Ripple Stablecoin (RLUSD) is increasing to Ethereum in 2026. The choice was made in a press launch, and 4 Ethereum Layer 2 networks had been picked.

The stablecoin will probably be on a “trial” through Optimism, Base (Coinbase’s L2), Ink (Kraken’s L2), and Unichain (Uniswap’s L2), the corporate stated. The combination is about to contain the interoperability protocol Wormhole.

The objective is to iron out any points earlier than the total public rollout deliberate for 2026, after remaining regulatory approvals.

Is This a Step Towards a Greater Ripple–Ethereum Partnership?

No “large partnership” was explicitly introduced past the technical integration with Wormhole, nevertheless individuals are speculating now.

This transfer is general web optimistic for the Ethereum ecosystem. RLUSD brings roughly $1.3 billion in current provide deeper into L2s, the place most actual DeFi exercise occurs, together with buying and selling, lending, and DEXs.

ICYMI, yesterday was a giant second for stablecoin adoption.$RLUSD is now in full progress mode as @Ripple

expands the asset to extra blockchains, powered by wormhole

It's positioned as one of many solely stablecoins that has an opportunity to problem the community results of present… pic.twitter.com/93hZjZDd13— Robinson Burkey (native arc) (@robinson) December 16, 2025

Alongside USDC and USDT, RLUSD is one other extremely regulated stablecoin possibility obtainable for ETH customers now. Establishments in search of compliant on-ramps for DeFi, funds, or tokenization will possible move capital into Ethereum L2s, rising general exercise and transaction charges.

L2s like Optimism, which Ripple described as a “essential entry level,” might even see rising utilization. Extra transactions imply increased sequencer charges and eventual settlement worth flowing again to Ethereum mainnet.

ATH

The quantity of $RLUSD borrowed on @aave Horizon reached a brand new all-time excessive of $108,957,112.02

https://t.co/qNKhEeNWkh pic.twitter.com/AxSvZMVDBl

— Sentora (beforehand IntoTheBlock) (@SentoraHQ) December 16, 2025

This doesn’t “take” something from ETH. It’s additive quantity on Ethereum-aligned chains and truly validates Ethereum’s dominance in DeFi scaling, as even Ripple, traditionally XRP-focused, is chasing liquidity right here.

Ethereum Worth Prediction: ETH All Time Excessive Going Into 2026?

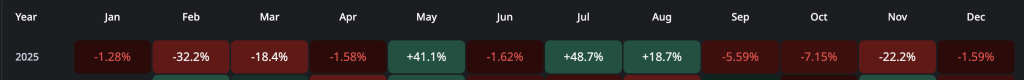

December returns have now flipped unfavorable. If December closes within the crimson, will probably be the ninth crimson month for ETH this 12 months.

The great factor is that draw back liquidity has virtually been taken out. Nevertheless, there may be nonetheless little or no shopping for momentum for Ethereum proper now.

From a technical standpoint, ETH value simply broke beneath $3,000. It isn’t the primary time, however it nonetheless triggers a warning.

Going into 2026, the ETH chart should maintain above $2,800, because it is a vital stage to maintain the construction wholesome. A dump beneath these ranges may end in a transfer towards new lows round $2,500.

May This Layer 2 Entice XRP Consideration Subsequent? Bitcoin Hyper ($HYPER)

Bitcoin could be the most safe community in crypto, however velocity and usefulness have at all times been its weak spots. That’s precisely the hole Bitcoin Hyper is attempting to shut.

Bitcoin Hyper is a brand new Layer 2 constructed to carry quick transactions, low charges, and full good contract performance to Bitcoin, with out compromising its safety. It leverages Solana-style high-performance structure whereas conserving BTC because the core settlement asset.

On the heart of the system is the Hyper Bridge, which permits BTC holders to maneuver funds onto the Hyper community in a trust-minimized manner. As soon as bridged, customers obtain a 1:1 illustration of BTC on the L2 with near-instant finality, opening entry to DeFi, staking, funds, meme cash, and NFT exercise that merely isn’t attainable on Bitcoin at present.

The concept is straightforward: let Bitcoin do what it does finest, safety and settlement, whereas Hyper handles velocity and execution. That mixture is why many see Bitcoin Hyper as one of many first severe makes an attempt to show Bitcoin right into a full financial layer, not only a retailer of worth.

Early curiosity has been robust, with Bitcoin Hyper already elevating practically $30M from traders betting that this may very well be the lacking piece for Bitcoin adoption at scale. As extra wallets, apps, and platforms combine the Hyper L2, demand for the $HYPER token may speed up alongside community utilization.

For traders the place the subsequent infrastructure rotation may come from, Bitcoin Hyper is positioning itself because the bridge between Bitcoin’s dominance and the fast-moving world of DeFi.

Go to the Official Bitcoin Hyper Web site Right here

The put up Ethereum Worth Prediction: Ripple Simply Picked ETH for $1.3 Billion Stablecoin – Huge Partnership Incoming? appeared first on Cryptonews.