Solana treasury companies are quickly increasing their holdings, with complete reserves climbing to six.49 million SOL, as institutional curiosity within the community reveals no indicators of slowing.

The newest disclosures from BIT Mining Restricted and Upexi Inc. present the rising momentum behind company Solana treasuries, reflecting each long-term conviction and short-term positive aspects from the token’s value rally.

Company Bets on Solana Develop as Treasury Beneficial properties and Staking Earnings Speed up

BIT Mining Restricted, a cryptocurrency infrastructure firm making ready to rebrand as SOLAI Restricted, introduced the acquisition of a further 17,221 SOL this week.

JUST IN: Solana treasury firm @BITMining_BTCM (NYSE: BTCM) has added 17,221 $SOL to its holdings, bringing its treasury to over 44,000 $SOL price about $9.95M. pic.twitter.com/6xCe2C101y

— SolanaFloor (@SolanaFloor) September 11, 2025

The acquisition brings its treasury to greater than 44,000 SOL, valued at roughly $9.95 million as of September 10, 2025.

Chairman and COO Bo Yu stated the corporate sees continued worth in strengthening its presence inside the Solana ecosystem, including that validator operations will stay central to its technique of securing the community and capturing staking rewards.

Whereas BIT Mining continues to be within the early phases of constructing its Solana portfolio, Upexi Inc. has already emerged as one of many largest company holders.

The availability chain and shopper merchandise firm shifted in April to give attention to a Solana treasury technique and now stories holdings of two,018,419 SOL valued at $447 million.

That determine displays an unrealized acquire of $142 million, with a lot of the firm’s tokens staked to generate an annual yield of round 8%. Every day staking rewards at present stand at roughly $105,000.

Upexi’s treasury technique has additionally delivered positive aspects on a per-share foundation. The agency launched an “adjusted SOL per share” metric to mirror the impact of capital issuance, staking revenue, and discounted locked SOL purchases.

1/ The Evolution of DATs:@UpexiTreasury was an early mover within the SOL and altcoin treasury motion, and we proceed to guide on new, inventive, and clever capital issuances. We see many traders and funds who dismissed DATs now launching their very own!

— Allan Marshall (@UpexiAllan) September 11, 2025

As of September 10, adjusted SOL per share stood at 0.0197, or $4.37 in greenback phrases, up 56% and 126%, respectively, since launching the initiative.

Chief Government Allan Marshall described current weeks as “extraordinarily robust,” citing each treasury efficiency and better visibility via participation in finance conferences.

The corporate has additionally established an advisory committee to strengthen its positioning, with former BitMEX CEO Arthur Hayes becoming a member of as its first member.

Chief Technique Officer Brian Rudick emphasised Upexi’s execution, pointing to 3 capital issuances that have been “materially within the cash” and continued development in SOL per share as proof of treasury administration success.

BIT Mining, alternatively, shifted to Solana earlier this 12 months when it unveiled plans to lift as much as $300 million to construct an SOL treasury and transition away from its legacy give attention to Bitcoin, Litecoin, Dogecoin, and Ethereum Basic mining.

Beneath the technique, all present crypto holdings are being transformed into SOL, with funds to be raised in phases relying on market situations.

BIT Mining has additionally launched DOLAI, a U.S. dollar-denominated stablecoin deployed on Solana in partnership with Brale Inc.

Introducing DOLAI – a USD-backed stablecoin launched with BIT Mining (NYSE: BTCM), issued on Solana by way of Brale’s regulated platform.

Constructed for Agentic funds.

pic.twitter.com/IMPVqnSMx3

— brale (@brale_xyz) August 26, 2025

The stablecoin is designed to attach AI brokers, retailers, shoppers, and institutional finance, whereas finally increasing to multi-chain use instances.

BIT Mining, at present the seventeenth largest public Bitcoin miner by market cap, now sees its future anchored in Solana staking, treasury development, and blockchain-enabled companies.

The surge in treasury exercise comes as SOL itself continues its regular climb. The token is buying and selling round $226, up 1.2% on the day and edging nearer to its all-time excessive of $293 set in 2021.

Institutional Treasuries Pour Billions Into Solana as New Autos Launch

Institutional curiosity in Solana is intensifying as main companies put together multi-billion-dollar treasury methods on the blockchain.

For instance, on August 25, Galaxy Digital, Soar Crypto, and Multicoin Capital entered superior talks to lift about $1 billion for a brand new Solana-focused treasury automobile, with Cantor Fitzgerald advising on the deal.

The plan includes buying a publicly traded entity to kind one of many largest company reserves devoted to Solana, surpassing the dimensions of all present treasuries.

@defidevcorp has added one other 196,141 Solana to its treasury, spending practically $39.76 million.#Solana #SOLhttps://t.co/OHlzvP4kNF

— Cryptonews.com (@cryptonews) September 5, 2025

In the meantime, DeFi Growth Corp added 196,141 SOL to its stability sheet on September 5, spending $39.76 million at a median value of $202.76 per token.

