A high-stakes feud has erupted between Fetch.ai CEO Humayun Sheikh and the Ocean Protocol Basis, threatening to dismantle considered one of crypto’s most formidable AI collaborations, the Synthetic Superintelligence (ASI) Alliance.

The battle, which facilities on about 286 million Fetch.ai (FET) tokens price roughly $84 million, has spiraled into on-chain accusations, authorized threats, and an sudden response from Binance.

Moreover, the dispute raises questions on governance inside the ASI Alliance, leaving holders not sure concerning the future construction and safety of their property.

Ocean Quits ASI Alliance: What Is Occurring?

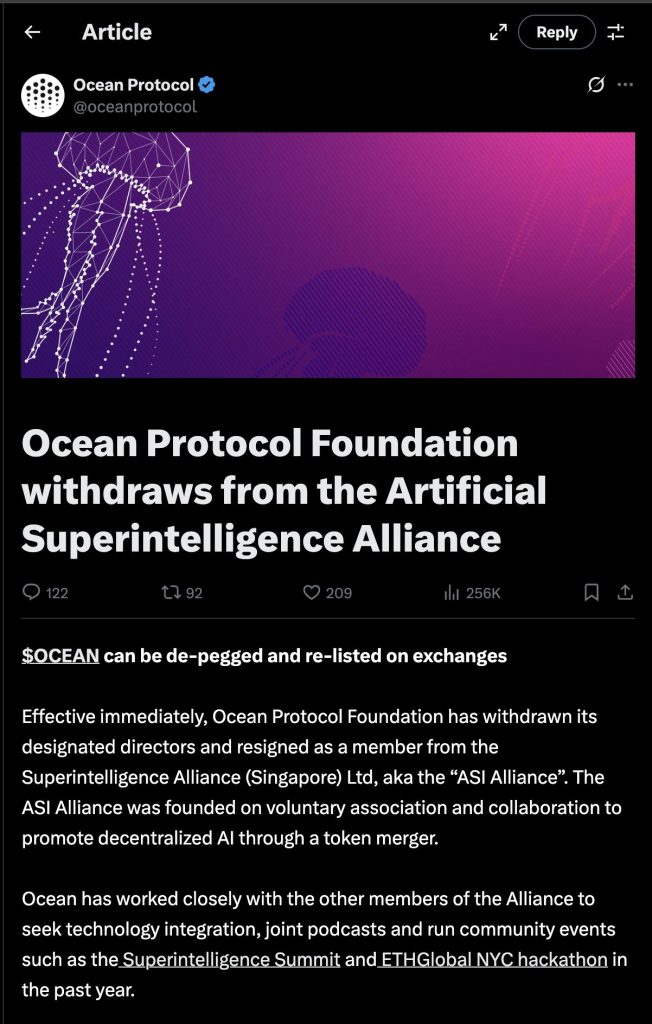

The ASI Alliance was fashioned in 2024 to unite three main AI-focused blockchain initiatives, Fetch.ai, Ocean Protocol, and SingularityNET, beneath a single token framework.

The fallout began earlier this month after Ocean introduced its full withdrawal from the ASI Alliance earlier this month.

The inspiration mentioned it was resigning all director and membership roles from the Singapore-based Superintelligence Alliance Ltd., marking the tip of its collaboration with Fetch.ai and SingularityNET.

Whereas the muse cited authorized constraints stopping it from revealing full particulars, Ocean hinted at deeper conflicts. “We’re, nevertheless, constrained from sharing the reality and info in the intervening time,” the assertion learn. “Please stand by whereas the method works its means by, and as quickly as we are able to share extra, we’ll.”

To the complete Ocean and ASI group.

We’re wanting to share extra details about Ocean’s departure from the ASI Alliance, to reply lots of the legitimate questions by the group and reply forcefully to allegations raised.

We’re, nevertheless, constrained from sharing the reality… pic.twitter.com/nXTwSqrjVn— Ocean Protocol (@oceanprotocol) October 10, 2025

Nonetheless, tensions escalated when Sheikh accused Ocean Protocol of secretly minting and changing thousands and thousands of tokens earlier than the merger.

The Accusation: Ocean Protocol Hit with “Rug Pull” Allegations as Fetch.ai CEO Exposes Secret Token Conversions

In an in depth submit on X, Sheikh alleged that Ocean minted 719 million OCEAN tokens in 2023, later changing 661 million of them into 286 million FET tokens in July 2025.

He claimed giant parts of those tokens have been transferred to centralized exchanges and buying and selling companies similar to GSR Markets and ExaGroup with out correct disclosure.

Whereas legals are taking place and we take each motion attainable to repair this drawback. I need to lay out info and occasions so group can see what is occurring.

If Ocean as stand alone venture did this it might be classed as a rug pull! (Solely my opinion)…

On Could 25, 2023, the… pic.twitter.com/zhwB9VXUlE— Humayun (@HMsheikh4) October 15, 2025

Sheikh described the transfer as a “rug pull” if carried out by a stand-alone venture and referred to as on Binance and different companies to analyze the transactions.

Blockchain knowledge cited by Sheikh exhibits that, between July 3 and July 14, 2025, greater than 76 million FET tokens have been moved to particular wallets, together with 21 million despatched to Binance and over 55 million to a GSR-linked handle.

