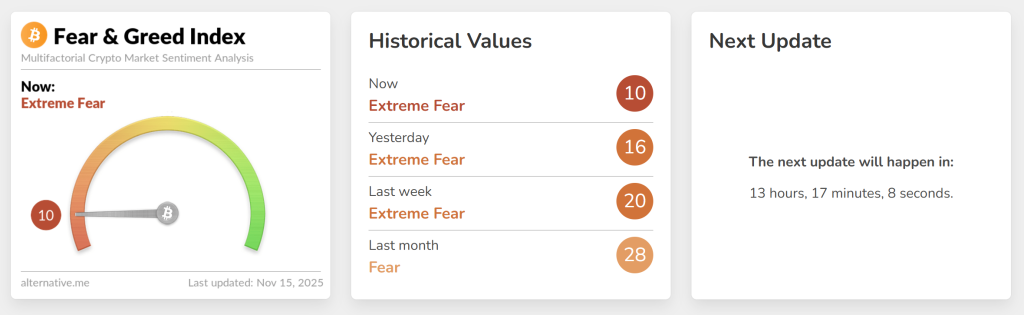

Bitcoin is buying and selling round $95,775, down almost 7% this week, because the broader crypto market slips into one among its most fragile sentiment phases of the 12 months. The Crypto Concern & Greed Index has collapsed to 10, marking “Excessive Concern” and matching ranges final seen in early March.

That shift alone is sufficient to make even long-term merchants pause, particularly as market cap has dropped to $1.91tn and momentum indicators proceed to melt.

Traditionally, excessive worry has tended to behave as a contrarian sign, usually exhibiting up close to key accumulation zones, however this time the technical construction isn’t providing a transparent verdict.

Bitcoin has slipped under its long-term ascending trendline for the primary time since spring, signaling a break within the rhythm that carried the market by most of 2024 and 2025.

Bitcoin (BTC/USD) Technical Image at a Crossroads

Bitcoin worth prediction appears bearish even when BTC is stabilising after a pointy decline that dragged the market into the $94,500–$92,000 assist area, an space that served as a pivot all through April and Could. Thursday’s lengthy decrease wick suggests patrons stepped in, however the follow-through has been timid.

The 20-EMA has rolled over, appearing as dynamic resistance, whereas the RSI sits close to 33, hovering above oversold territory with out forming a transparent bullish divergence.

Candlestick behaviour reinforces the uncertainty. This week’s sample resembles a smaller model of a 3 black crows sequence, adopted by a single rejection candle, not fairly sufficient to sign capitulation, however sufficient to gradual the decline. Worth is now squeezed between the damaged trendline above and a mid-range ground under, a zone the place markets often make fast choices.

Key Ranges to Watch

A shift in momentum requires proof. Merchants are watching:

- $99,000 – First signal patrons are regaining management

- $103,700 – The damaged trendline; reclaiming it could reset momentum

- $92,000 – Breakdown stage that exposes deeper assist

- $83,000 – Giant liquidity pocket and subsequent main draw back goal

A each day shut above $99,000 would verify a short-term reversal, particularly if accompanied by a bullish engulfing candle and an RSI above 40.

Is This an Accumulation Backside?

Excessive worry can create alternative, however it may well additionally precede one other wave of promoting. With Bitcoin caught between conflicting alerts – oversold momentum vs. damaged construction, merchants are approaching this zone cautiously. If patrons defend $92,000, this might evolve right into a basic accumulation pocket. If not, the market could revisit deeper helps earlier than stability returns.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new part to the Bitcoin ecosystem. Whereas BTC stays the gold normal for safety, Bitcoin Hyper provides what it at all times lacked: Solana-level velocity. The end result: lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the mission emphasizes belief and scalability as adoption builds. And momentum is already robust. The presale has surpassed $27 million, with tokens priced at simply $0.013265 earlier than the following improve.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s largest ecosystems. If Bitcoin constructed the muse, Bitcoin Hyper might make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The publish Bitcoin Worth Prediction: Excessive Concern Index Hits 10 – Is This the Accumulation Backside Merchants Waited For? appeared first on Cryptonews.