Ethereum is buying and selling close to $4,471 after a modest 1.14% dip over the previous 24 hours, leaving its market cap at $539.7 billion. Regardless of short-term volatility, onchain indicators, ETF inflows, and company treasury strikes counsel ETH could also be making ready for a breakout that might carry costs towards the $5,000 milestone.

Community Indicators and Onchain Power

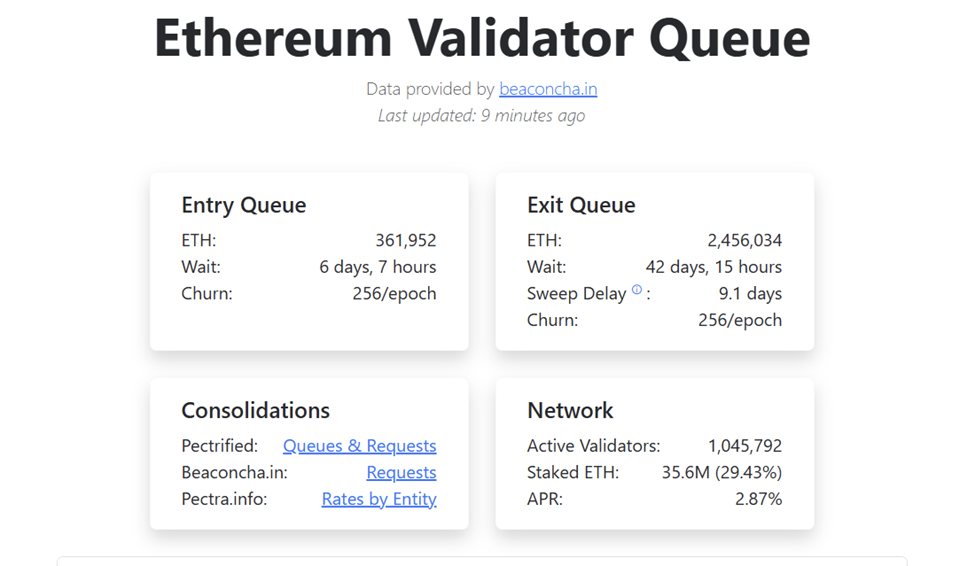

Ethereum’s current value motion has been combined. On one aspect, validator exits have surged, with greater than 2.45 million ETH—price $11 billion—ready to be unstaked. This has prolonged the withdrawal queue to an estimated 42 days, elevating issues about near-term provide strain.

Nonetheless, unstaking doesn’t at all times translate into instant promoting. For a lot of establishments, it’s a part of a rebalancing technique.

On the identical time, community fundamentals are bettering. Transaction charges climbed 35% from final week, and energetic addresses rose 10%, reflecting rising use of Ethereum’s ecosystem.

Larger community exercise boosts validator yields and strengthens safety, whereas payment burns scale back total provide. Company treasuries are additionally increasing publicity.

Prior to now month alone, firms added 877,800 ETH, about $4 billion at present costs, into reserves. This regular influx has come from corporations like Bitming Immersion Tech, SharpLink Gaming, and The Ether Machine, all underscoring ETH’s rising profile as a reserve asset.

ETFs and Treasury Help Gas $5K Ethereum Outlook

Ethereum has outpaced the broader crypto market by 21% over the previous two months, sustaining dominance in decentralized functions. In line with DeFiLlama, Ethereum, together with its layer-2 networks, controls 64.5% of whole worth locked, far forward of Solana’s 9%.

Spot Ether ETFs are additionally offering highly effective institutional tailwinds. Property underneath administration in these funds now stand at $24.7 billion, with $213 million in internet inflows final Thursday alone. These merchandise provide a regulated channel for establishments to achieve ETH publicity, additional cementing Ethereum’s function in conventional finance.

Trade balances proceed to shrink, with 2.69 million ETH withdrawn within the final two months—driving out there provide to a five-year low. That discount in liquid ETH not solely eases promoting strain but additionally indicators sustained accumulation.

Collectively, shrinking provide, institutional inflows, and company reserves are constructing a basis for Ethereum’s subsequent transfer larger.

Ethereum (ETH/USD) Technical Roadmap Towards $5,000

From a technical perspective, Ethereum value prediction is impartial as ETH is consolidating inside a symmetrical triangle, with resistance round $4,566 and help at $4,440.

Momentum indicators are combined: the RSI sits close to 41, pointing to oversold situations, whereas candlestick patterns trace at bearish strain.

A bullish engulfing candle above $4,566 may reverse sentiment rapidly, opening the best way towards $4,670, $4,775, and ultimately $5,000.

The important thing vary for merchants is $4,440 to $4,566. A sustained protection of this zone favors upside continuation, with projections suggesting a breakout path towards $5,000–$5,200 within the coming weeks. A breakdown beneath $4,350, nonetheless, may drag ETH again towards $4,238 and even $4,108 earlier than new demand seems.

Ethereum consolidates close to $4,470 inside a symmetrical triangle.

– Help holds at $4,440, resistance at $4,566.

– Breakout above $4,670 eyes $5K, whereas a drop beneath $4,350 dangers $4,238. #Ethereum #ETH pic.twitter.com/k2P0iHTHkD— Arslan Ali (@forex_arslan) September 20, 2025

Regardless of short-term warning, the larger image stays constructive. Ethereum’s mixture of rising institutional flows, shrinking provide, and resilient community exercise suggests that after present pressures ease, the trail to $5,000 seems more and more attainable.

Presale Bitcoin Hyper ($HYPER) Combines BTC Safety With Solana Pace

Bitcoin Hyper ($HYPER) is positioning itself as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM). Its objective is to develop the BTC ecosystem by enabling lightning-fast, low-cost sensible contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched safety with Solana’s high-performance framework, the mission opens the door to thoroughly new use instances, together with seamless BTC bridging and scalable dApp growth.

The workforce has put sturdy emphasis on belief and scalability, with the mission audited by Seek the advice of to provide traders confidence in its foundations.

Momentum is constructing rapidly. The presale has already crossed $17.2 million, leaving solely a restricted allocation nonetheless out there. At at this time’s stage, HYPER tokens are priced at simply $0.012945—however that determine will enhance because the presale progresses.

You should buy HYPER tokens on the official Bitcoin Hyper web site utilizing crypto or a financial institution card.

Click on Right here to Take part within the Presale

The put up Ethereum Value Prediction: This Crucial Onchain Stage Might Unlock a Push to $5,000 appeared first on Cryptonews.