The European Central Financial institution has confirmed that it’s going to start permitting blockchain-based transactions to settle in central financial institution cash in 2026, as political consideration more and more shifts to the unresolved privateness questions surrounding the proposed digital euro.

In a press release launched Friday, ECB government board member Piero Cipollone stated the establishment is making ready to make distributed ledger know-how settlements doable inside its current financial infrastructure subsequent yr.

The private and non-private sector should work collectively to form the way forward for cash, says Government Board member Piero Cipollone at @AspenInstitute. By providing pan-European cash, infrastructures and requirements, we assist built-in, protected and revolutionary funds… pic.twitter.com/uWHCbXHJdX

— European Central Financial institution (@ecb) December 19, 2025

On the similar time, he stated the ECB is continuous technical work on the digital euro, a central financial institution digital forex that will perform as a digital type of money throughout the euro space.

The transfer marks a concrete step towards integrating blockchain-based techniques into Europe’s monetary plumbing.

ECB Readies Digital Euro System, Places Resolution in Lawmakers’ Fingers

Beneath the plan, transactions executed on DLT platforms would have the ability to settle straight in central financial institution cash fairly than counting on non-public intermediaries.

The ECB has argued that that is crucial to stop fragmentation in tokenized markets and to make sure that new digital asset ecosystems proceed to depend on a risk-free public settlement asset.

Cipollone stated the digital euro infrastructure would even be designed to work together with different central financial institution digital currencies, permitting establishments to make use of it for cross-border funds.

He added that safeguards comparable to holding limits and the absence of curiosity funds can be inbuilt to stop large-scale shifts of deposits away from business banks, preserving their position in credit score creation and financial transmission.

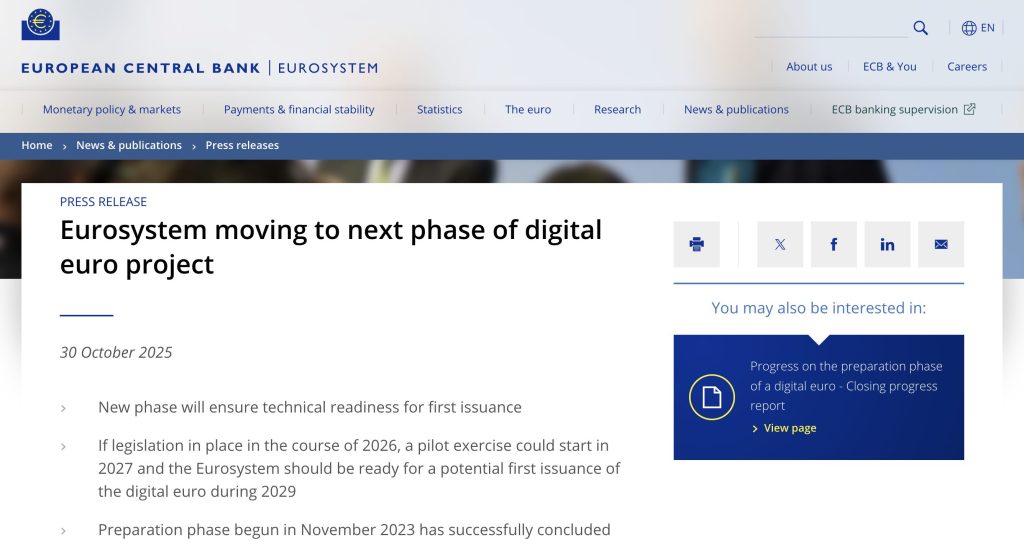

The ECB’s technical preparations are largely full, following a two-year preparation part that led to October 2025.

The challenge has now moved right into a readiness part, with the central financial institution choosing potential system suppliers and testing settlement mechanisms.

Nevertheless, officers have careworn that the ECB can’t proceed and not using a authorized framework accredited by EU lawmakers.

ECB President Christine Lagarde said this week that the central financial institution’s design work is completed and that duty now lies with political establishments.

ECB President Christine Lagarde stated that the digital euro is technically prepared and is now awaiting legislative approval.#ECB #DigitalEuro #EUStablecoinhttps://t.co/4cdYV6UdSJ

— Cryptonews.com (@cryptonews) December 19, 2025

If the laws is adopted in 2026, pilot transactions utilizing the digital euro may start in mid-2027, with the ECB aiming to be prepared for a primary issuance in 2029.

ECB Guarantees Privateness, however EU Guidelines Complicate the Digital Euro Imaginative and prescient

Because the timeline turns into clearer, the talk over privateness has intensified.

The ECB has persistently stated it doesn’t assist a programmable digital euro that will limit how customers can spend their cash.

It has additionally proposed an offline cost choice that will enable low-value transactions to happen with out being recorded on a central ledger, providing privateness protections corresponding to money.

Offline balances can be saved regionally on units or sensible playing cards, enabling device-to-device funds with out third-party validation.

These assurances distinction with broader regulatory tendencies within the European Union.

Latest EU proposals on knowledge retention and anti-money laundering have raised issues amongst privateness advocates, significantly as new AML guidelines are set to ban crypto accounts that enable transaction anonymization from 2027.

July 2027 triggers a compliance countdown for blockchain firms within the EU who should shut down nameless crypto accounts or danger expulsion.#EU #CryptoAccountshttps://t.co/Oa89JRaSmg

— Cryptonews.com (@cryptonews) Might 2, 2025

Critics argue that these insurance policies danger undermining the privateness ensures promised for a digital euro, even when the ECB itself doesn’t search entry to person knowledge.

Political negotiations at the moment are underway because the Council of the EU agreed on December 19 on its negotiating place for the digital euro’s authorized framework, clearing the way in which for talks with the European Parliament, which is anticipated to finalize its stance by Might 2026.

ECB officers have described discussions amongst member states as constructive however have acknowledged that privateness, knowledge entry, and democratic oversight stay contentious points.

Public curiosity additionally stays unsure. An ECB shopper survey revealed in March discovered that many Europeans see no use for a digital euro and like current cost strategies, together with money and financial institution accounts.

A brand new European Central Financial institution (ECB) report highlights Europeans' reluctance to undertake the digital euro, posing challenges for its deliberate rollout.#ECB #DigitalEuro https://t.co/3IIUvpseRd

— Cryptonews.com (@cryptonews) March 13, 2025

Whereas the ECB has stated adoption ranges wouldn’t threaten monetary stability, it has acknowledged that public belief and schooling shall be important.

The publish ECB Confirms DLT Transactions Coming in 2026 as Digital Euro Privateness Debate Heats Up appeared first on Cryptonews.