Key Takeaways:

- The late-2024 Fed price cuts triggered crypto rallies. Bitcoin and Ethereum each posted double-digit beneficial properties within the first weeks.

- Later cuts noticed weaker and even detrimental strikes, because the market had already priced in simpler coverage.

- Crypto tends to react most strongly to the primary indicators of a coverage shift reasonably than to continued easing.

- With one other price minimize anticipated this month, it’s unclear whether or not historical past will repeat. Different forces like sentiment, regulation, and world dangers may play a job.

The Federal Reserve is predicted to chop rates of interest by 25 foundation factors later in October. In keeping with the CME Group’s FedWatch Instrument, there’s now a 96.7 % probability of a price minimize on the subsequent assembly. On the similar time, the crypto market is underneath stress from different macro headlines, such because the Donald Trump-China tariffs and worries about U.S. regional banks and unhealthy loans.

How may the following price minimize have an effect on crypto? When the Fed cuts charges, the market usually experiences short-term volatility. Whereas cuts are normally seen as a tailwind, the precise end result depends upon extra than simply coverage: total financial circumstances, market sentiment, regulation, and geopolitical occasions all matter.

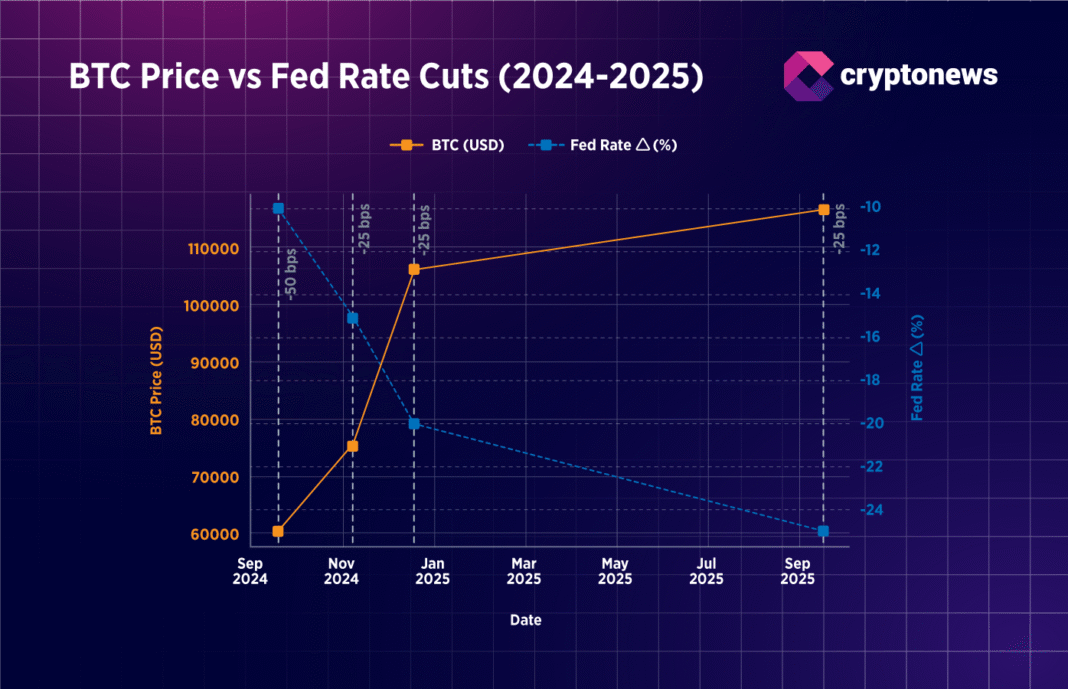

On this analysis, we study the newest 4 Fed price cuts — September 18, 2024, November 7, 2024, December 18, 2024, and September 17, 2025 — and have a look at how they affected Bitcoin and Ethereum instantly after the bulletins.

The September 2024 minimize sparked the most important rally of the cycle. Inside every week, Bitcoin jumped about 6.6% to round $64,300, and Ethereum climbed almost 13% to $2,650. Over the following month, each gained roughly 11%. That might imply traders welcomed the Fed’s first clear pivot towards simpler coverage.

After the November 2024 minimize, Bitcoin surged 16% in every week and greater than 32% in a month. Ethereum rose 17% and 47.5% over the identical durations.

By December 2024, the rally started to chill. Bitcoin briefly broke above $108,000 earlier than falling again under $100,000. Ethereum dropped about 10% over the next month.

The latest minimize in September 2025 got here at a time of already low charges and softer sentiment. Bitcoin slipped about 7% within the subsequent month, and Ethereum misplaced round 13%. That might imply the affect of financial easing is beginning to fade for crypto.

The chart under tracks the Ethereum value towards adjustments within the Fed’s price. It reveals normal ETH/ USD value tendencies from September 2024 by way of October 2025. The suitable axis reveals how a lot the Fed funds price has fallen in whole because the begin of the easing cycle.

The info reveals how the primary price cuts in September and November 2024 got here with robust crypto rallies, whereas the later ones in December 2024 and September 2025 introduced smaller and even detrimental strikes. It suggests the market’s response weakened as traders had already priced in simpler coverage.

What It Means

The primary two strikes in September and November 2024 delivered the most important beneficial properties, with Bitcoin and Ethereum each posting double-digit jumps over the next weeks.

Nevertheless, by late 2024, the thrill appears to have light. Markets had already priced in continued easing, and later cuts introduced little or no upside. The strongest response got here early within the cycle, when traders first sensed a flip towards looser coverage.

Because the Fed is predicted to chop charges once more this month, historical past reveals that Bitcoin and Ethereum usually react shortly at first however lose steam because the easing cycle continues. Market sentiment, regulation, and world dangers additionally play a job, which means that financial coverage is just a part of the story.

The put up How Might Fed’s Subsequent Price Minimize Have an effect on Bitcoin and Ethereum? Right here’s What Historical past Reveals appeared first on Cryptonews.