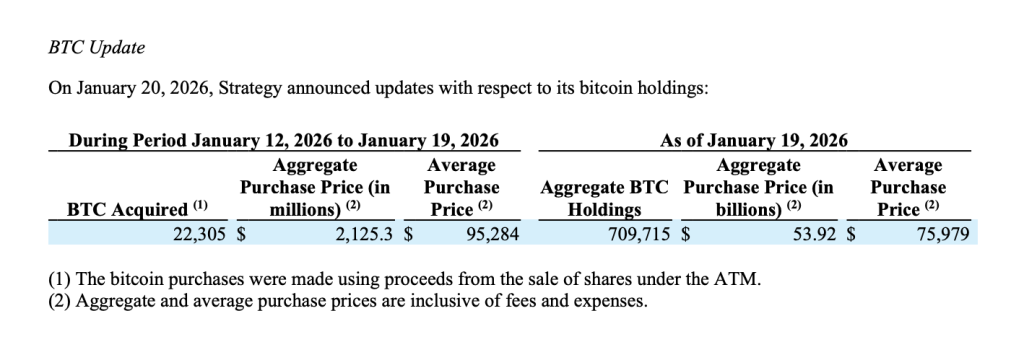

Billionaire Michael Saylor’s Technique has added one other 22,305 bitcoin to its steadiness sheet spending roughly $2.13 billion as the corporate continues its aggressive accumulation technique.

Technique has acquired 22,305 BTC for ~$2.13 billion at ~$95,284 per bitcoin. As of 1/19/2026, we hodl 709,715 $BTC acquired for ~$53.92 billion at ~$75,979 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/6hpAeOxp2I

— Technique (@Technique) January 20, 2026

The acquisition disclosed on January 20, follows gross sales performed beneath Technique’s at-the-market (ATM) fairness and most popular inventory packages between January 12 and January 19, 2026. The bitcoin was acquired at a median value of roughly $95,284 per BTC, inclusive of charges and bills.

As of January 19, Technique now holds a complete of 709,715 bitcoin acquired for roughly $53.92 billion at a median value of $75,979 per BTC.

ATM Program Funds Newest Bitcoin Acquisition

In accordance with the submitting, Technique raised roughly $2.125 billion in internet proceeds through the interval via a mixture of fairness and most popular inventory issuance. Nearly all of capital was generated via gross sales of STRC variable-rate most popular shares and MSTR Class A standard inventory.

Notably, Technique bought 2.95 million STRC shares for $294.3 million in internet proceeds and issued 10.4 million MSTR shares, producing $1.83 billion. Smaller quantities had been raised via STRK most popular inventory gross sales, whereas no issuance occurred beneath STRF or STRD through the interval.

The corporate confirmed that proceeds from the ATM program had been used on to fund bitcoin purchases, reinforcing its long-standing capital markets-to-bitcoin conversion technique.

Bitcoin Holdings Proceed to Scale

With the most recent acquisition, Technique’s bitcoin holdings have grown by greater than 22,000 BTC in a single week, cementing its place as the biggest company holder of bitcoin globally.

At present ranges, the corporate’s mixture holdings symbolize over 3% of bitcoin’s complete circulating provide. Whereas the typical buy value of latest acquisitions sits above Technique’s historic price foundation, administration has repeatedly emphasised long-term accumulation over short-term value sensitivity.

The disclosure exhibits that whereas the most recent tranche was acquired close to latest market highs, Technique’s blended acquisition value stays materially decrease because of earlier purchases made at discounted ranges.

Capital Markets Technique Stays Intact

Technique’s continued use of most popular inventory issuance and fairness gross sales displays a deliberate effort to diversify funding sources whereas minimizing operational money move dependence.

The agency nonetheless has greater than $8.4 billion of MSTR inventory and billions in most popular securities obtainable for future issuance beneath its ATM packages.

Regardless of heightened volatility in crypto markets and ongoing regulatory uncertainty, Technique has maintained its bitcoin-centric capital allocation framework, positioning BTC as its major treasury reserve asset.

Lengthy-Time period Conviction Unchanged

The most recent buy exhibits Technique’s unwavering conviction in bitcoin as a long-duration retailer of worth and financial asset. By systematically changing capital raised in conventional markets into bitcoin publicity, the corporate continues to function as a leveraged proxy for institutional bitcoin adoption.

As of January 19, Technique’s steadiness sheet displays not simply scale however persistence — a defining function of its strategy as bitcoin enters a extra institutionally pushed part of market maturity.

The put up Billionaire Michael Saylor’s Technique Buys 22,305 Bitcoin for $2.13B – Is One thing Huge Coming? appeared first on Cryptonews.