Spot bitcoin exchange-traded funds in the US recorded one other surge of inflows on Thursday, drawing $552.78 million in a single day as institutional buyers rotated again into the asset with renewed conviction.

Based on SoSoValue information, BlackRock’s iShares Bitcoin Belief (IBIT) led the cost with $366.2 million in inflows, adopted by Constancy’s FBTC with $134.7 million.

Bitwise’s BITB added $40.43 million, whereas smaller contributions got here from VanEck, Invesco, and Franklin Templeton.

Institutional Urge for food Revives as Bitcoin, Ether ETFs Put up Heavy Inflows

The most recent figures mark the fourth consecutive day of optimistic flows for U.S. spot bitcoin ETFs. Throughout these 4 periods, inflows reached a cumulative $1.7 billion, reversing the weak spot seen firstly of September when funds briefly posted their first weekly outflows since June.

On August 29, spot bitcoin ETFs shed $126.64 million, trimming complete property underneath administration to $139.95 billion. Since then, sentiment has shifted sharply, with recent inflows boosting complete internet property to $149.64 billion, representing 6.57% of Bitcoin’s market capitalization.

Cumulative internet inflows since launch have now reached $56.19 billion. Buying and selling exercise has additionally been strong, with volumes hitting $2.83 billion on Thursday.

Market watchers observe that September is historically one in every of Bitcoin’s weakest months, however the current streak of inflows suggests a renewed institutional urge for food.

Bitcoin (BTC) was buying and selling at $115,455 on the time of writing, up 1.04% over the previous 24 hours.

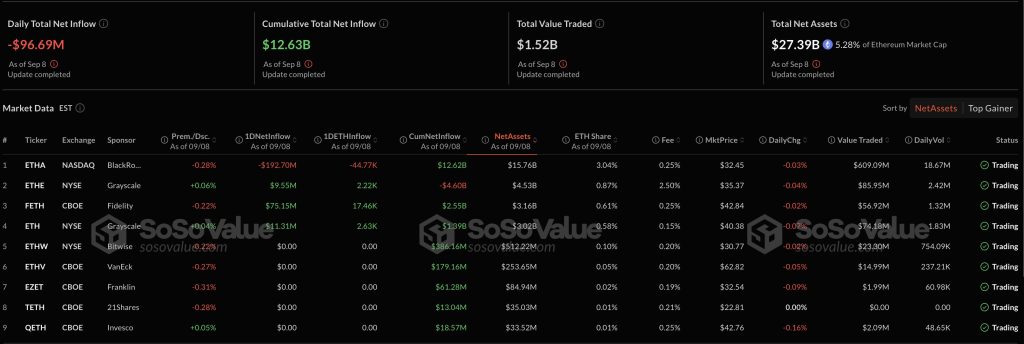

Ethereum merchandise have additionally regained momentum after a rocky begin to the month. Spot ether ETFs recorded $113.12 million in inflows on Thursday, led by Constancy’s FETH with $88.34 million.

Bitwise’s ETHW contributed $19.65 million, and Grayscale’s ETHE added $14.58 million, whereas Franklin’s EZET and Grayscale’s Ether Mini Belief posted smaller inflows.

A $17.39 million outflow from BlackRock’s ETHA partly offset the positive factors however was not sufficient to derail the general optimistic development.

Collectively, Bitcoin and Ether ETFs attracted greater than $660 million in a single day, signaling a resurgence of institutional demand.

Ethereum (ETH) traded at $4,517 at press time, up 2.87% in 24 hours. The broader crypto market gained 1.81%.

The inflows comply with per week of key U.S. financial releases that bolstered investor sentiment. Inflation information got here in softer than anticipated, whereas labor statistics revisions pointed to a weaker jobs market.

105 of 107 economists anticipate the Fed to chop charges 25 foundation factors on September 17 as Bitcoin surges above $116,000, concentrating on $140,000.#Bitcoin #RateCut #Fedhttps://t.co/iulmtuVc8z

— Cryptonews.com (@cryptonews) September 12, 2025

Markets at the moment are extensively anticipating a 25 basis-point fee lower from the Federal Reserve on September 17, a shift that has fueled optimism throughout danger property, together with cryptocurrencies.

Crypto Funds See Combined Flows as SEC Weighs New ETF Proposals

Digital asset funding merchandise recorded $352 million in outflows final week, in keeping with CoinShares, whilst softer U.S. payroll information strengthened expectations of a September fee lower.

Buying and selling volumes fell 27% from the prior week, signaling a cooling of investor urge for food. Nonetheless, year-to-date inflows stay robust at $35.2 billion, barely forward of final yr’s tempo.

Regional flows have been break up, with the U.S. seeing $440 million in redemptions whereas Germany and Hong Kong attracted inflows of $85.1 million and $8.1 million, respectively.

Bitcoin remained resilient, pulling in $524 million. Ethereum, nevertheless, drove the general outflows, shedding $912 million throughout seven straight buying and selling days.

Regardless of this, cumulative ETH inflows for the yr stand at $11.2 billion. Solana and XRP continued regular streaks, attracting $1.16 billion and $1.22 billion, respectively, over the previous 21 weeks.

Information from HODL15Capital reveals bitcoin ETPs now maintain greater than 1.47 million BTC, or about 7% of the capped provide, with U.S. ETFs accounting for 1.29 million BTC.

BlackRock’s IBIT leads with 746,810 BTC, adopted by Constancy’s FBTC with practically 200,000.

Bitcoin ETPs have amassed over 1.47 million BTC, accounting for roughly 7% of the cryptocurrency’s mounted 21 million provide.#Bitcoin #ETPshttps://t.co/4xyi1EEzE1

— Cryptonews.com (@cryptonews) September 2, 2025

Globally, bitcoin ETPs have added 170,000 BTC thus far in 2025, price $18.7 billion, although August introduced internet outflows of $301 million as buyers rotated into ether funds, which drew $3.95 billion.

In the meantime, the U.S. Securities and Change Fee is reviewing 92 crypto ETF purposes, together with a number of Solana and XRP merchandise.

Franklin Templeton’s proposals for each tokens have been delayed till November 14, whereas BlackRock’s Ethereum staking modification was pushed to October 30.

Bloomberg analysts estimate a 95% approval chance for Solana and XRP ETFs this yr, with prediction markets placing Solana’s odds close to 99%.

Regardless of near-term outflows, digital asset inflows have bounced again sharply in September, with $2.48 billion coming into funds final week alone.

The submit Bitcoin ETFs Ignite with $553M Each day Inflows, Fueling a $1.7B Bullish Streak appeared first on Cryptonews.