Layer 1 blockchain tokens suffered extreme depreciation in 2025, with main belongings shedding as much as 73% of their worth regardless of sustained developer exercise, in keeping with the newest Finish-of-12 months report from OAK Analysis.

Whereas Bitcoin maintained relative power all year long, various Layer 1 tokens skilled brutal sell-offs that uncovered structural weaknesses in tokenomics and market positioning.

The report reveals a decisive shift from hypothesis to basic worth creation, with the market punishing protocols unable to point out real financial exercise.

Consumer Reallocation Masks Market Stagnation

The yr witnessed huge person redistribution slightly than total progress, with whole Month-to-month Energetic Customers declining 25.15% throughout main chains, in keeping with the report’s blockchain metrics evaluation.

Solana suffered the steepest decline, shedding almost 94 million customers (a drop of greater than 60%), whereas BNB Chain nearly tripled its person base by capturing fleeing members.

Layer 2 networks skilled comparable divergence. Base demonstrated the strongest progress, with TVL rising 37.2% to $4.41 billion, in keeping with the report, solidifying its place by way of Coinbase’s distribution benefit.

In the meantime, Optimism noticed TVL contract 63%, dropping from almost $2 billion to $786 million as capital rotated towards extra aggressive rivals.

Token Efficiency Displays Brutal Actuality

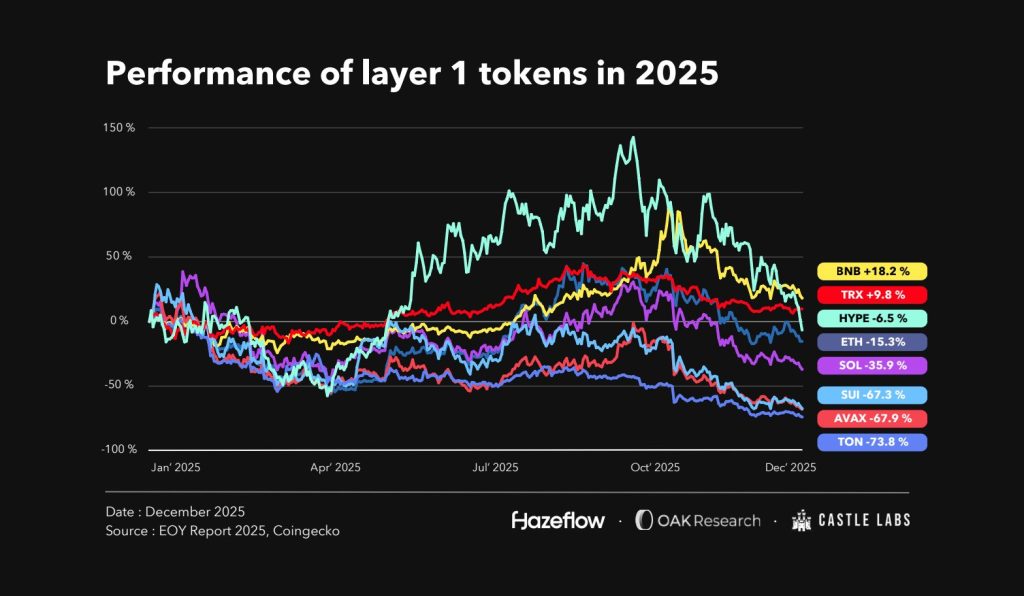

Value motion informed an unforgiving story. Amongst main Layer 1 tokens monitored since January, solely two completed optimistic:

- BNB gained 18.2%.

- TRX rose 9.8%.

The rest suffered catastrophic losses, with Solana dropping 35.9% and newer entrants like TON and AVAX falling over 67%.

Layer 2 tokens fared even worse regardless of technical progress.

The report paperwork that Optimism and zkSync Period each posted declines exceeding 84%, whereas Polygon and Arbitrum fell by greater than 73%.

Solely Mantle managed a modest 8.3% acquire, attributed to concentrated provide management slightly than basic power.

The report identifies a number of converging forces behind the decline. They are often summed up into three important causes:

- Overleveraged tokenomics with steady unlock schedules.

- Lack of credible value-capture mechanisms linking community utilization to token demand.

- Institutional choice for Bitcoin and Ethereum over smaller-cap alternate options.

Developer Exercise Diverges From Value

Regardless of worth carnage, developer exercise remained sturdy throughout choose ecosystems, in keeping with information from Electrical Capital cited within the report.

The EVM Stack maintained the most important developer base, with 17,473 whole contributors (up to date), together with 5,405 full-time builders, representing over 32% of exercise.

Bitcoin posted the strongest two-year progress in full-time builders amongst main ecosystems, rising 90.5% to 1,003 contributors.

Solana and the broader SVM Stack grew 75.8% over two years to 4,578 full-time builders, demonstrating sustained technical ambition regardless of brutal token efficiency.

General, the developer ecosystem is rising, however the disconnect between their exercise and token costs revealed what the report phrases as “market maturation.”

Groups continued constructing by way of down cycles, however speculative capital not rewarded infrastructure with out clear paths to income technology.

Income Meta Emerges as Criterion

The elemental lesson of 2025 grew to become inescapable, in keeping with the report’s financial evaluation. The report asserts that protocols with out credible income streams are vulnerable to extinction.

The trade pivoted decisively towards the “income meta,” the place precise money flows mattered greater than narrative.

Stablecoin issuers dominated income technology, accounting for 76% of earnings amongst high protocols.

Tether and Circle mixed generated $9.8 billion yearly, whereas derivatives platforms like Hyperliquid added $1.1 billion by way of sustainable fee-based fashions.

The report additionally identified a harsh fact that generic Layer 1s and Layer 2s missing differentiation couldn’t compete.

Networks required 10x enhancements in velocity, value, or safety to justify unbiased existence.

Outlook Stays Difficult

Wanting towards 2026, infrastructure tokens face continued headwinds regardless of regulatory readability in key markets, the report concludes.

The mixture of excessive inflation schedules, inadequate demand for governance rights, and focus of worth seize in base layers suggests additional consolidation forward.

The general sentiment within the altcoin market heading into 2026 stays cautious, notably as they’re experiencing a steep decline by no means seen earlier than.

Protocols that generate significant income could stabilize, however they continue to be topic to Bitcoin’s volatility and protracted unlock stress from early traders.

For present Layer 1 tokens, the report asserts that survival is dependent upon Ethereum and Solana, and that renewed institutional adoption would possibly restore hope.

With out management from market majors, generic infrastructure tokens will proceed to development towards irrelevance as capital concentrates in protocols that present financial worth slightly than technological novelty alone.

The publish L1 Tokens Crushed in 2025 as SOL, AVAX Drop Over 65%: Report appeared first on Cryptonews.