MSCI’s proposal to exclude digital asset treasury firms from its International Investable Market Indexes has triggered mounting opposition from trade leaders, with analysts warning the transfer might set off promoting strain of $10 billion to $15 billion throughout 39 firms holding $113 billion in mixed float-adjusted market capitalization.

The session closes December 31, with a ultimate choice anticipated January 15, 2026, concentrating on corporations whose digital asset holdings exceed 50% of complete belongings, with implementation scheduled for February’s Index Overview.

Technique Inc. formally challenged the proposal in a December 10 letter, signed by Government Chairman Michael Saylor and CEO Phong Le, calling the transfer “misguided” and “profoundly dangerous penalties” to capital markets and U.S. digital asset management.

The corporate argued that the proposal conflicts with the present administration’s pro-innovation digital asset agenda, together with initiatives equivalent to a Strategic Bitcoin Reserve and efforts to broaden retirement plan entry to digital belongings.

Working Corporations Face Funding Fund Classification

Technique’s core argument facilities on distinguishing working companies from passive funding automobiles.

The corporate emphasised that it runs a Bitcoin-backed company treasury and capital markets program, issuing fairness and fixed-income devices with various ranges of Bitcoin publicity.

BitcoinForCorporations’ technical evaluation demonstrates MSCI’s proposal violates core benchmark rules of representativeness, neutrality, and stability beneath IOSCO and BMR requirements.

We spell out the potential implications of MSCI's proposed 50% DAT exclusion rule: https://t.co/ceJZU0dRTP pic.twitter.com/5CixFrEYVR

— George Mekhail (@gmekhail) December 17, 2025

The group notes that MSCI has traditionally included REITs regardless of their 75% actual property focus, Berkshire Hathaway, with its massive funding portfolio, and mining firms holding substantial gold reserves.

But, it has by no means excluded working firms based mostly on their treasury asset composition.

Technique warned MSCI’s 50% threshold is unfair, noting crypto volatility and divergent accounting requirements might trigger firms to “whipsaw on and off” indices as valuations fluctuate.

Business Coalition Challenges Methodology

Try Asset Administration additionally submitted opposition on December 6, with CEO Matt Cole arguing that the proposal misunderstands the function of Bitcoin-focused corporations in AI infrastructure.

Miners, together with MARA Holdings, Riot Platforms, and Hut 8, are retooling information facilities for high-intensity AI workloads. “Many analysts argue that the AI race is more and more restricted by entry to energy, not semiconductors,” Cole wrote.

Try proposed a parallel “ex-digital asset treasury” index model, permitting selective avoidance whereas sustaining full market publicity for others.

For now, BitcoinForCorporations’ petition opposing the exclusion has gathered over 1,000 signatures, whereas Bitwise Asset Administration has additionally voiced its help for the technique, arguing “the facility of an awesome index lies in its neutrality.”

Bitwise helps @Technique inclusion in MSCI's International Investable Market Indexes. https://t.co/TXtKb8SvAN pic.twitter.com/sOa4v6sCyh

— Bitwise (@BitwiseInvest) December 11, 2025

Monetary Impression Evaluation Reveals Concentrated Threat

Prior to now, JPMorgan analysts have beforehand estimated that Technique alone might face $2.8 billion in outflows, with $9 billion of its market capitalization held by passive funds.

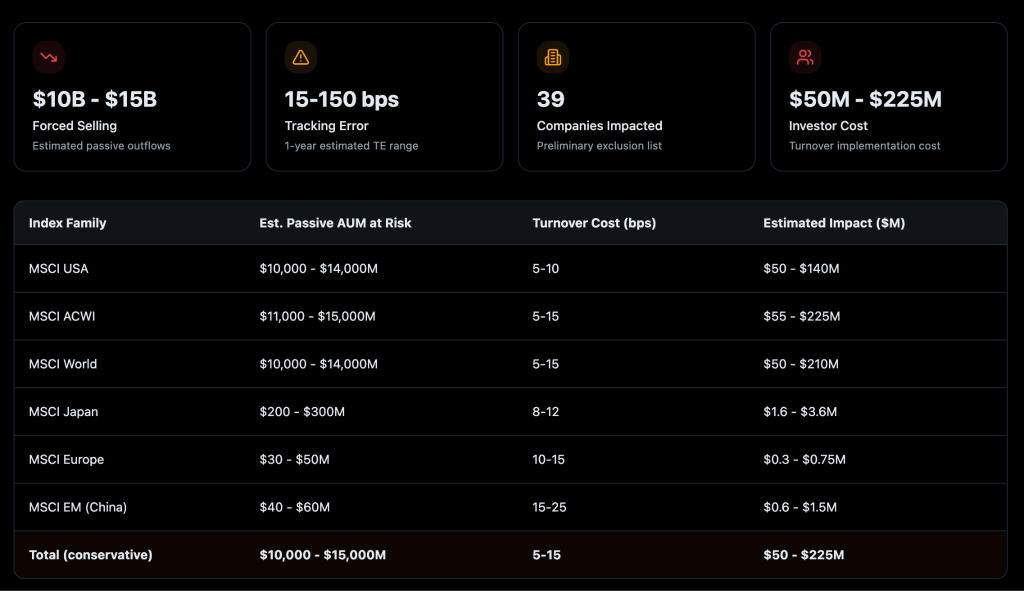

BitcoinForCorporations’ evaluation initiatives complete pressured promoting between $10 billion and $15 billion, with monitoring error starting from 15 to 150 foundation factors, relying on volatility, notably dangerous to institutional mandates with 20 to 50 foundation level monitoring tolerances.

The preliminary record consists of 18 present constituents representing $98 billion in float-adjusted market capitalization going through speedy removing, accounting for 87% of complete capital influence.

An extra 21 non-constituents, price $15 billion, face everlasting exclusion, representing huge pre-emptive blocking in MSCI’s methodology. Technique accounts for 74.5% of the overall impacted market cap at $84.1 billion.

Implementation prices are estimated between $50 million and $225 million throughout index households, with turnover prices starting from 5 to 25 foundation factors. The MSCI ACWI faces the very best estimated influence, starting from $55 million to $225 million.

Talking with Cryptonews, Farzam Ehsani, Co-founder and CEO of VALR, defined that markets are pricing in potential pressured flows.

“The market is assessing not solely the probability of a decline in inventory costs of firms whose steadiness sheets are tied to Bitcoin’s actions, but in addition potential chain reactions inside funds utilizing these indices as benchmarks,” Ehsani stated.

Affected firms collectively maintain over $137 billion in digital belongings.

The trade awaits MSCI’s January 15 choice. Technique urged MSCI to reject the proposal, stating “the wiser course is for MSCI to stay impartial and let the markets determine the course of DATs.“

The submit MSCI Index Modifications Might Power $15B Crypto Treasury Selloff appeared first on Cryptonews.