Institutional traders anticipate tokenized property to take up a a lot bigger function in international portfolios by the tip of the last decade, with non-public markets seen as the primary to shift.

A State Avenue examine revealed Thursday tasks that by 2030, between 10% and 24% of institutional investments may very well be made via tokenized devices.

Personal fairness and personal fastened revenue are seen because the almost certainly early candidates for tokenization. These markets have lengthy struggled with illiquidity and excessive operational prices, making them prime targets for digital devices designed to spice up effectivity and unlock liquidity.

“The acceleration in adoption of rising applied sciences is exceptional. Institutional traders are shifting past experimentation, and digital property are actually a strategic lever for development, effectivity, and innovation,” mentioned Joerg Ambrosius, president of Funding Providers at State Avenue.

He added that tokenization, synthetic intelligence and quantum computing are converging to reshape the way forward for finance, with early adopters main the cost.

Our 2025 international analysis on #digitalassets and rising applied sciences reveals a decisive shift in adoption and strategic dedication amongst institutional traders towards #tokenization and blockchain-enabled transformation. Learn extra: https://t.co/hzk1f3dZ1O pic.twitter.com/tULwI2Ke88

— State Avenue (@StateStreet) October 9, 2025

Digital Belongings Common 7% of Portfolios, Set to Extra Than Double in Three Years

The analysis additionally exhibits that whereas tokenization is gaining traction, many traders consider different applied sciences could have an excellent larger affect on operations.

Greater than half of respondents pointed to generative AI and quantum computing as extra transformative than blockchain, although they see the applied sciences working in tandem.

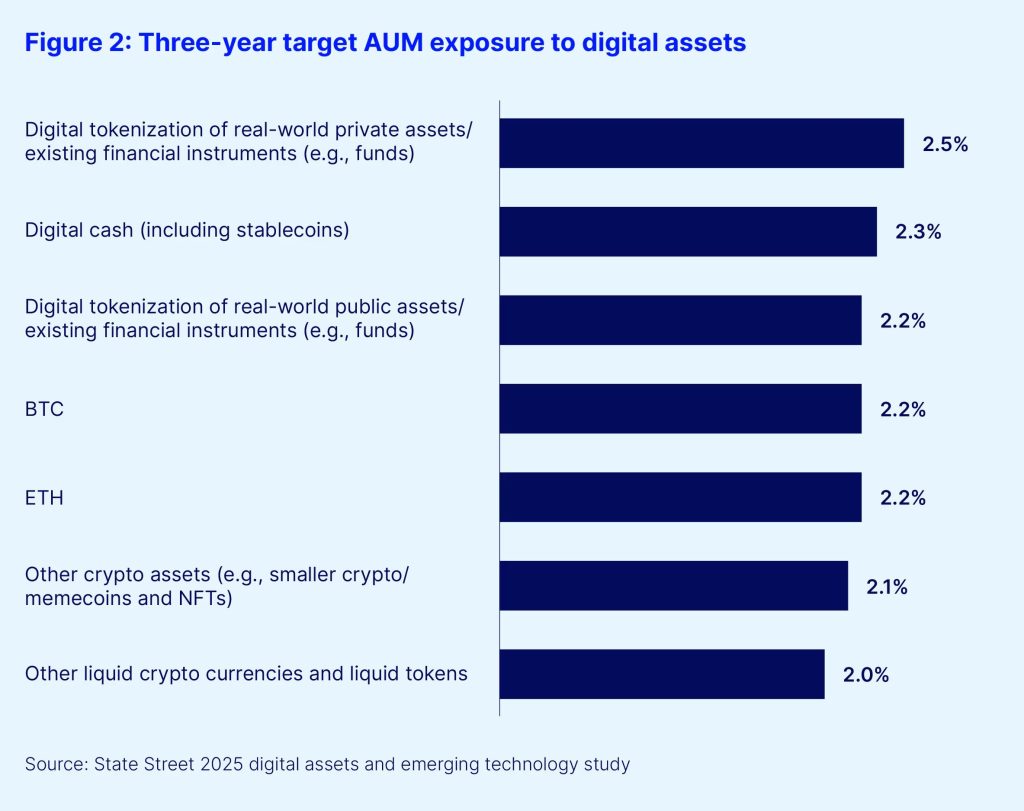

At the moment, institutional portfolios maintain a mean of seven% in digital property, in line with the examine. That determine is predicted to rise to 16% inside three years. The most typical types are digital money, together with tokenized variations of listed equities and glued revenue. On common, respondents maintain 1% of their portfolios in every of those classes.

Asset Managers Outpace Homeowners in Bitcoin, Ethereum and Tokenized Belongings

Asset managers reported increased publicity than asset house owners throughout practically each class. 14% of managers mentioned they held 2% to five% of portfolios in Bitcoin, in contrast with 7% of asset house owners. A small share of managers additionally admitted to having at the very least 5% of property in Ethereum, meme cash or NFTs, pointing to the broader vary of danger urge for food.

Tokenization of real-world property is one other space the place managers are forward. They reported larger publicity to tokenized public property, tokenized non-public property and digital money than asset house owners.

Even so, cryptocurrencies stay the most important driver of returns inside digital portfolios.

27% of respondents mentioned Bitcoin is their strongest performer immediately. 1 / 4 additionally anticipate it to stay the highest performer in three years.

In the meantime, Ethereum ranked second. 21% cited it as their greatest return generator now, and 22% anticipate that development to proceed.

In contrast, solely 13% mentioned tokenized public property drive most of their digital returns. Simply 10% pointed to non-public property. These figures are anticipated to stay principally unchanged over the subsequent three years.

State Avenue Finds Confidence Rising That Tokenization Pattern Is Sturdy

State Avenue’s examine suggests that personal property may very well be the primary main beneficiaries of tokenization. This is able to possible occur as soon as infrastructure improves and investor confidence matures.

Furthermore, establishments broadly anticipate digital property to turn out to be mainstream inside a decade. This displays rising acceptance that the shift is structural quite than cyclical.

The findings add weight to the view that tokenization may rework capital markets. By digitizing possession of property similar to actual property and personal credit score, establishments may reduce settlement occasions, scale back prices, and broaden entry to traders who had been beforehand excluded from non-public markets.

The submit Tokenized Belongings Might Kind As much as a Quarter of Portfolios By 2030: State Avenue appeared first on Cryptonews.