U.S. spot Solana exchange-traded funds logged one other sturdy efficiency this week, recording $58 million in each day internet inflows on Monday, their highest degree since early November.

The newest figures lengthen Solana’s streak of 20 consecutive days of constructive inflows, marking one of the resilient ETF runs seen within the digital asset market this 12 months.

the unbroken streak of each day inflows to the solana etf (topped off by a report day of inflows) is drastically beneath appreciated.

thanks in your consideration to this matter https://t.co/8ItbDL85JO— raj

(@rajgokal) November 25, 2025

Solana ETFs Surge Whereas Bitcoin and Ethereum Shed Billions in Month-to-month Outflows

Based on knowledge from SoSoValue, the inflows had been led by Bitwise’s BSOL, which drew $39.5 million on the day, the third-largest single-day influx for the reason that merchandise launched in late October.

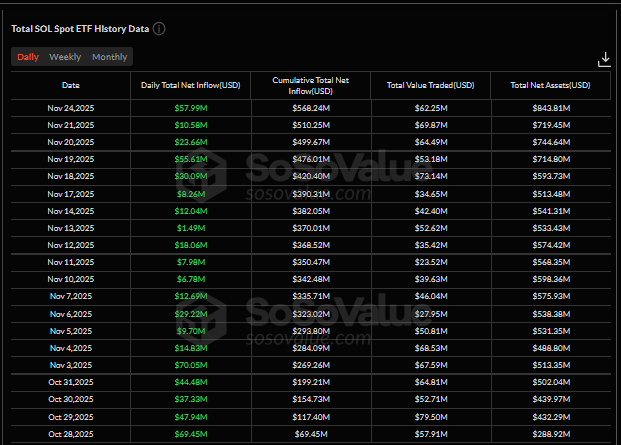

That pushed whole internet inflows for Solana ETFs to $568.24 million since debut, whereas mixed internet property climbed to $843.81 million, equal to 1.09% of Solana’s market capitalization.

The sustained exercise stands out sharply towards the broader market backdrop, the place each Bitcoin and Ethereum ETFs have confronted weeks of heavy redemptions.

Bitcoin ETFs recorded a month-to-month outflow of $3.70 billion between November 3 and November 24, whereas Ethereum ETFs noticed an outflow of $1.64 billion throughout the identical interval.

Solana stays the one main asset to submit persistent inflows all through November, attracting $369 million over the previous three weeks as BTC and ETH funds continued to lose capital.

Analysts say latest flows level to a broader shift in how establishments are positioning themselves within the digital asset market.

Solana’s ETF has carried out much better than early forecasts, which anticipated slower traction amid the latest downturn.

Based on market researchers, the constant inflows sign that Solana is more and more being seen as a “blue-chip” asset. They famous that this regular capital base may assist present help whilst danger urge for food throughout the crypto sector weakens.

Observers additionally famous the rising variety of conventional finance corporations selecting Solana for tokenization efforts. Tasks corresponding to xStocks, which brings U.S. equities and ETFs on-chain, had been cited as examples of rising institutional exercise.

Even so, analysts warned that ETF energy doesn’t assure fast worth appreciation. SOL stays closely influenced by broader market sentiment, and any sustained response within the token might take longer to materialize.

Solana ETFs Method $1B AUM After Robust Weekly Inflows

Throughout particular person issuers, Bitwise’s BSOL stays by far the dominant product, with $567.10 million in internet property.

Grayscale’s GSOL follows at $117.90 million, after taking in $4.66 million in new capital on Monday.

Constancy’s FSOL and VanEck’s VSOL additionally recorded a few of their highest single-day inflows to this point, with $9.7 million and $3.1 million, respectively, whereas 21Shares’ TSOL and Canary’s SOLC continued to report constructive however reasonable exercise.

Over the six-day window between November 17 and November 24, Solana ETFs added $177.93 million in new capital, rising from $390.31 million in cumulative inflows to $568.24 million.

In the meantime, the whole AUM of Solana ETFs is nearing a significant milestone. With mixed property now above $870 million, the merchandise are on observe to succeed in $1 billion within the close to time period.

A brand new influx catalyst can also be approaching: Franklin Templeton’s Solana ETF, which has not but launched, is anticipated to carry further institutional demand as soon as accepted.

The flows distinction sharply with weakening market situations. SOL stays down 30% up to now 30 days, and up to date buying and selling has proven declining quantity and adverse perpetual funding charges.

The token is buying and selling round $137, down 1% on the day and 13% up to now two weeks.

In January 2025, JP Morgan initially forecasted that Solana ETFs may see between $3-6B in inflows inside their first 6-12 months. The financial institution re-evaluated its place in October, altering its projections to ~$1.5B within the first 12 months.

Technical indicators present that SOL continues to be locked in a broader corrective part. Analysts monitoring the asset’s Elliott Wave construction say the market could also be shifting via a deeper Wave C decline, with potential draw back targets between $80 and $95 if present help ranges fail.

The token can also be buying and selling under its 200-day EMA, a situation usually related to prolonged consolidation intervals.

The submit Solana ETF Inflows Hit Report $58M With Consecutive Weekly Features — Right here’s What Solana’s Founder Simply Stated appeared first on Cryptonews.