China has tightened export controls on uncommon earth magnets, escalating tensions with Washington and triggering widespread turbulence throughout world markets, together with a $7 billion sell-off in cryptocurrencies.

The transfer, seen as direct retaliation towards President Donald Trump’s newly introduced 100% tariffs on Chinese language items, has reignited fears of a full-scale commerce conflict between the world’s two largest economies.

Over 1.66 million crypto merchants had been liquidated because the market skilled a pointy downturn, wiping out $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

— Cryptonews.com (@cryptonews) October 11, 2025

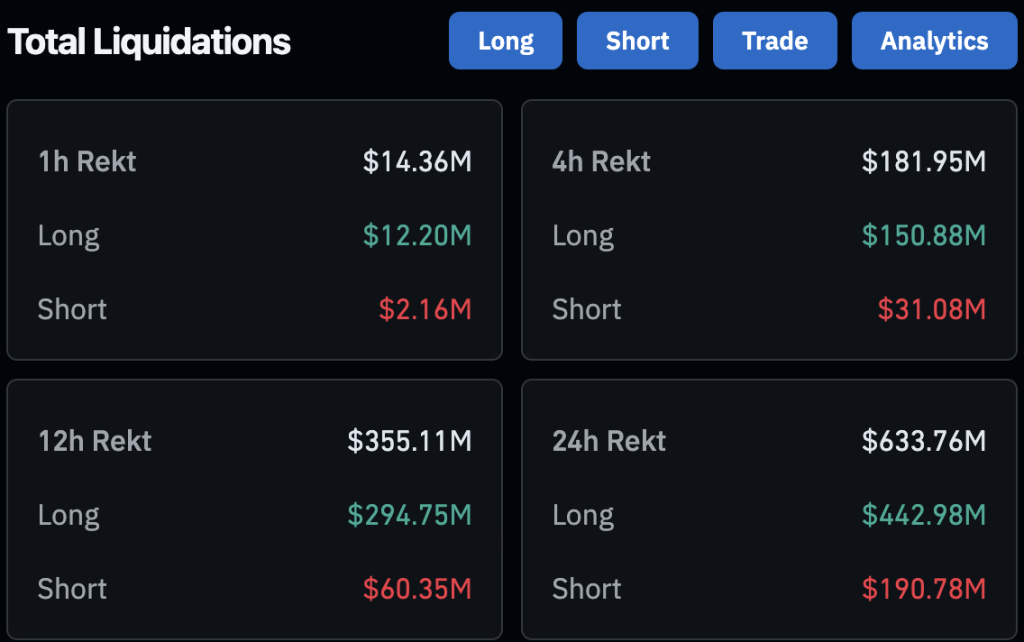

Following the announcement, over 1.66 million merchants had been worn out in 24 hours, leading to $19.33 billion in liquidated positions. Bitcoin and Ethereum alone accounted for almost $10 billion of these losses, making it one of many 12 months’s most extreme deleveraging occasions.

Moreover, the Crypto Concern & Greed Index plunged from a “Greed” stage of 64 on Friday to 27 (“Concern”) on Saturday, its lowest in six months.

Uncommon Earth Exports Fall 31% as Beijing Tightens Controls

The most recent measures develop Beijing’s present restrictions to 5 extra uncommon earth parts, together with holmium and erbium, requiring export approval for any product containing greater than 0.1% of Chinese language-sourced uncommon earths.

These supplies are important to industries starting from electrical autos and wind generators to superior protection programs.

With China controlling greater than 90% of worldwide uncommon earth processing capability, the brand new coverage has raised considerations over potential provide chain disruptions and mounting manufacturing prices worldwide.

Sources acquainted with the matter mentioned Chinese language magnet producers have been dealing with tighter scrutiny on export license purposes since September. Approval processes have lengthened, with purposes more and more returned for added documentation.

