Institutional traders are rising their publicity to digital belongings at a document tempo this 12 months, however expectations for 2026 are far much less optimistic, in accordance with new analysis by Swiss crypto financial institution Sygnum.

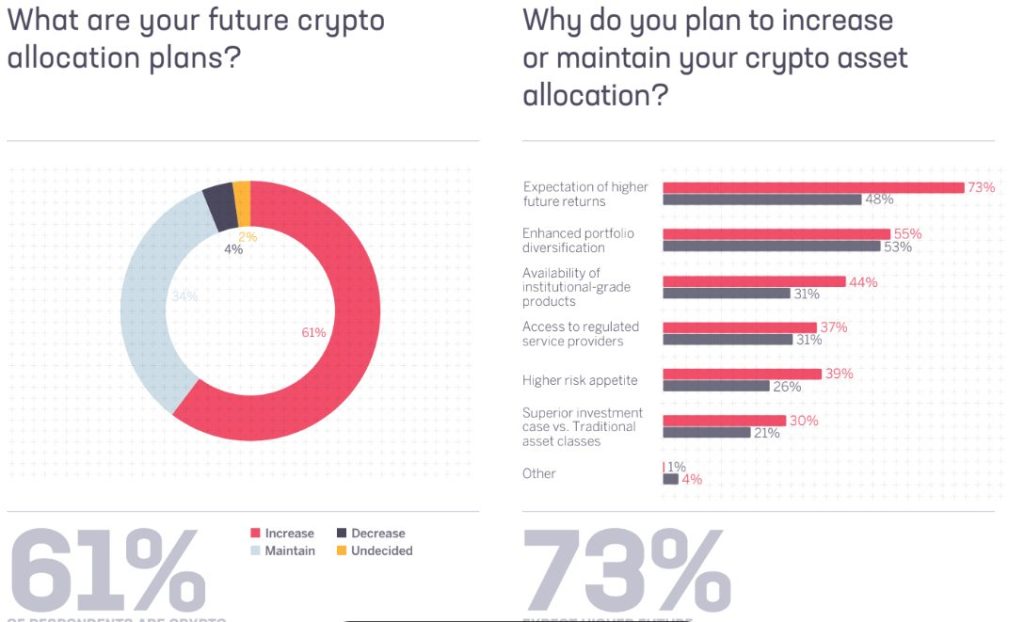

In its Future Finance 2025 report launched this week, Sygnum discovered that 61% of institutional respondents plan to develop their cryptocurrency investments by year-end, with 38% including publicity in This autumn alone.

The findings mirror rising confidence in digital belongings as a long-term portfolio part, even after a pointy market correction in October that erased practically $20 billion in market worth.

Has Institutional Confidence Peaked in Crypto, or Is This Simply the Starting?

Sygnum stated the shift marks a transition from speculative buying and selling to strategic diversification. “Establishments are considering much less about crypto as protection and extra about participation within the structural evolution of worldwide finance,” stated report writer Lucas Schweiger.

The survey lined over 1,000 skilled and high-net-worth traders throughout 43 nations.

Whereas the short-term outlook stays sturdy, Sygnum’s information suggests the rally could cool in 2026 as liquidity slows and macroeconomic tailwinds fade.

“The story of 2025 is considered one of measured threat, pending regulatory selections, and highly effective demand catalysts,” Schweiger wrote. “Self-discipline has tempered exuberance, however not conviction, out there’s long-term progress trajectory.”

About 55% of establishments stay short-term bullish, anticipating additional upside pushed by ETF approvals and coverage readability.

Nonetheless, investor sentiment turns impartial to bearish past year-end, with slower progress anticipated by mid-2026 as price cuts plateau and regulatory progress stalls.

A significant factor behind this shift is the rising focus of Bitcoin holdings amongst giant entities and controlled funds.

CryptoNews evaluation of CryptoQuant and Dune Information reveals institutional and entity-scale holders have steadily absorbed extra provide since spot ETF approvals in January 2024.

Retail traders, who as soon as owned 17% of Bitcoin’s circulating provide in 2020, have diminished their holdings by roughly 20% over the previous 12 months, whereas ETF-related and institutional wallets now management over 7 million BTC.

This displays a broader structural change as giant holders transfer funds into regulated ETFs for tax and compliance advantages, signaling deeper integration into conventional finance.

Sygnum’s report additionally discovered that institutional curiosity in tokenized real-world belongings like bonds and funds rose from 6% to 26% year-over-year.

The financial institution stated tokenization is changing into the gateway for conservative traders in search of regulated on-chain publicity.

Coinbase, Sygnum Experiences Present Establishments Holding Regular Regardless of Coverage Delays

Curiosity in crypto ETFs past Bitcoin and Ether is increasing quickly. Over 80% of respondents stated they need broader ETF entry, and 70% indicated they’d improve allocations if staking rewards have been provided.

Sygnum advised that staking-enabled ETFs could possibly be the subsequent main driver of institutional inflows as soon as regulatory circumstances enable.

Nonetheless, delays in key U.S. coverage developments, together with the Market Construction invoice and approval of altcoin ETFs, have launched uncertainty.

The continued U.S. authorities shutdown, now coming into its forty first day, has postponed at the least 16 pending crypto ETF purposes, dampening short-term momentum.

Regardless of these headwinds, institutional conviction stays agency. Coinbase’s newest Navigating Uncertainty survey discovered that 67% of enormous traders stay bullish on Bitcoin heading into 2026, at the same time as some acknowledge the market is coming into the late stage of its bull cycle.

@Coinbase discovered that 67% of institutional traders are bullish on Bitcoin, at the same time as some consider market is nearing the top of its bull run.#Crypto #Bitcoinhttps://t.co/FdLD8DMMco

— Cryptonews.com (@cryptonews) October 20, 2025

Coinbase researchers famous that supportive macro components, together with anticipated Federal Reserve price cuts and monetary stimulus in China, might lengthen market energy into 2025.

Nonetheless, analysts warn that as liquidity tightens and long-term holders take income, market progress might sluggish by mid-2026.

Sygnum’s report described 2025 as a 12 months of “highly effective demand catalysts” tempered by regulatory warning.

The financial institution expects institutional participation to deepen via ETF adoption, tokenized belongings, and diversification however stated the subsequent section of the cycle will probably take a look at investor self-discipline relatively than exuberance.

The submit Institutional Traders Are Piling into Crypto — However a 2026 Downturn Is Looming: Sygnum appeared first on Cryptonews.