Former TD Ameritrade chairman Joe Moglia declared on Tuesday that each monetary asset can be tokenized inside 5 years, warning that conventional finance has but to completely settle for this inevitable shift.

Talking on CNBC, Moglia said, “5 years from now, there’s not going to be a inventory, there’s not going to be an choice, not going to be a mutual fund, ETF, something that’s not in impact tokenized.“

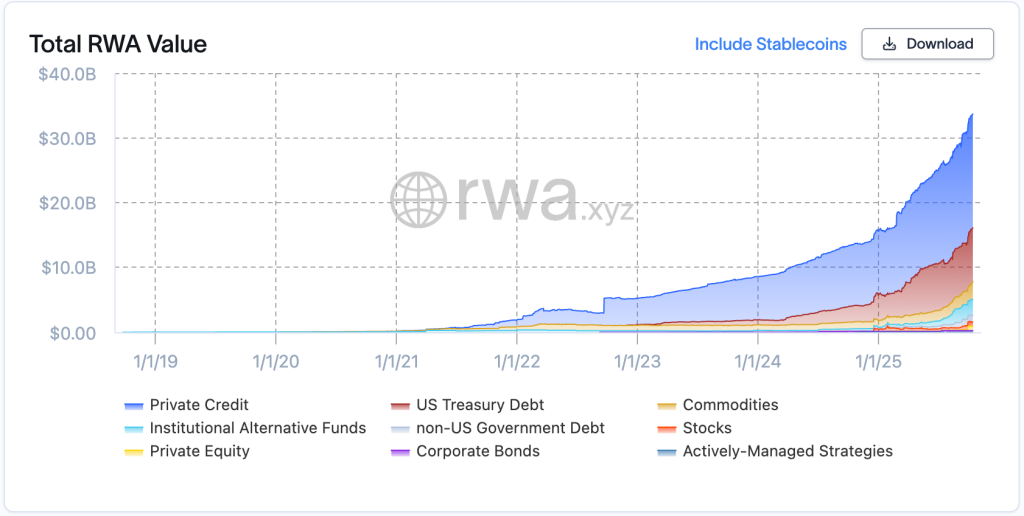

The prediction comes as real-world asset tokenization has surged previous $33.91 billion, up 10.14% in 30 days, with the variety of asset holders reaching 483,892, in response to RWA.xyz.

Non-public credit score leads at $17.5 billion, adopted by U.S. Treasury debt at $8.3 billion and commodities at $2.8 billion, pushed by tokenized gold breaking $3 billion.

Moglia now chairs FG Nexus, an Ethereum treasury firm, whose journey resembles that of BlackRock CEO Larry Fink’s transformation from a crypto skeptic to an advocate.

“That’s as a result of he was an actual conventional finance man. Now he’s a DeFi man,” Moglia stated of Fink.

Nevertheless, Ethereum dominates with $12.1 billion in tokenized property, a 57.55% market share.

As compared, Solana holds simply $686.3 million, regardless of reaching a 35.34% month-to-month development price, which raises questions concerning the uniformity of world adoption throughout the subsequent 5 years.

Ethereum Privateness Push and Solana Income Management Drive Institutional Flows

Ethereum launched its “privateness cluster” staff to develop protocol-level privateness options, together with personal funds and zero-knowledge infrastructures.

Talking with Cryptonews, Shawn Younger, chief analyst at MEXC Analysis, said the improve “demonstrates how Ethereum seeks to proceed its market management in each innovation and infrastructure.”

Younger emphasised that privateness applied sciences “will play a key position in attracting conventional monetary establishments looking for a blockchain that balances transparency with discretion.”

Solana led all main networks in Q3 income for the fourth consecutive quarter.

Ray Youssef, CEO of NoOnes, instructed Cryptonews that Solana “recorded over 4% positive aspects in September as Ether fell 5%,” pushed by treasury accumulation and upcoming upgrades.

Solana treasuries crossed $4 billion with $2 billion allotted in September, which is a 230% enhance in comparison with Ethereum’s 35% development.

Ahead Industries and Helius drove accumulation forward of Alpenglow and Firedancer upgrades, which launched in This autumn.

Youseff projected that Solana might “soar as excessive as $300 by Q1 2026” if upgrades and ETF selections align, although “macro headwinds might halt momentum, inflicting SOL to retest the $200-$210 vary.“

Tokenized Shares Hit $677M as Gold and Tesla Drive Adoption

Tokenized shares exploded to $676.77 million, up 22.62% in 30 days, with month-to-month switch quantity surging 182.46% to $665.90 million. Month-to-month lively addresses jumped 39.20% to 32,746.

Tesla grew to become the preferred tokenized inventory with over $25 million held by 14,000 distinctive holders on Solana, in response to Solana itself.

.@Tesla now has 14,000 new buyers, holding $25 million collectively on Solana

Increased https://t.co/j22z9hy4Pb— Solana (@solana) October 15, 2025

Moglia revealed that FG Nexus is tokenizing its reinsurance firm.

“We’re taking a look at tokenizing that threat. We’re within the strategy of having a look at that now,” explaining that the agency is now transferring in direction of institutional tokenization.

Commodities led RWA development, reaching $3.31 billion, a 31.14% month-to-month enhance, as tokenized gold surpassed $3 billion in worth.

Whereas talking with Cryptonews, Dustin Becker, Tech Lead at GoldDAO, defined that tokenization “strips out all these layers of belief in third events that might break. With tokenized gold, you possibly can even leverage your gold in DeFi.“

In response to RWA.xyz, the month-to-month switch quantity reached $5.08 billion, a 286.96% enhance, as buyers shifted from ETFs to on-chain alternate options amid macroeconomic uncertainty.

Earlier this month, Stablecoins surpassed a market capitalization of $300 billion, and at the moment have 196.08 million holders.

Moglia famous that Secretary Bessent projected a “$2 trillion market” inside two years, with Ethereum capturing roughly 60% of exercise.

Nevertheless, blockchain distribution reveals focus dangers. Ethereum hosts 435 RWA property totaling $12.1 billion, whereas second-place ZKsync Period holds $2.36 billion, an 81% hole.

Solana’s seventh-place rating, regardless of a 60% tokenized inventory market share, means that infrastructure fragmentation might delay common tokenization past Moglia’s timeline.

The publish Each Asset Tokenized in 5 Years, Says TD Ameritrade Ex-Chair – However Not In all places appeared first on Cryptonews.