Digital asset funding merchandise recorded one other week of inflows as bettering sentiment round main cryptocurrencies continues to attract capital again into the market, in response to the most recent information from CoinShares.

Weekly inflows into digital asset exchange-traded merchandise (ETPs) reached $716 million, pushing whole property below administration (AuM) to $180 billion.

Whereas nonetheless properly beneath the $264 billion all-time excessive the regular inflows counsel investor confidence is step by step rebuilding after a unstable interval for crypto markets.

Be taught extra in our full report: https://t.co/xTpsANOdqw

— CoinShares (@CoinSharesCo) December 15, 2025

Investor Confidence Step by step Improves

CoinShares famous that digital asset funds have now posted their third consecutive week of modest inflows showibg what it described as a “cautious but more and more optimistic” investor base.

This comes regardless of combined value efficiency following the US Federal Reserve’s latest rate of interest minimize, with post-decision buying and selling marked by uneven flows and divergent sentiment throughout property.

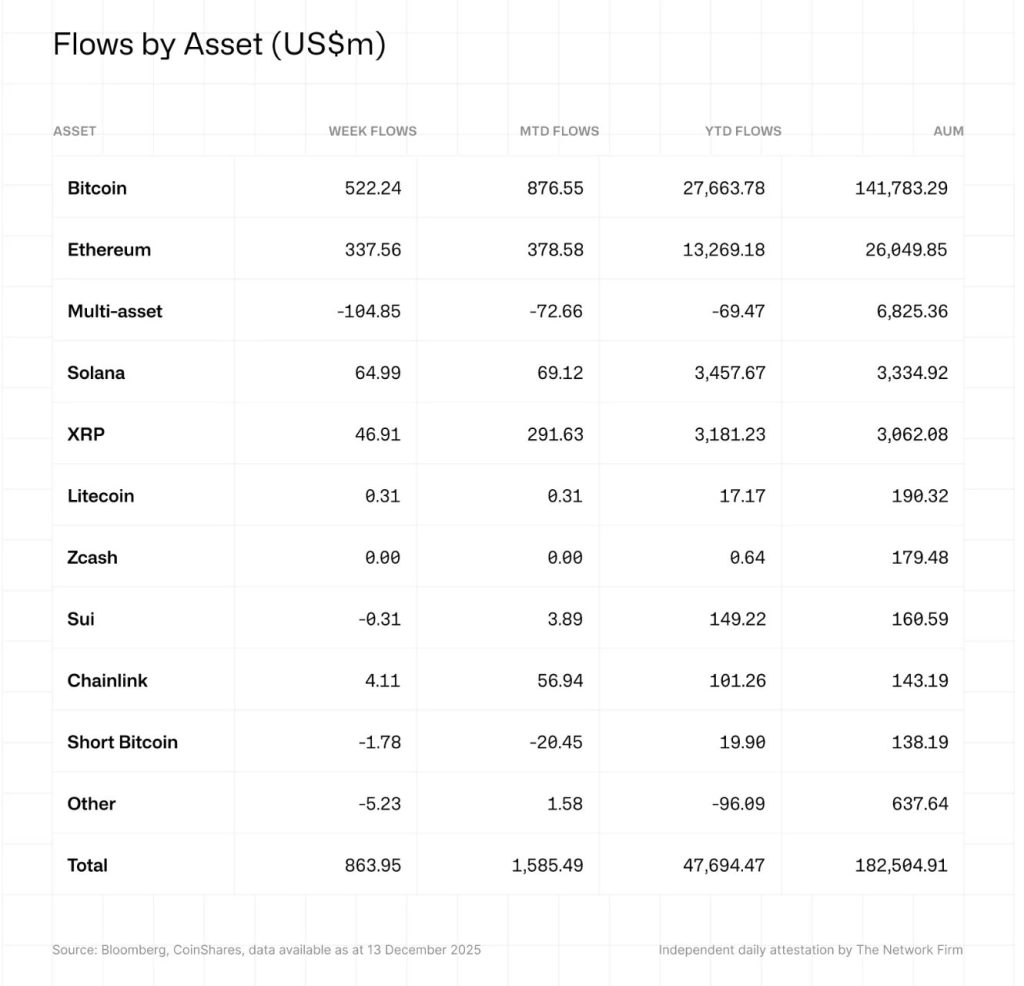

Whole inflows throughout digital asset funding merchandise reached $864 million over the broader reporting interval, underscoring continued demand at the same time as macro uncertainty persists. CoinShares mentioned the info additionally suggests buyers are rising publicity slightly than making broad risk-on bets.

US Dominates Regional Inflows

Inflows have been broad-based geographically however closely concentrated in a handful of markets. The US led by a large margin accounting for $483 million of weekly inflows adopted by Germany with $96.9 million and Canada with $80.7 million.

an extended timeframe, the US additionally continues to dominate sentiment posting $796 million of inflows final week alone. Germany and Canada additionally remained web constructive, with inflows of $68.6 million and $26.8 million respectively. CoinShares mentioned these three international locations have pushed the majority of demand in 2025.

Bitcoin, Ethereum and XRP Lead Demand

Bitcoin remained the most important beneficiary in absolute phrases, attracting $352 million in weekly inflows. Notably, short-Bitcoin funding merchandise recorded outflows of $1.8 million, signalling an additional easing of unfavorable sentiment towards the asset.

Regardless of thje renewed curiosity CoinShares highlights that Bitcoin has been a relative laggard this yr, with year-to-date inflows of $27.7 billion in comparison with $41 billion over the identical interval in 2024.

Ethereum continues to shut the hole recording $338 million in weekly inflows and lifting year-to-date inflows to $13.3 billion. That determine is a 148% improve in comparison with 2024 additionally reflecting rising institutional engagement with Ethereum-based merchandise.

XRP additionally stood out – drawing $245 million in inflows whereas Chainlink posted a report $52.8 million weekly influx — equal to 54% of its whole AuM.

Altcoins Present Selective Energy

Past the most important cryptos Solana’s year-to-date inflows reached $3.5 billion, a tenfold improve in comparison with 2024, though latest weekly flows have been extra muted.

Aave and Chainlink recorded smaller weekly inflows of $5.9 million and $4.1 million respectively.

Not all property benefited – Hyperliquid noticed weekly outflows of $14.1 million, highlighting that investor urge for food stays selective slightly than indiscriminate.

Total CoinShares mentioned the info factors to a market that’s stabilising, with capital gravitating towards large-cap and established digital property as confidence slowly returns.

The submit Digital Asset ETP Inflows Hit $716M as Bitcoin, Ethereum and XRP Lead Weekly Positive factors: CoinShares appeared first on Cryptonews.