Vitalik Buterin needs a extra secure basis for Ethereum’s long-term development. He thinks low-risk DeFi protocols might be the regular revenue stream for Ethereum, like Google Search is for Google. This strategy, he argues, would allow Ethereum to proceed supporting experimental and cultural purposes with out compromising its monetary resilience.

Buterin defined that DeFi doesn’t must be flashy or revolutionary to be efficient. As an alternative, it ought to function a reliable income supply that’s neither ethically questionable nor misaligned with Ethereum’s values.

He additionally urged builders to discover new types of digital property, akin to basket currencies and flatcoins tied to client value indices, which might strengthen Ethereum’s function as a spine for international monetary innovation.

If you wish to educate your self on Ethereum and the way forward for $ETH, go learn Vitalik’s new weblog put up.

Low-risk DeFi ought to undoubtedly be part of Ethereum. We’re nowhere close to the place we need to be, and that is simply one other showcase of the place we’re heading. https://t.co/1lhYoohtCk pic.twitter.com/OS2rfXqpkR— Djani (@DjaniWhaleSkul) September 20, 2025

This debate surfaces as Ethereum’s DeFi ecosystem crosses the $100 billion complete worth locked (TVL) threshold for the primary time since early 2022. That milestone reveals each the restoration from the bear market and Ethereum’s continued dominance in DeFi.

In response to DefiLlama information, Ethereum and its layer-2 options have 64.5% of complete TVL, whereas Solana has lower than 9%.

Onchain Exercise Indicators Power

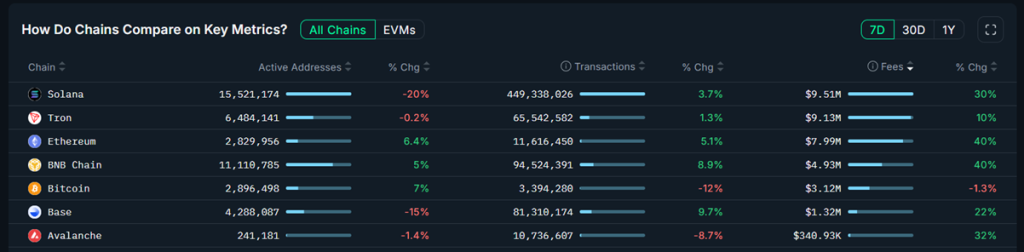

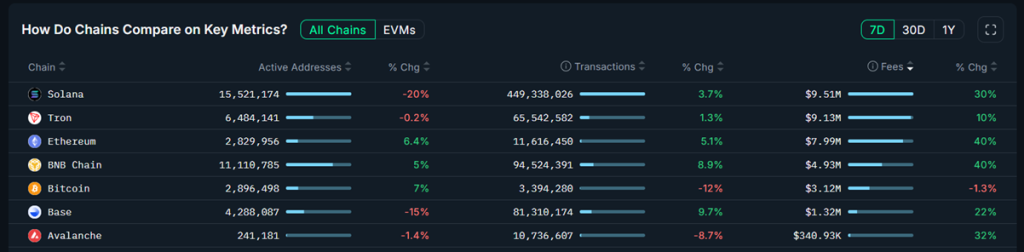

Ethereum’s fundamentals are bettering consistent with its DeFi resurgence. Charges on the community have elevated by 40% over the previous week, whereas the variety of energetic pockets addresses has risen by 10%. As a result of all Ethereum transactions require ETH, increased utilization immediately contributes to demand for the token.

Rising charges additionally profit validators, bettering community safety whereas fueling Ethereum’s automated burn mechanism, which steadily reduces provide.

This mixture of upper exercise and structural provide discount reinforces Ethereum’s long-term funding case.

Caption: Blockchains ranked by 7-day charges, USD. Supply: Nansen

On the identical time, decentralized trade (DEX) volumes have exceeded $3.5 trillion, exhibiting Ethereum’s unmatched scale in decentralized purposes.

Regardless of this power, ETH has struggled in latest classes, down 4.15% on the week and buying and selling close to $4,468. Every day buying and selling quantity has slipped greater than 30% to $18 billion, reflecting a quieter however consolidating market.

Ethereum (ETH/USD) Value Prediction – Technical Outlook

Ethereum’s value prediction seems impartial, because the cryptocurrency is buying and selling inside a narrowing vary, with value motion confined to a symmetrical triangle since mid-September.

The 50-day EMA at $4,519 has capped positive factors, whereas the 200-day EMA at $4,394 continues to behave as help. Volatility stays muted, however triangles like this normally resolve with a decisive transfer.

Momentum indicators present a market leaning cautious. The RSI at 40 displays weakening power, whereas repeated higher wicks close to $4,587 spotlight provide strain. Nonetheless, the rising base of the sample indicators patrons are defending the $4,418–$4,394 zone.

A break beneath $4,394 would expose $4,350 and doubtlessly $4,280. On the upside, reclaiming $4,520 might reopen $4,587 and $4,670, with a measured breakout pointing towards $4,760 and even $5,000.

For merchants, looking forward to bullish candles close to help is essential. For buyers, consolidation right here might show to be the inspiration for Ethereum’s subsequent main rally into 2026.

Presale Bitcoin Hyper ($HYPER) Combines BTC Safety With Solana Velocity

Bitcoin Hyper ($HYPER) is positioning itself as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM). Its objective is to broaden the BTC ecosystem by enabling lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched safety with Solana’s high-performance framework, the venture opens the door to thoroughly new use instances, together with seamless BTC bridging and scalable dApp improvement.

The staff has put robust emphasis on belief and scalability, with the venture audited by Seek the advice of to provide buyers confidence in its foundations.

Momentum is constructing shortly. The presale has already crossed $17.3 million, leaving solely a restricted allocation nonetheless obtainable. At as we speak’s stage, HYPER tokens are priced at simply $0.012955—however that determine will improve because the presale progresses.

You should purchase HYPER tokens on the official Bitcoin Hyper web site utilizing crypto or a financial institution card.

Click on Right here to Take part within the Presale

The put up Ethereum Value Prediction: Coinbase Analysts Say the ETH Pullback is a Purchase the Dip Sign appeared first on Cryptonews.