Tether, the world’s largest participant within the digital asset sector, has taken a deeper step into crypto-backed credit score markets with a brand new funding in Ledn, probably the most established suppliers of Bitcoin-backed loans.

The transfer comes throughout a renewed wave of exercise throughout the lending sector, which has already surpassed $1 billion in mortgage originations this yr and is now exhibiting indicators of a broader comeback after the extreme collapse of 2022–2023.

Ledn Crosses $2.8B in Bitcoin Loans as Crypto Lending Market Rebounds

Ledn has originated greater than $2.8 billion in Bitcoin-backed loans since launch, cementing its place as a significant lender within the crypto credit score market.

The corporate has already issued over $1 billion in 2025 alone, its strongest yr on report, and practically equaled its whole 2024 lending quantity within the newest quarter with $392 million in Q3.

Its annual recurring income now exceeds $100 million, exhibiting rising demand from each retail and institutional debtors in search of liquidity with out promoting their Bitcoin.

Tether mentioned the funding displays its long-term imaginative and prescient of constructing monetary infrastructure that enables customers to unlock credit score whereas persevering with to carry their digital belongings.

Chief Government Paolo Ardoino mentioned the partnership strengthens the function of digital belongings in real-world finance and helps self-custody fashions that many crypto customers depend on.

Ledn’s platform consists of custodial safeguards, threat controls, and liquidation programs designed to guard customers’ collateral all through the life of every mortgage.

The funding arrives because the Bitcoin-backed lending market begins to broaden once more. In accordance with DataIntelo’s outlook, the broader crypto-collateralized credit score section is forecast to develop from $7.8 billion in 2024 to greater than $60 billion by 2033.

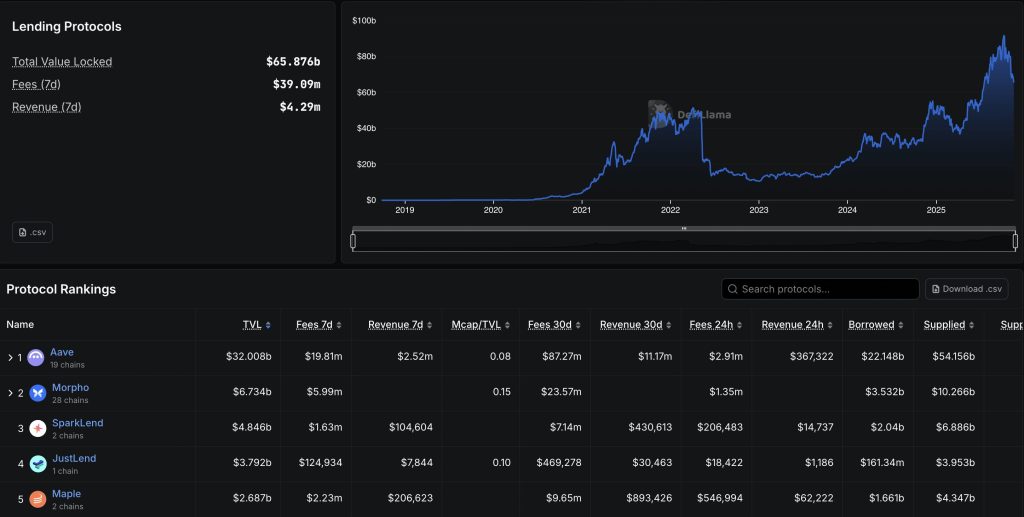

The sector already reached $90 billion in October and is at present at $65.87 billion.

A lot of the business’s restoration has been formed by tighter threat practices after the failures of Celsius, Voyager, BlockFi, Genesis, and different lenders over the past bear market, a collapse pushed by reckless lending, poisonous collateral, and unsecured loans.

Ledn’s determination to double down on Bitcoin-backed merchandise is bolstered by this shift towards safer buildings.

Co-founder and CEO Adam Reeds mentioned the corporate’s mortgage e-book is on monitor to just about triple from 2024 ranges, and that demand for Bitcoin monetary providers is rising rapidly as buyers search extra predictable types of credit score entry throughout each centralized and decentralized platforms.

Tether’s funding can be aligned with the corporate’s broader technique of increasing its presence throughout international monetary markets.

In its newest attestation, ready by BDO, Tether reported greater than $10 billion in internet revenue for the yr thus far, together with $6.8 billion in extra reserves.

The agency issued greater than $17 billion in new USDT throughout Q3, lifting the stablecoin’s circulating provide above $174 billion. Tether’s publicity to U.S. Treasuries hit a report $135 billion, putting the corporate among the many world’s largest overseas holders of U.S. debt.

Lending Exercise Reignites as Main Platforms Increase Providers and Regulators Tighten Guidelines

The lending sector as a complete is experiencing renewed motion.

Crypto.com just lately started integrating Morpho, the second-largest DeFi lending protocol, into its platform, permitting customers to borrow stablecoins towards wrapped Bitcoin and Ether straight on its Cronos chain.

Morpho’s providers, already holding over $7.7 billion in worth, might be out there even to U.S. customers regardless of new restrictions on stablecoin yield funds below the GENIUS Act.

Regulators are additionally adjusting to elevated exercise. South Korea launched sweeping pointers in September that cap lending charges at 20% yearly and ban leveraged merchandise that exceed collateral worth.

The principles comply with issues over aggressive lending applications at main exchanges, the place companies had begun providing unusually excessive borrowing limits earlier than authorities intervened.

The publish Tether Dives Into Bitcoin-Backed Lending as Market Soars Previous $1B in Loans appeared first on Cryptonews.