Bitcoin (BTC/USD) fell sharply beneath $111,000 this week, extending losses as international danger sentiment deteriorated. Many of the promoting bias was triggered as BTC bought rejected close to $124,500, the place a bearish engulfing candle on the each day chart confirmed heavy profit-taking and a possible short-term development shift.

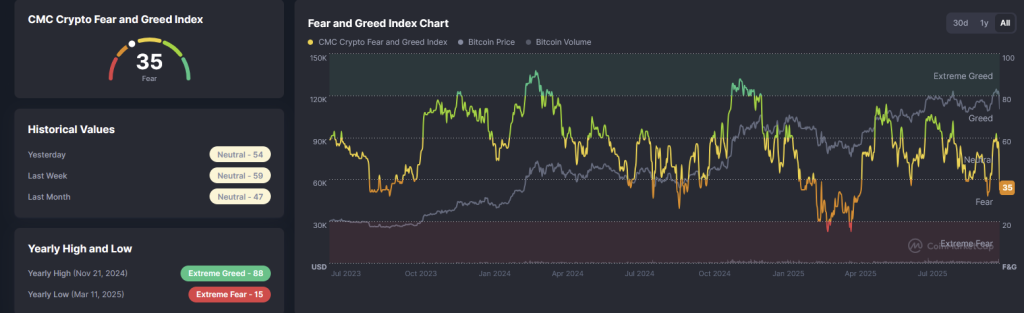

The transfer coincided with broader macro jitters, driving the Crypto Worry and Greed Index all the way down to 35 (Worry), its lowest in over a month.

This drop mirrors the danger reset throughout international markets, with the whole crypto market cap slipping to $3.7 trillion and 24-hour buying and selling volumes nearing $497 billion.

Crypto Enters Danger-Off Territory

The most recent downturn underscores how Bitcoin stays intently tied to broader market sentiment. Correlation with U.S. equities climbed once more this week as danger property offered off amid renewed commerce and inflation considerations.

- Bitcoin: $110,705, down 8.59% in 24h

- Ethereum: $3,764, down 12.94%

- BNB: $1,092, down 13.6%

- Solana: $183, down 16.3%

- XRP: $2.41, down 14.0%

The Altcoin Season Index dipped to 37, confirming a renewed shift towards Bitcoin dominance. On the similar time, the CoinMarketCap 20 Index, monitoring main tokens, slid 10.5% to 235.1, highlighting broad promoting stress throughout the sector.

Investor psychology has additionally turned defensive. Historic Worry and Greed information reveals sentiment has deteriorated from impartial (54) final week to concern (35) now, the steepest weekly decline since March.

As we mentioned in our earlier Bitcoin worth predictions, the bearish butterfly sample accomplished its first goal, triggering a pointy selloff. Now, let’s check out the recent evaluation and the place Bitcoin may head subsequent.

Bitcoin Chart Outlook: Key Ranges to Watch

Technically, Bitcoin’s drop beneath its ascending trendline from April indicators a weakening bullish construction. The RSI (38.8) signifies that BTC is coming into oversold territory, whereas the MACD has crossed bearishly into unfavorable momentum.

The $108,000–$110,000 zone stays an important help space that has repeatedly attracted long-term consumers since June. Candle formations during the last three periods, marked by lengthy decrease wicks, point out dip consumers defending this degree.

A Doji or spinning high close to this area may mark the early levels of a reversal, significantly if confirmed by a rebound above $117,000, which aligns with the 50-day shifting common and prior resistance zone.

If this restoration holds, Bitcoin might try one other retest of $124,000, adopted by a medium-term goal close to $126,000–$130,000. Alternatively, failure to remain over $108,000 may expose draw back targets close to $103,000 and $98,200, the place historic demand zones reside.

#Bitcoin – As famous in our earlier forecast, BTC accomplished the bearish butterfly’s first goal earlier than tumbling 9% to $110K. Worth now checks key help at $108K–$110K. A rebound above $117K may set off restoration towards $124K–$126K, whereas failure dangers deeper pullback to $103K. pic.twitter.com/4D4spTnEqX

— Arslan Ali (@forex_arslan) October 11, 2025

Market Sentiment and Buying and selling Setup

Regardless of the selloff, technical evaluation indicators it as a wholesome reset relatively than the beginning of a brand new bearish development. With the Crypto Worry and Greed Index at 35, market sentiment now mirrors early accumulation phases seen in prior cycles.

With that mentioned, a possible buy-the-dip setup emerges close to $108,000, with stop-losses beneath $107,500 and upside targets at $124,000–$126,000. This aligns with each Fibonacci retracement and shifting common confluence, providing a good risk-reward ratio for swing merchants.

If momentum improves, Bitcoin may resume its uptrend towards $130,000 in This fall, particularly as institutional flows, ETF demand, and blockchain adoption proceed to offset macro volatility.

Presale Bitcoin Hyper ($HYPER) Combines BTC Safety With Solana Velocity

Bitcoin Hyper ($HYPER) is positioning itself as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM). Its purpose is to increase the BTC ecosystem by enabling lightning-fast, low-cost sensible contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched safety with Solana’s high-performance framework, the challenge opens the door to completely new use instances, together with seamless BTC bridging and scalable dApp improvement.

The crew has put robust emphasis on belief and scalability, with the challenge audited by Seek the advice of to present traders confidence in its foundations.

Momentum is constructing shortly. The presale has already crossed $23 million, leaving solely a restricted allocation nonetheless out there. At as we speak’s stage, HYPER tokens are priced at simply $0.013095—however that determine will enhance because the presale progresses.

You should buy HYPER tokens on the official Bitcoin Hyper web site utilizing crypto or a financial institution card.

Click on Right here to Take part within the Presale

The submit Bitcoin Worth Evaluation: Indicators to Watch as Macro Shock Sends Crypto Worry Index to 35 appeared first on Cryptonews.