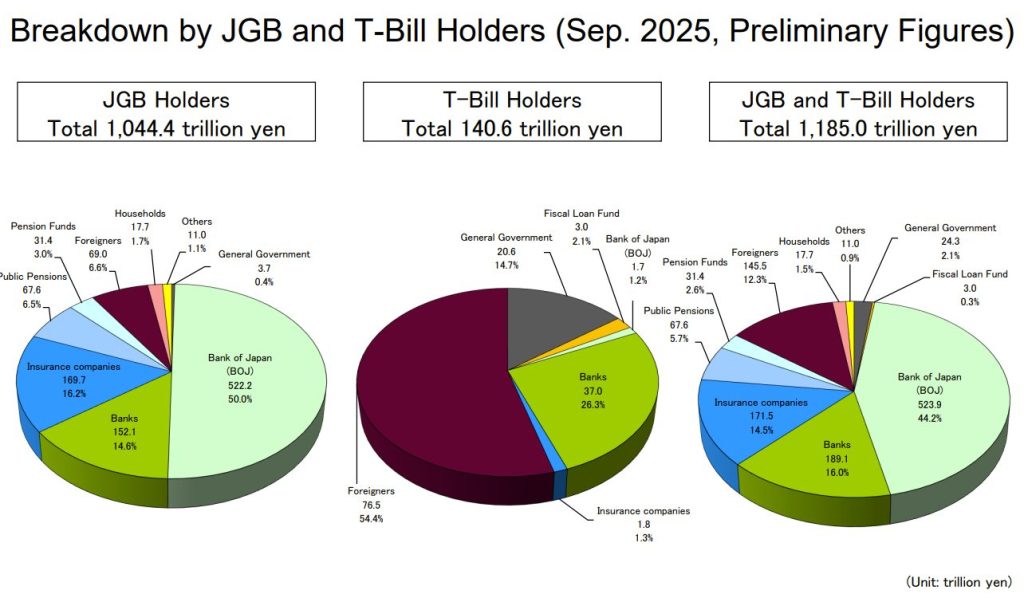

At the moment, the BOJ dominates Japan’s JGB market, holding roughly 50% of the 1,055-trillion-yen market, adopted by insurance coverage corporations and home banks. International traders and public pensions signify smaller market shares.

Okabe proposed that stablecoin issuers might fill rising gaps, with JPYC planning to allocate 80% of proceeds to JGBs and 20% to financial institution deposits.

Main Banks Unite for Yen Stablecoin Initiative

Regardless of strict rules, Japan’s three largest monetary establishments, Mitsubishi UFJ Monetary Group, Sumitomo Mitsui Monetary Group, and Mizuho Monetary Group, are collaborating on a joint initiative to launch yen-backed stablecoins for home customers.

The banking trio intends to advertise settlements utilizing pegged cryptocurrencies, difficult the market dominance of dollar-denominated stablecoins like USDT and USDC.

In response to Nikkei, the banks will set up infrastructure enabling company shoppers to switch stablecoins between entities in accordance with standardized protocols, initially specializing in yen-pegged tokens, with potential dollar-pegged variations deliberate for future deployment.

Japan’s Nomura Holdings and SBI Holdings are creating the primary crypto ETF merchandise, awaiting approval for itemizing on the Tokyo Inventory Alternate. #JapanCryptoETF #NomuraHoldings #SBIHoldingshttps://t.co/zT14u2QbqK

— Cryptonews.com (@cryptonews) January 26, 2026

These developments align with Japan’s broader digital finance transformation, as cashless fee adoption surged to 42.8% in 2024 from simply 13.2% in 2010.

Stories additionally point out that Japan’s monetary watchdog is contemplating permitting banks to buy and maintain digital belongings comparable to Bitcoin for funding functions earlier than 2028.

The submit Japan Proposes Strict Bond Requirements for Stablecoin Collateral – Can Issuers Meet the Bar? appeared first on Cryptonews.