Bitcoin is once more close to one other essential on-chain inflection level as a key profitability indicator goes again to the degrees that final occurred throughout some of the painful downtrends within the historical past of the market.

CryptoQuant analyst Adler AM information exhibits that the Internet Realized Revenue and Lack of Bitcoin has dropped by roughly 97% after it achieved its latest excessive and is now approaching the degrees of near-zero territory.

The state of affairs is just like these noticed in June 2022 earlier than BTC plummeted from about 30,000 to virtually 16,000.

Internet Realized P/L has dropped by 97% and returned to zero. The final time this occurred was in June 2022 – proper earlier than the drop from $30K to $16K. Whales are nonetheless in revenue (a 25-80% buffer), so there isn’t any panic but. However the market is being supported not by patrons – however by the… pic.twitter.com/ooQsnaGTCA

— Axel

Adler Jr (@AxelAdlerJr) January 26, 2026

Internet Realized P/L tracks the stability between realized income and losses on the Bitcoin community primarily based on on-chain value foundation. Constructive readings sign dominant profit-taking, whereas adverse values mirror loss-driven promoting.

Readings close to zero counsel trades are occurring near value foundation, indicating revenue exhaustion and a stability between patrons and sellers.

Bitcoin Promoting Strain Fades, however Consumers Keep on the Sidelines

The analyst identified that the present setup resembles the interval simply earlier than Bitcoin’s essential capitulation leg in 2022. In late 2024 and early 2025, Internet Realized P/L surged above $1.5 billion, reflecting an overheated profit-taking part.

By January 26, 2026, that determine had collapsed to roughly $60 million, successfully flattening on the zero line. In 2022, an analogous return to zero didn’t mark a backside.

As an alternative, the metric continued decrease into deeply adverse territory, falling to round minus $350 million as the worth slid one other 50%.

Adler famous that the current zero studying shouldn’t be interpreted as a bullish reversal sign. As an alternative, it represents a pause the place promoting stress from profit-takers has largely dried up, however contemporary demand has not stepped in.

On-chain information suggests the market is at the moment being supported extra by the absence of sellers than by robust shopping for curiosity, a fragile equilibrium that has traditionally damaged decrease throughout risk-off environments.

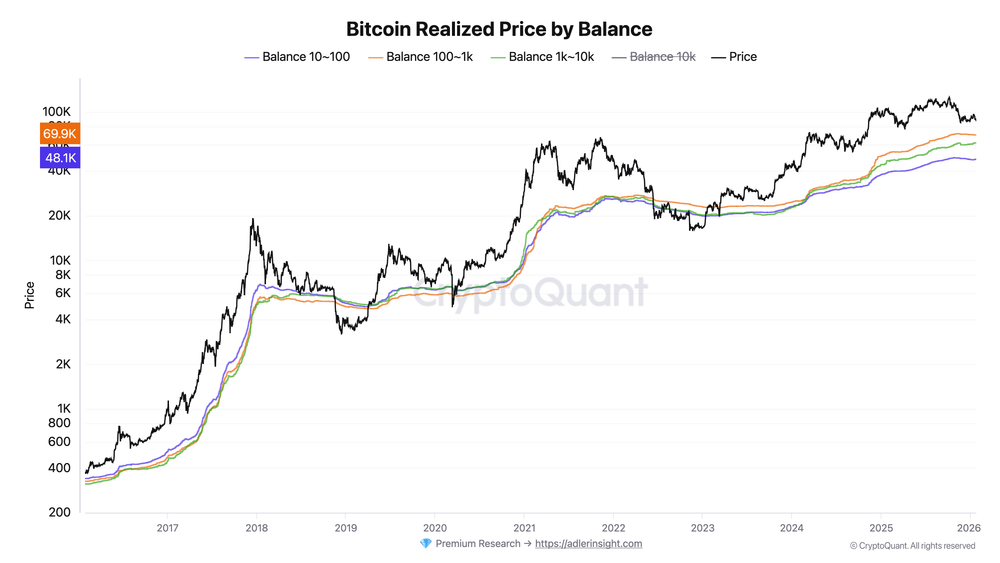

Regardless of the warning indicators, giant Bitcoin holders stay in revenue, as realized value information segmented by stability dimension exhibits that every one main whale cohorts are nonetheless comfortably above their common acquisition prices.

Holders with balances between 100 and 1,000 BTC have the very best realized value, close to $69,900, giving them an estimated revenue buffer of about 25% at present costs.

Different giant cohorts, together with wallets holding 10–100 BTC and people with greater than 10,000 BTC, have common entry costs nearer to $48,000 and $51,000, translating to unrealized positive factors of 70% to 80%.

This helps clarify the dearth of panic promoting, at the same time as value has pulled again sharply from latest highs.

Bitcoin Slips Beneath $88K as Volatility Picks Up

On the time of writing, Bitcoin was priced at roughly $87,756, having fallen by roughly 1.1% within the final 24 hours and 5.7% within the final week.

Buying and selling quantity, nonetheless, surged greater than 160% day over day to $53.1 billion, pointing to heightened exercise as merchants reposition amid volatility.

Macro stress has contributed to the discomfort as a result of U.S. President Donald Trump threatened to impose 100% tariffs on any Canadian merchandise in case Ottawa strengthens commerce relations with China, and the rumors of a possible American authorities shutdown resurfaced.

The transfer triggered greater than $320 million in liquidations of leveraged lengthy positions in a matter of hours.

Additionally, CoinShares reported $1.73 billion in outflows from digital asset funding merchandise final week.

Digital asset funding merchandise noticed sharp outflows final week, with traders pulling $1.73B — the most important weekly decline since mid-November 2025, in keeping with CoinShares.#BTC #ETPs https://t.co/2ni4w83evG

— Cryptonews.com (@cryptonews) January 26, 2026

Bitcoin-linked merchandise accounted for $1.09 billion of these outflows, with the majority coming from U.S.-based funds.

Alternate order guide information exhibits sell-offs have been absorbed with modest quantity delta, indicating managed promoting.

Analysts say liquidity stays secure, with no indicators but of cascading capitulation.

The publish Bitcoin’s Internet Realized P/L Hits Zero Once more — Is a June 2022-Fashion Capitulation Subsequent? appeared first on Cryptonews.