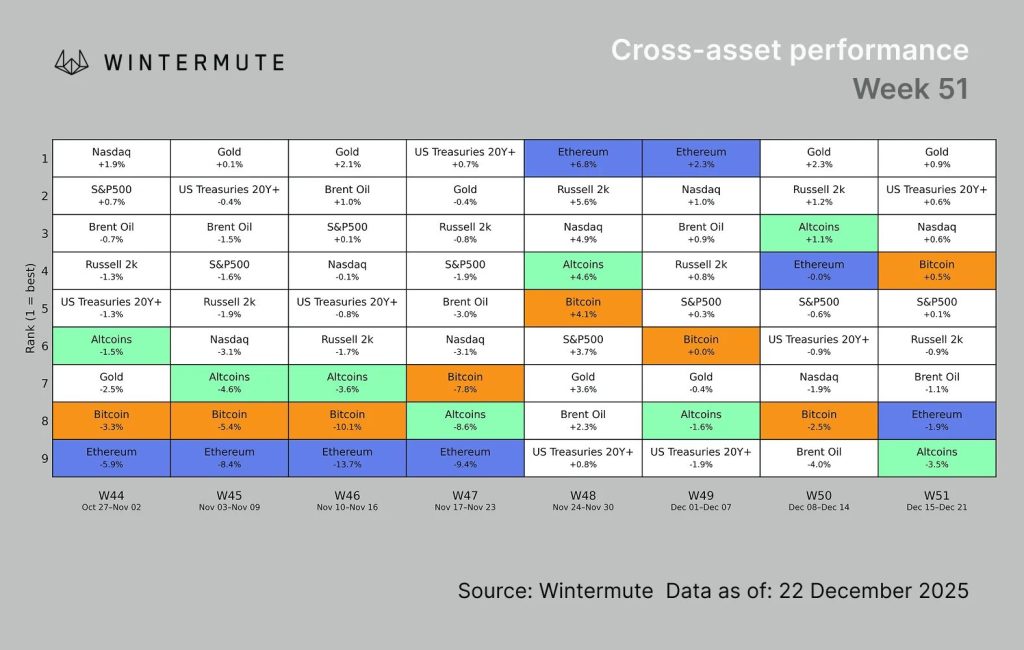

Bitcoin dominance continues its relentless climb as markets consolidate into year-end, leaving altcoins trapped underneath heavy provide strain and an unforgiving token unlock schedule.

Wintermute’s newest market replace confirms what many merchants feared. Retail traders are rotating out of altcoins and again into main property, signaling the tip of the anticipated altcoin rally that usually follows Bitcoin’s sturdy efficiency.

The broader crypto market prolonged losses over the previous 24 hours, with Bitcoin slipping 1.12% beneath $87,000 and Ethereum dropping 1.5% close to $3,000.

A number of altcoins noticed sharp pullbacks, with the NFT sector main declines at over 9% as weak short-term threat urge for food dominated buying and selling exercise.

Bitcoin and Ethereum Soak up Market Strain

Crypto markets noticed intense draw back strain early final week, with Bitcoin falling beneath $85,000 midweek and Ethereum breaching $3,000.

Liquidations surged to roughly $600 million on Monday, adopted by one other $400 million every day on Wednesday and Thursday as uneven circumstances pressured leveraged positions out quickly.

Bitcoin step by step recovered towards $90,000 later within the week, however the value motion remained constrained.

Perpetual open curiosity dropped $3 billion for Bitcoin and $2 billion for Ethereum in a single day, leaving markets weak to sharp strikes regardless of diminished leverage heading into the Christmas vacation interval.

Wintermute’s inner circulation knowledge reveals mixture shopping for strain returning to main property, with institutional circulation offering constant help for the reason that summer season.

The extra notable shift entails retail merchants rotating out of altcoins and again into Bitcoin and Ethereum, aligning with the rising consensus that Bitcoin should lead earlier than threat urge for food sustainably strikes down the market cap curve.

For now, Wintermute stood on the trail that “the market continues to commerce uneven as liquidity continues to be skinny and discretionary desks winding down into 12 months finish.”

Macro Headwinds Compound Altcoin Struggles

Markets stay range-bound as liquidity thins and discretionary desks wind down into year-end.

Draw back strikes keep abrupt however more and more self-contained as leverage flushes rapidly and capital retrenches into probably the most liquid property.

Bitcoin and Ethereum proceed appearing as main threat absorbers whereas the broader market struggles underneath provide strain and restricted threat urge for food.

“Funding and foundation throughout majors remained comparatively compressed via the sell-off,” Wintermute stated, with choices markets persevering with to cost a variety of outcomes as implied volatility stays elevated.

Notably, a latest Galaxy Analysis evaluation reveals that Bitcoin by no means crossed $100,000 when adjusted for inflation utilizing 2020 {dollars}, regardless of reaching an all-time excessive above $126,000 in October.

“Should you regulate the worth of Bitcoin for inflation utilizing 2020 {dollars}, BTC by no means crossed $100,000,” Alex Thorn, head of analysis at Galaxy, stated. “It really topped at $99,848 in 2020 greenback phrases.“

Conventional Finance Entry Gives Medium-Time period Help

Conventional monetary gamers proceed coming into the house regardless of latest market volatility, offering a extra sturdy basis for future progress.

Bitmine added one other 67,886 ETH price $201 million to its treasury, bringing whole December purchases to roughly $953 million.

Nonetheless, Bitcoin and Ethereum ETF web flows have turned destructive since early November, signaling diminished institutional participation and broader crypto-market liquidity contraction.

Bitcoin ETFs recorded $650.8 million in outflows over the previous 4 days, led by BlackRock’s Bitcoin ETF (IBIT), which recorded the biggest single-day outflow of $157 million.

Ethereum spot ETFs additionally recorded a web outflow of $95.52 million, with all 9 ETFs posting no inflows, in response to SosoValue.

Farzam Ehsani, co-founder and CEO of VALR, outlined two believable situations heading into 2026.

“Both the present drawdown displays strategic positioning by giant gamers forward of renewed accumulation, or the market is present process a deeper reset pushed by macro headwinds and Federal Reserve coverage,” he informed Cryptonews.

David Schassler, head of multi-asset options at VanEck, additionally maintained a constructive outlook regardless of present weak point.

Bitcoin costs would recoup in 2026, setting it as much as be a “prime performer,” regardless of the present market downturn, VanEck supervisor predicts.#VanEck #Bitcoin2026 #BTCOutlookhttps://t.co/3t8TvlvWcj

— Cryptonews.com (@cryptonews) December 24, 2025

“Bitcoin is lagging the Nasdaq 100 Index by roughly 50% year-to-date, and that dislocation is setting it as much as be a prime performer in 2026,” he wrote within the firm’s 2026 outlook report.

Ehsani sees scope for Bitcoin to revisit the $100,000–$120,000 vary within the second quarter of 2026, although he cautioned that “with out the emergence of latest main gamers, there will probably be no altcoin season; at greatest, we will anticipate a market restoration to earlier ranges.“

The submit Wintermute Warns: Altcoin Season Is Lifeless as Bitcoin Dominance Soars appeared first on Cryptonews.