Could Ethereum actually hit $10,000 this cycle? Crypto hedge fund XWIN Finance believes the reply lies in liquidity dynamics.

As world M2 cash provide reaches document highs and trade reserves plummet, XWIN analysts argue that Ethereum is approaching its “revaluation part,” a structural shift that would ship ETH surging to 5 figures if present developments maintain.

Over the previous three years, the U.S. M2 cash provide has entered a renewed enlargement part, hitting a document excessive of roughly $22.2 trillion.

JUST IN

: U.S. M2 Cash Provide jumps to a brand new all-time excessive of $22.2 Trillion

pic.twitter.com/tAVX6YZsWm

— Barchart (@Barchart) September 23, 2025

Bitcoin has been the primary to seize this “liquidity wave,” climbing greater than 130% since 2022 and displaying an exceptionally excessive correlation with M2 of round 0.9.

Alternate Provide Shock and M2 Enlargement Reveals ETH to $10k is Sensible

Ethereum, against this, stays behind, having risen solely about 15% throughout the identical interval. This hole represents a transparent “liquidity lag,” nevertheless, on-chain knowledge suggests this hole could also be closing.

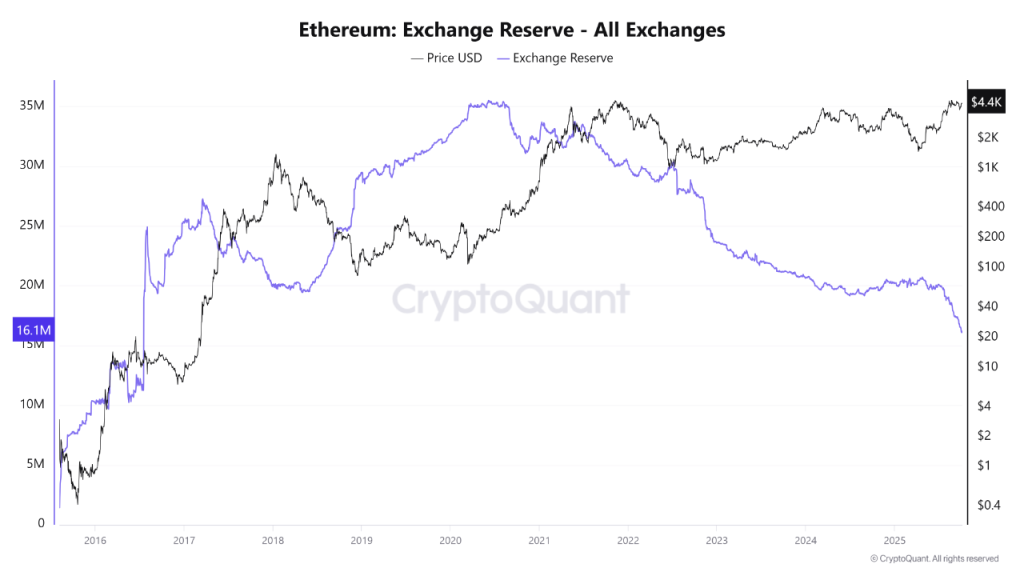

Alternate reserves have fallen to round 16.1 million ETH, down greater than 25% since 2022, indicating a structural decline in promoting strain.

Netflows to exchanges have remained persistently unfavourable, displaying that ETH is being withdrawn into self-custody or staking contracts.

In the meantime, the Coinbase Premium Index has turned constructive once more, pointing to renewed shopping for curiosity from U.S. establishments.

These indicators mirror situations noticed in early 2020 and 2021, each of which had been precursors to main Ethereum rallies.

Traditionally, Ethereum tends to lag behind Bitcoin within the early phases of financial easing cycles.

But when BTC dominance falls under 60%, capital typically rotates into the altcoin market, and the ETH/BTC ratio begins to climb.

That sample seems to be rising once more, suggesting that 2025 may mark a shift from a Bitcoin-led part to an Ethereum- and altcoin-led part.

