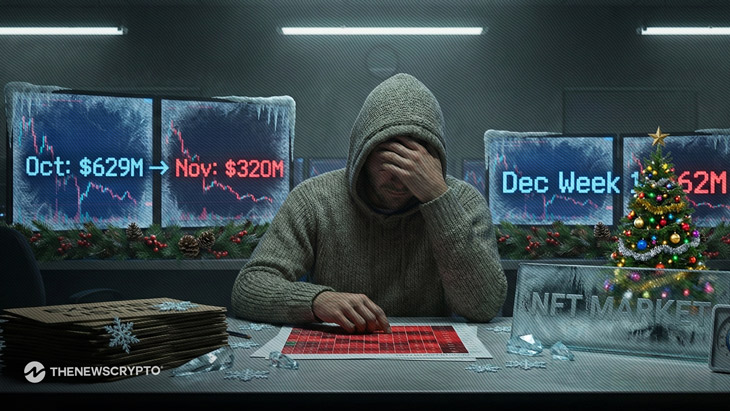

- Month-to-month NFT gross sales plummeted to $320 million in November, down 49% from October’s $629 million.

- Complete market capitalization collapsed 66% from $9.2 billion in January to simply $3.1 billion at present.

The non-fungible token trade retains going decrease and decrease and recorded its worst efficiency in 2025 because the buying and selling volumes declined throughout main collections. In line with CryptoSlam analytics, month-to-month gross sales in November dropped to solely $320 million, which is a dramatic 49% lower from the October determine of $629 million. The cumulative market worth of the sector has come all the way down to $3.1 billion, which is a really massive 66% fall from the excessive of $9.2 billion in January.

The primary week of December solely introduced $62 million price of gross sales, making it the slowest weekly efficiency of the entire yr and indicating that the weak point goes to proceed. Business insiders say that the momentum appears to have stopped utterly and that there are only a few indicators of a restoration within the close to future.

Blue-Chip Collections Expertise Widespread Losses

In basic, many of the high NFT collections that existed for fairly some time had their values considerably eroded all through November. There have been solely a handful of exceptions that managed to interrupt away from the destructive development that was prevailing within the market.

CryptoPunks, which continues to be the gathering with the very best market worth, went down by 12% over the last month. The worth of the Bored Ape Yacht Membership dropped by 8.5%, whereas that of the Pudgy Penguins decreased by 10.6%; thus, these figures are indicative of the weak point throughout historically steady digital belongings.

In November, the art-centric sequence had a troublesome time, with Fidenza dropping 14.6% of its worth and Moonbirds taking place 17.9%. Mutant Ape Yacht Membership went down by 13.4% and Chromie Squiggle dropped 5.6%, to replicate the promoting stress that was broadly unfold within the section. Probably the most important drop for the highest ten rankings in November was a 48% plunge of Hypurr, which made it the worst-performing assortment of the month.

In a really destructive market which dominated the month of November, solely two collections had been in a position to flip constructive returns. Infinex Patrons, which is presently the second-ranked complete market cap assortment, was up 14.9% over the interval, whereas Autoglyphs was essentially the most exceptional single performer. The generative artwork assortment went up by 20.9% which was a really distant second to another top-tier NFT initiatives for November in a really robust market surroundings.

The prolonged decline is inflicting individuals to ask what the short-term prospects of the sector may be because the yr 2025 is coming to an finish, with much less investor curiosity and fewer buyers being engaged.

Highlighted Crypto Information As we speak: