KindlyMD Inc., a healthcare and Bitcoin treasury firm, is dealing with the chance of being delisted from the Nasdaq after its share worth remained under the alternate’s minimal bid requirement for an prolonged interval.

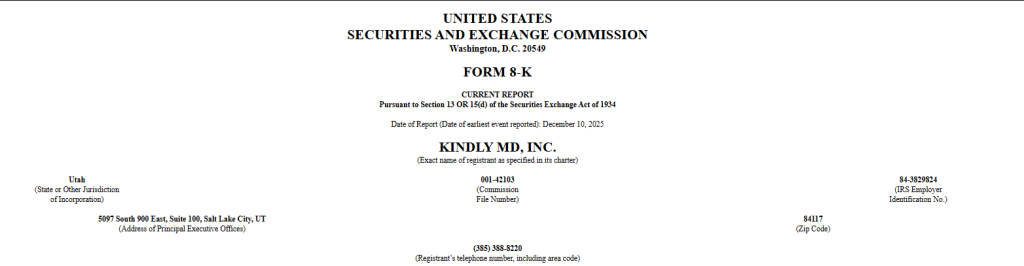

In a Type 8-Okay submitting dated Dec. 12, the corporate disclosed that it had obtained a discover from Nasdaq’s Itemizing {Qualifications} Division after its frequent inventory closed under $1 for 30 consecutive buying and selling days, putting it out of compliance with Nasdaq Itemizing Rule 5450(a)(1).

KindlyMD’s shares, which commerce beneath the ticker NAKA, are at present priced at $0.38. The inventory is down almost 5% on the day, has fallen greater than 30% over the previous month, and is down over 73% 12 months up to now.

KindlyMD Faces June 2026 Deadline to Get better Inventory Value

Below Nasdaq guidelines, KindlyMD has 180 calendar days, or till June 8, 2026, to regain compliance by sustaining a closing bid worth of at the very least $1 for no less than 10 consecutive buying and selling days.

KindlyMD’s present state of affairs marks a steep reversal from earlier optimism surrounding its Bitcoin technique.

In Might, the corporate merged with Nakamoto, a Bitcoin-focused public entity, in one of many first identified circumstances of a healthcare agency formally adopting Bitcoin as a core treasury asset.

@KindlyMD merges with Bitcoin-native Nakamoto to launch the first-ever Bitcoin-backed healthcare firm. #Bitcoin #treasury #Metaplanethttps://t.co/Gw5h56BP70

— Cryptonews.com (@cryptonews) Might 13, 2025

The mixed entity retained the KindlyMD identify, with Nakamoto working as a completely owned subsidiary, and raised greater than $700 million by means of a mixture of non-public placements and convertible debt to fund Bitcoin purchases.

That technique accelerated in August, when KindlyMD acquired 5,764 Bitcoin in a single transaction, spending roughly $679 million at a mean worth above $118,000 per coin.

Based on CoinGecko knowledge, the corporate now holds Bitcoin valued at about $502.6 million, putting it round thirty second amongst public Bitcoin treasury holders, down from twenty sixth three months earlier.

At present costs, the place carries an unrealized lack of roughly $176 million, or about 26%.

Bitcoin itself is buying and selling close to $87,000, up modestly on the week, however many publicly listed corporations holding crypto on their stability sheets have seen their shares fall quicker than the underlying belongings.

The Bitcoin Treasury Commerce Isn’t One-Dimension-Suits-All: KindlyMD vs. Technique

KindlyMD’s monetary filings mirror the pressure of its speedy transformation. In its third-quarter report, the corporate posted income of $0.4 million from its healthcare operations, whereas working bills climbed to $10.8 million, pushed largely by prices tied to its Bitcoin technique.

KindlyMD (NASDAQ: NAKA) at this time introduced its Q3 2025 monetary outcomes.

Please assessment our press launch for full monetary particulars and forward-looking statements.

Press launch obtainable herehttps://t.co/QQHBZg0nGk— Nakamoto (@nakamoto) November 19, 2025

The corporate reported a internet lack of $86 million for the quarter, together with non-cash expenses linked to the Nakamoto merger and unrealized digital asset losses.

Notably, the corporate stated the Nasdaq’s discover has no quick impression on its itemizing and that its shares will proceed buying and selling on the Nasdaq International Market through the compliance interval.

If it fails to recuperate, the corporate might search to switch to the Nasdaq Capital Market or pursue a reverse inventory break up, although it cautioned that there isn’t any assurance both step would achieve success.

The state of affairs differs from Technique Inc., previously MicroStrategy, which is dealing with uncertainty tied to index eligibility quite than alternate guidelines.

Technique’s spot @MicroStrategy in main indexes is now in danger, with JPMorgan warning {that a} removing from MSCI USA or the Nasdaq 100 might spark billions in outflows.#Technique #CryptoStocks https://t.co/ozDjakVUm7

— Cryptonews.com (@cryptonews) November 21, 2025

MSCI started reviewing its index methodology in October 2025, triggering a pointy sell-off in MSTR shares.

The corporate has formally submitted its 12-page letter to MSCI opposing the proposal.

Whereas the inventory later stabilized after retaining its Nasdaq 100 place, the chance stays, with a delisting probably triggering billions in compelled passive fund gross sales.

MSCI is predicted to concern a closing choice in January 2026.

Notably, throughout the market, digital asset treasury shares have broadly underperformed their underlying holdings in current months.

Information exhibits that in November, inflows into DATS have been solely $1.32 billion in inflows, their lowest stage of the 12 months, exhibiting a cooling of investor urge for food as volatility and regulatory uncertainty persist.

The submit KindlyMD Bitcoin Treasury Faces Nasdaq Delisting As It Plunges Under $1 — Can It Survive Like MSTR? appeared first on Cryptonews.