All of this makes the This fall goal of $10,000 ETH look inside vary, and if that occurs, it will not be the results of speculative extra however a pure final result of liquidity biking by way of the crypto market.

Arthur Hayes: Trump’s Wartime Financial system Might Push $ETH to $10K by 12 months-Finish

Arthur Hayes, co-founder of BitMEX, additionally believes that $10,000 Ethereum by the top of 2025 appears properly inside attain.

In a July weblog submit, Hayes laid out his thesis, tying the potential value surge to U.S. President Donald Trump’s financial insurance policies and what he describes as a shift to a wartime economic system.

BitMEX Co-Founder @CryptoHayes predicts Bitcoin may attain $250,000 and Ethereum $10,000 by the top of 2025 as macroeconomic developments gasoline the crypto bull market.#Bitcoin #Crypto #BullMarkethttps://t.co/vf4Qpuihjo

— Cryptonews.com (@cryptonews) July 23, 2025

In accordance with Hayes, the return of Trump has introduced in a credit-heavy financial technique designed to extend industrial output, particularly in areas like uncommon earths and protection manufacturing.

Hayes believes this method, which mirrors points of financial planning in China, will flood the system with credit score.

That, he argues, will create favorable situations for danger belongings, particularly prime cryptocurrencies like Bitcoin and Ethereum.

Ethereum has now reclaimed the $4,600 stage, gaining 11.34% up to now seven days with a market capitalization of $561.93 billion.

CoinShares’ latest report has proven that U.S. spot Ethereum ETFs, alongside Ethereum digital asset treasuries, have been driving ETH’s value rally.

Ethereum noticed inflows totaling $1.48 billion final week alone, pushing whole year-to-date (YTD) inflows to a document $13.7 billion, near triple that of final 12 months.

The biggest weekly ETPs inflows on document: $5.95B@Bitcoin noticed its largest weekly inflows on document totalling US$3.55B, with @solana additionally breaking its document, at US$706.5M. @ethereum noticed inflows totalling US$1.48B while XRP (@Ripple) additionally noticed substantive inflows of US$219.4M.… pic.twitter.com/w3ccONHEzk

— CoinShares (@CoinSharesCo) October 6, 2025

And it’s attainable that ETH ETFs will solely get busier within the coming months, with main asset supervisor Grayscale submitting at this time so as to add staking to its Ethereum ETF.

Kevin Rusher, founding father of RAAC, a real-world asset borrowing and lending ecosystem, argues that Ethereum’s days under $5,000 could quickly be over.

“Whereas the crypto market is experiencing a short-term sell-off after ETH hit near all-time excessive over the weekend, the market returns for ETH have been eye-popping over the medium time period,” Rusher mentioned.

Mixed with staking yields and institutional adoption, such situations may create what he calls “fiery demand” for ETH.

$4,800 Resistance Examined Once more: Can ETH Break By to $7K-$10K?

On the technical entrance, the weekly Ethereum chart exhibits a key inflection level as value as soon as once more exams the most important resistance zone round $4,800, a stage that has rejected ETH a number of instances since 2021.

The repeated tops close to this area kind a broad triple-top sample, indicating heavy provide strain slightly below the all-time excessive.

The present transfer has pushed Ethereum above the 78.6% Fibonacci retracement stage, suggesting the market is making an attempt to finish a full cycle towards the 100% extension close to $4,917.

A confirmed breakout and weekly shut above this resistance may set off a powerful continuation part, with Fibonacci projections putting medium-term upside targets between $7,000 and $10,000, relying on the power of the breakout.

Conversely, failure to interrupt by way of may result in a short-term retracement towards the $3,500–$3,800 zone, which aligns with the 61.8% retracement space and rising trendline help.

The submit Crypto Hedge Fund Predicts Ethereum’s “Subsequent Revaluation Section” if Liquidity Retains Rising – $ETH to 10K Sensible? appeared first on Cryptonews.