Moscow Trade and St. Petersburg Trade have confirmed readiness to launch regulated crypto buying and selling as soon as Russia’s legislative framework takes impact by mid-2026.

Based on native stories, the exchanges’ bulletins got here following the Financial institution of Russia’s December 23 launch of a regulatory idea that units July 1, 2026, because the deadline for creating complete cryptocurrency laws.

Moscow Trade said it’s “actively engaged on options to service the cryptocurrency market,” whereas St. Petersburg Trade emphasised it already possesses “the mandatory technological infrastructure for buying and selling and settlements.“

From Resistance to Regulated Markets

Russia’s path towards crypto regulation started gaining momentum in mid-2024, when the Ministry of Finance first proposed permitting certified buyers to commerce digital currencies on licensed exchanges.

Anatoly Aksakov, head of the State Duma Monetary Market Committee, mentioned on the time that main exchanges had been “already actively concerned in creating the cryptocurrency market and organizing the mandatory infrastructure.“

The regulatory framework divides market entry between certified and non-qualified buyers underneath sharply completely different situations.

Non-qualified buyers will likely be restricted to buying liquid cryptocurrencies from an outlined listing after passing necessary data assessments, with annual purchases capped at 300,000 rubles (roughly $3,800) via a single middleman.

Certified buyers face no quantity restrictions however should show understanding of crypto dangers via testing, although they are going to be barred from buying nameless tokens that conceal transaction knowledge.

Regardless of the forthcoming buying and selling infrastructure, Russian authorities preserve their ban on utilizing cryptocurrencies for home funds.

Russian lawmaker Anatoly Aksakov mentioned that funds in Russia should solely be performed in rubles, dismissing crypto turning into authorized tender.#RussiaCrypto #CryptoPayments #CryptoRegulationhttps://t.co/BLk0c4qHcQ

— Cryptonews.com (@cryptonews) December 17, 2025

State Duma Committee Chairman Anatoly Aksakov bolstered this place on December 17, declaring that cryptocurrencies “won’t ever turn into cash inside our nation” and might solely perform as funding devices, with all home funds required in rubles.

The Financial institution of Russia initially known as for a complete ban on crypto exchanges and token buying and selling, however Western sanctions prompted a coverage shift.

Mining Growth Drives Financial Integration

Russia’s crypto ecosystem has expanded dramatically past buying and selling hypothesis.

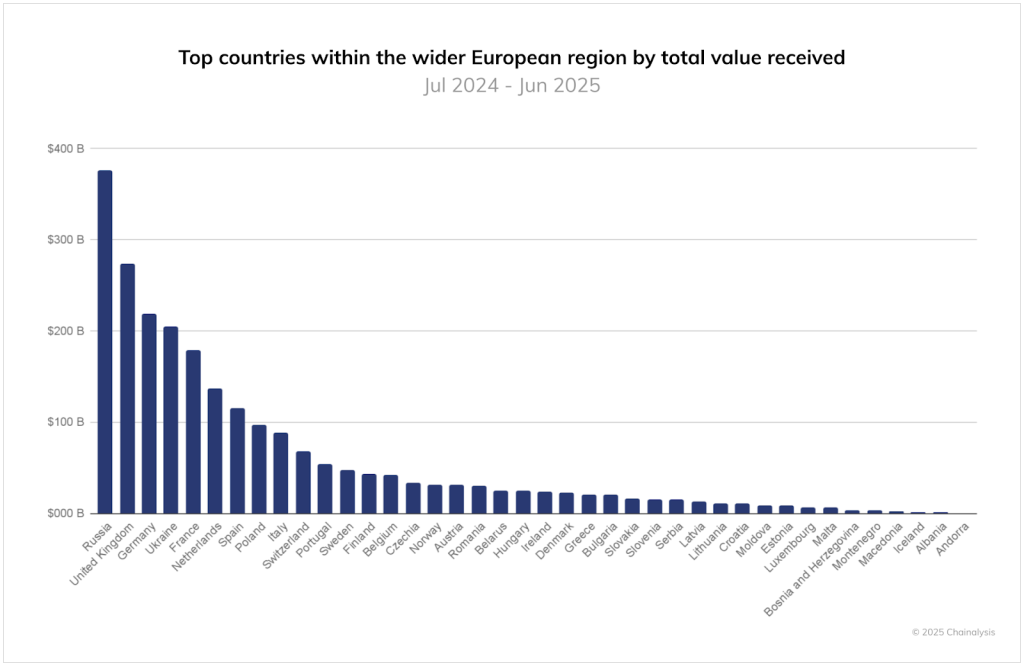

The nation recorded $376.3 billion in acquired crypto transactions between July 2024 and June 2025, surpassing the UK’s $273.2 billion and making Russia Europe’s largest crypto market by transaction quantity, in response to Chainalysis knowledge.

Giant-scale transfers exceeding $10 million grew 86% in Russia throughout this era, almost double the 44% development seen throughout the remainder of Europe, whereas DeFi exercise surged eightfold in early 2025 earlier than stabilizing at three and a half occasions the mid-2023 baseline.

A lot of this development has been tied to A7A5, a ruble-pegged stablecoin that reached $500 million in market capitalization regardless of Western sanctions, turning into the world’s largest non-dollar stablecoin.

The mining sector has additionally turn into notably vital for Russia’s economic system.

Senior Kremlin official Maxim Oreshkin not too long ago argued that crypto mining ought to be categorised as export exercise since mined property successfully movement overseas even with out crossing bodily borders.

Trade estimates recommend Russia produces tens of hundreds of Bitcoins yearly, producing roughly 1 billion rubles in each day mining income, and that the nation accounted for over 16% of world hashrate throughout the summer season months.

In truth, Central Financial institution Governor Elvira Nabiullina additionally not too long ago acknowledged that crypto mining contributes to the ruble’s power.

Russia's Central Financial institution confirms crypto mining strengthens the ruble as Kremlin officers push for formal export classification amid persistent underground operations.#Russia #Crypto #Mininghttps://t.co/P0JGyFTYfp

— Cryptonews.com (@cryptonews) December 22, 2025

Nevertheless, she famous that quantifying its precise affect stays tough, as a lot of the business operates in grey areas, with unlawful mining costing Russia billions of {dollars} yearly via stolen electrical energy and unpaid taxes.

Russia legalized crypto mining on November 1, 2024, requiring authorized entities to register with the Federal Tax Service.

Banks Enter Digital Property Market

Russia’s largest lender, Sberbank, has begun providing regulated crypto-linked investments totaling 1.5 billion rubles in structured bonds and digital monetary property tied to Bitcoin, Ethereum, and broader crypto portfolios.

Deputy Chairman Anatoly Popov confirmed “lively dialogue” with the Financial institution of Russia on integrating crypto companies inside regulated frameworks whereas constructing proprietary blockchain infrastructure.

Because it stands now, the regulatory timeline requires legislative frameworks to be accomplished by July 1, 2026, with legal responsibility for unlawful crypto middleman actions taking impact from July 1, 2027.

The put up Russia’s High Inventory Exchanges Able to Launch Crypto Buying and selling by 2026 appeared first on Cryptonews.