Although nonetheless inside the Commerce Ministry’s 45-day window, the evaluation course of now resembles that of April, when export delays precipitated magnet shortages and short-term shutdowns at a number of automotive vegetation.

Knowledge launched Monday confirmed China’s uncommon earth exports plunged 31% in September, suggesting that the slowdown had already begun earlier than the most recent spherical of restrictions.

Beijing’s Ministry of Commerce has defended the controls, calling them “reputable actions” meant to refine China’s export administration system.

“China has constantly and resolutely safeguarded its personal nationwide safety,” a spokesperson mentioned, including that the measures align with worldwide requirements.

It has simply been discovered that China has taken a very aggressive place on Commerce in sending an especially hostile letter to the World, stating that they had been going to, efficient November 1st, 2025, impose massive scale Export Controls on just about each product they…

— Trump Reality Social Posts On X (@TrumpTruthOnX) October 10, 2025

President Trump, nevertheless, responded on Friday with a social media publish promising a 100% tariff on all Chinese language imports, accusing Beijing of “terribly aggressive” export techniques. He additionally warned of doable U.S. export bans on vital software program starting November 1.

The alternate rattled markets and solid doubt on a possible assembly between Trump and Chinese language President Xi Jinping later this month.

China fired again on Tuesday, vowing to “battle to the tip” if the U.S. escalates. “America can not concurrently search dialogue whereas threatening new restrictive measures,” China’s commerce ministry mentioned in a press release.

Don’t fear about China, it is going to all be high quality! Extremely revered President Xi simply had a nasty second. He doesn’t need Despair for his nation, and neither do I. The united statesA. desires to assist China, not harm it!!! President DJT

(TS: 12 Oct 12:43 ET)…— Trump Reality Social Posts On X (@TrumpTruthOnX) October 12, 2025

Trump appeared to melt his stance on Sunday, posting that “it is going to all be high quality,” calling Xi “extremely revered,” and saying the U.S. needed to “assist, not harm” China.

Crypto Market Sinks $7B as China Tightens Uncommon Earth Controls

The timing of Beijing’s transfer has additionally raised considerations inside the crypto mining sector. Uncommon earths are important for GPU and ASIC chip manufacturing, that means tighter Chinese language export evaluations might enhance {hardware} prices and probably influence mining problem and community hash charges within the quick time period.

The Federal Reserve’s subsequent strikes might additional sway sentiment. Fed Chair Jerome Powell is about to talk Tuesday on the NABE Annual Assembly in Philadelphia, the place buyers count on readability on rate-cut prospects.

Fed Chair Jerome Powell’s speech tomorrow might set off a crypto market crash as merchants await steering on rates of interest and financial coverage amid U.S.-China commerce tensions. #CryptoMarket #Powell #FederalReserve https://t.co/uYtW13jgYK

— Cryptonews.com (@cryptonews) October 13, 2025

Analysts say any hawkish tone might deepen the market downturn, whereas indicators of coverage easing could stabilize threat property

Regardless of the transient conciliatory tone, markets remained unstable. Wall Road suffered losses, with U.S. tech shares falling over 2%, whereas world commodities rallied as buyers shifted to protected havens. Gold surged to a document $4,200 per ounce, and silver climbed to $51.70.

The crypto market bore the sharpest influence. Over $500M in leveraged positions had been liquidated inside hours of China’s announcement, as merchants rushed to de-risk amid the mounting geopolitical uncertainty.

Bitcoin plunged 3.1% to round $113,600 earlier than briefly dipping beneath $111,700. Ethereum fell 5.1%, buying and selling beneath $4,000 for the primary time in weeks.

XRP and Dogecoin every crashed by greater than 30%, marking one of many steepest single-day declines this 12 months.

The broader crypto market capitalization dropped 3.2% to $3.8 trillion.

The publish China Hits Again at Trump’s Tariffs with Uncommon Earth Restrictions — Wipes Over $500M from Crypto Market appeared first on Cryptonews.