Blockchain analytics agency Bubblemaps has escalated allegations of misconduct in opposition to decentralized alternate MYX Finance, claiming the mission’s core group is straight tied to wallets that siphoned $170 million value of MYX tokens from a current airdrop.

The agency’s findings increase questions on what could also be one of many largest Sybil assaults ever recorded within the crypto sector.

Contemporary Evaluation Ties MYX Creator to Wallets Behind Suspicious Token Claims

The controversy first surfaced on September 9 when Bubblemaps revealed an evaluation pointing to round 100 newly created wallets that claimed 9.8 million MYX tokens, roughly 1% of the mission’s provide.

@bubblemaps has flagged a potential $170M Sybil assault within the @MYX_finance airdrop, alleging 100 wallets secured 1% of provide.#Crypto #MYX #Airdrophttps://t.co/c8dOGLEXIi

— Cryptonews.com (@cryptonews) September 10, 2025

Valued at greater than $170 million on the time, the tokens had been allegedly secured in a coordinated vogue, with every pockets funded by OKX on April 19 and later claiming tokens concurrently on Might 7.

Bubblemaps described the sample as “the largest airdrop Sybil of all time.”

MYX, which noticed its totally diluted valuation soar to $17 billion inside 48 hours of launch, was fast to defend itself. The mission acknowledged that some customers requested deal with modifications earlier than launch, however denied any wrongdoing.

In an announcement, MYX Finance insisted that its reward campaigns had been designed to stay open and inclusive, even permitting large-scale participation, and pledged to strengthen Sybil protections sooner or later.

That clarification, nevertheless, did little to ease issues. Bubblemaps returned with contemporary proof as we speak, saying its new evaluation reveals a direct connection between MYX’s creator pockets and one of many addresses concerned within the suspicious exercise.

2/ Two days in the past, we revealed how one entity claimed $170M from the $MYX airdrop with 100 freshly funded wallets

On the time, no indicators pointed on to the MYX core group

However new proof modified thathttps://t.co/wNgjYcENqb— Bubblemaps (@bubblemaps) September 11, 2025

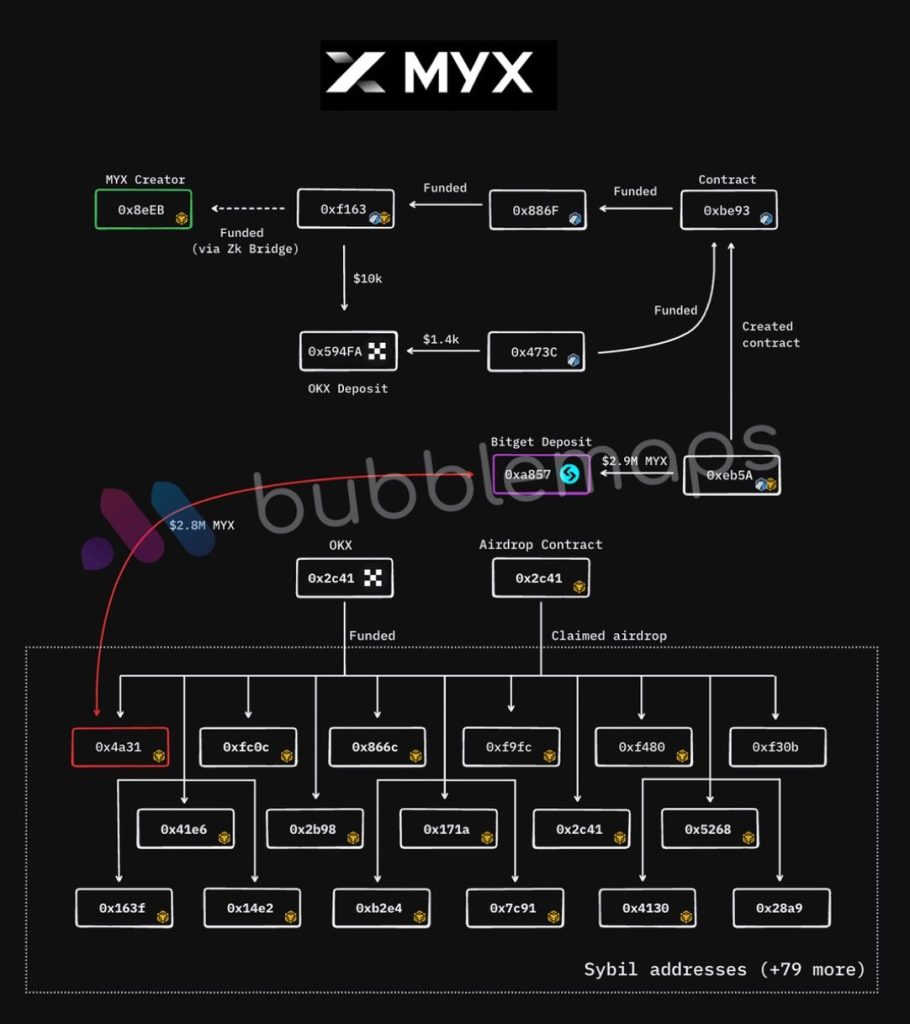

In accordance with the blockchain information, the path started with the creator’s pockets, 0x8eEB, and prolonged throughout a number of chains, ultimately linking to pockets 0x4a31.

This deal with, Bubblemaps mentioned, matched the identical funding and claiming patterns because the 95 different Sybil wallets recognized earlier.

What stood out, the agency famous, was that pockets 0x4a31 despatched $2.8 million value of MYX to a deposit deal with, 0xeb5A, which has been linked on to the mission’s creator.

Bubblemaps argued that this overlap can’t be dismissed as a coincidence.

“If these 100 wallets actually had been unbiased, why do all of them share the identical funding and claiming sample? Why does one share a deposit deal with with the token creator?” the agency requested in its newest publish.

The accusations have added gasoline to rising doubts across the legitimacy of MYX’s token distribution. The suspected Sybil allocation, value over $200 million at its peak earlier than token costs corrected, has forged a shadow over the mission’s speedy rise.

Analysts argue that if confirmed, the scandal might undermine belief not solely in MYX but additionally within the broader credibility of token distribution campaigns.

As of yesterday, MYX Finance maintained its place that the distribution course of was honest. The mission emphasised that solely its “Cambrian” marketing campaign had strict anti-Sybil measures in place, whereas different incentive packages centered on buying and selling quantity and liquidity provision.

As a decentralized alternate, MYX has at all times upheld the rules of equity and openness. Other than the “Cambrian” marketing campaign, the place anti-sybil measures had been utilized to the fee-free marketing campaign in the direction of bots that wash traded extensively , all different marketing campaign rewards have been…

— MYX.Finance (@MYX_Finance) September 9, 2025

MYX additionally harassed that it revered participation from all customers, together with these with in depth involvement.

However Bubblemaps has dismissed these responses as inadequate. The analytics agency described MYX’s assertion as obscure and even likened it to an AI-generated reply, questioning the mission’s willingness to deal with the precise on-chain hyperlinks uncovered.

“Be MYX Finance, launch your token, run an airdrop marketing campaign, 100 Sybil addresses obtain 1% of the provision, go from 0 to $20B FDV in a single day, and drop a protracted, obscure GPT reply,” Bubblemaps wrote.

The investigation is ongoing, and MYX has but to supply an in depth rebuttal to the direct pockets connections offered by Bubblemaps.

$MYX Value Falls Amid Renewed Give attention to Staff-Led Sybil Assault on Airdrop

$MYX has come beneath strain following contemporary scrutiny over a suspected airdrop scandal.

In accordance with CoinMarketCap, the token is buying and selling at $13.81, down 17% within the final 24 hours, although nonetheless up greater than 1,000% over the previous week.

The allegations heart on what analysts describe as a Sybil assault, the place a number of wallets are used to say outsized rewards.

Usually pushed by greed quite than sabotage, the tactic has turn out to be a recurring problem throughout crypto. Tasks now deploy superior monitoring instruments to detect such habits, however attackers proceed to adapt.

Previous instances spotlight the dimensions of the issue. In 2023, one actor managed 21,877 wallets on zkSync utilizing bots that mimicked regular buying and selling exercise. The scheme prices simply $1.50 to $2 in ETH charges per pockets, making detection tough.

In 2024, Solana-based Io.web was hit by a Sybil exploit that spoofed 1.8 million GPUs to say rewards, forcing the community to overtake its safety mannequin.

The controversy round MYX reveals that even high-profile tasks stay weak. As token launches entice large sums, Sybil exercise continues to check the bounds of crypto’s defenses.

The publish $MYX Staff Accused in $170M Airdrop Scandal – Inside Job Now Confirmed? appeared first on Cryptonews.