Over the previous 3 months:@oceanprotocol offered 196M $FET @Fetch_ai offered 43M $FET @SingularityNET offered 6M $FET

Throughout this era, the worth of #FET $FET dropped by over 50%.

Do you suppose the worth drop was attributable to the venture staff dumping?https://t.co/43DYufTbCl pic.twitter.com/3UJ1hgUnu2— Whaler Discuss (捕鲸者说) (@whalertalk) October 15, 2025

One other 13.5 million FET have been allegedly transferred to an account funded by ExaGroup, with practically 200 million remaining tokens later distributed to a number of Gnosis Secure wallets in August.

Sheikh claimed most of these funds have since been despatched to Binance.

Because the dispute intensified, Binance introduced on Wednesday that it might cease supporting Ocean deposits by way of the Ethereum community beginning October 20.

The trade warned customers that ERC-20 OCEAN deposits made after that date “won’t be credited and will result in asset loss.”

Whereas Binance didn’t point out the feud instantly, the timing and community restriction raised hypothesis that the platform was responding to dangers linked to the disputed tokens.

Sheikh mentioned Binance’s transfer mirrored the trade “listening” to group considerations about Ocean’s transfers.

Following the exit, Sheikh pledged to personally fund class-action lawsuits in not less than three jurisdictions and urged affected FET holders to collect proof of economic losses.

If you’re or have been a holder of $fet and have misplaced cash throughout this Ocean motion be prepared along with your proof. I’m personally funding a category motion in 3 or presumably extra jurisdictions. I will probably be establishing a channel for all to submit your claims. Maintain tight and be prepared!

— Humayun (@HMsheikh4) October 16, 2025

He additionally accused Ocean of changing group reward tokens earlier than the departure and demanded public disclosure of pockets signatories linked to the OceanDAO and Ocean Expedition entities.

Ocean Protocol Denies $84M Token Misuse Allegations: Lawsuits Incoming

In a press release posted on X, the muse affirmed that its treasury “stays intact” and confirmed that the dispute has entered formal arbitration beneath the ASI merger framework.

Ocean

is working and lively. We’re refraining from partaking in unfounded claims and dangerous rumours that make the scenario worse for the complete ASI and Ocean communities. Ocean had earlier recommended waiving confidentiality over the adjudicator's current findings as a method of…

— Ocean Protocol (@oceanprotocol) October 16, 2025

Ocean additionally disclosed that it had proposed waiving confidentiality over an adjudicator’s findings to make sure transparency, a transfer it claims was rejected by Fetch.ai’s CEO, Humayun Sheikh.

“Ocean is working and lively,” the assertion learn. “We’re getting ready responses to the varied unfounded claims and allegations whereas respecting the ambits of the legislation.”

Ocean additional acknowledged Binance’s sole discretion over OCEAN’s itemizing and deposits, noting it stays dedicated to “productive and collaborative cooperation” with the trade as buying and selling exercise and investor scrutiny intensify.

The arbitration marks a key juncture for either side, with authorized outcomes more likely to form the way forward for token governance and belief inside the decentralized AI ecosystem.

FET and OCEAN Costs Plunge as Authorized Battle Looms, however What Would possibly Be the Explanation for the Breakup?

The controversy has shaken confidence within the once-unified AI coalition. FET’s value dropped practically 10% in 24 hours, buying and selling at $0.2954, whereas OCEAN fell to $0.26 after dropping greater than 70% of its worth since March.

Central to the break up are basic disagreements over tokenomics and venture path.

Ocean, whose mission facilities on constructing a decentralized knowledge market, sought extra autonomy to maintain its imaginative and prescient of user-owned knowledge layers for the AI financial system

Fetch.ai, in the meantime, has been centered on creating autonomous AI brokers and advancing a broader AGI token ecosystem alongside SingularityNET.

The dispute got here to a head over the token merger construction. Underneath the ASI consolidation plan, OCEAN holders have been supplied a hard and fast trade charge to swap their tokens for FET, which was rebranded as ASI.

This fastened charge, which mixed with Fetch.ai’s issuance of latest tokens to soak up OCEAN provide, launched inflationary strain that damage each tokens’ market efficiency.

Ocean’s group, which largely resisted full conversion, considered the association as unfavorable and opposite to its long-term token worth technique. Roughly 270 million OCEAN tokens throughout 37,000 wallets stay unconverted.

In response, Ocean introduced a buyback and burn initiative funded by venture earnings to revive market confidence and scale back provide. The staff additionally inspired main exchanges, together with Coinbase, Kraken, and Binance US, to relist OCEAN, thereby pushing to reclaim its unbiased market presence.

The fallout has now escalated right into a authorized dispute, with either side buying and selling accusations of mismanagement and deceptive conduct.

What started as an formidable collaboration to unite decentralized AI initiatives now stands as a cautionary story of how conflicting governance fashions and tokenomics can fracture even probably the most visionary partnerships.

The submit Ocean vs. Fetch.ai Turns Ugly: Contained in the $84M ASI Token Scandal Tearing Crypto’s AI Giants Aside appeared first on Cryptonews.