The acquisition lifted its complete holdings above 2 million SOL, valued at $412 million, with the agency confirming plans to stake its full place for yield.

On September 8, Ahead Industries introduced a $1.65 billion personal placement led by Galaxy Digital, Soar Crypto, and Multicoin Capital, with present shareholder C/M Capital Companions becoming a member of. The elevate, one of many largest Solana-specific financings so far, closed on September 11.

The corporate stated proceeds would fund a brand new cryptocurrency treasury program targeted on SOL purchases, together with working capital and future offers.

SOL Methods launches on Nasdaq as STKE with $94M Solana treasury – is that this the $SOL breakout catalyst?#Solana #SOLhttps://t.co/aN4Ff5ksHc

— Cryptonews.com (@cryptonews) September 10, 2025

Including to the momentum, Canada-based SOL Methods started buying and selling on Nasdaq below the ticker STKE on September 10 with $94 million in Solana treasury holdings, changing into the primary U.S.-listed Solana-focused public firm.

Following a share consolidation to fulfill alternate necessities, the agency now manages 3.62 million SOL below delegation, together with 402,623 from its treasury, and stories report staking participation from practically 9,000 wallets.

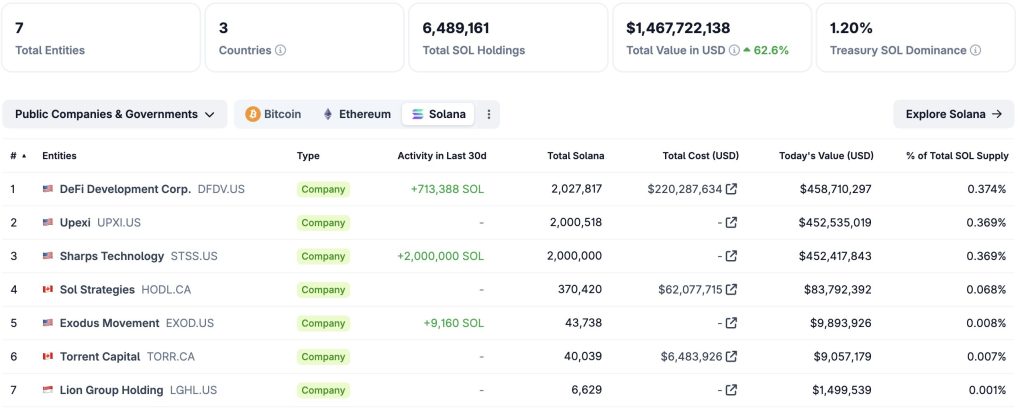

In line with CoinGecko’s Solana treasury reserve knowledge, seven entities now maintain 1.20% of Solana, valued at $1.4 billion.

Solana Breaks $220 as DeFi TVL Hits File $12.2B Amid Institutional Accumulation

Solana (SOL) has climbed above $220 for the primary time since February, hitting a seven-month excessive as capital flows and technical indicators level to renewed momentum. The rally comes regardless of a slowdown in new person onboarding, with deal with creation at a five-month low.

Analysts recommend the surge is being pushed by present holders and institutional accumulation somewhat than recent retail inflows.

Massive-scale purchases have added to the bullish tone. Information present Galaxy Digital purchased 430,000 SOL price $97 million from Binance inside an hour, bringing its 12-hour complete to 1.35 million SOL valued at $302 million.

JUST IN: @galaxyhq's aggressive Solana accumulation continues because the agency purchased 430,000 $SOL price $97M from @binance within the final hour. Over the previous 12 hours, Galaxy has collected 1.35M $SOL price $302M. pic.twitter.com/gOGqJ4Kms6

— SolanaFloor (@SolanaFloor) September 11, 2025

Arkham Intelligence additionally recognized 4 new wallets receiving 222,644 SOL, price $48.2 million, from Coinbase Prime in what seems to be coordinated accumulation.

On the DeFi aspect, Solana reached a brand new milestone with complete worth locked (TVL) surpassing $12.2 billion on September 11, edging previous its earlier report of $12 billion in January.

TVL has grown 15% prior to now month and greater than doubled from $4.8 billion at first of 2024.

Solana now leads Ethereum’s Layer-2 networks mixed, although Ethereum continues to dominate DeFi with practically $97 billion locked.

From a technical standpoint, Solana flashes bullish indicators after breaking out of a symmetrical triangle sample at round $212, suggesting a possible upside of $240.

Different charts additionally present a double backside close to $198–200, confirmed by a breakout above the $212 neckline, projecting short-term targets of $222–224.

Indicators help the transfer, with the MACD histogram turning inexperienced and the RSI trending increased, displaying renewed shopping for power.

Analysts observe that holding above $210–212 is vital for continuation, with resistance seen at $220–224.

A drop beneath $208 might weaken the setup, however momentum favors a push increased within the close to time period.

The submit Solana Treasury Companies Increase Holdings to six.5M SOL as Upexi Posts 126% Surge appeared first on Cryptonews.