Metaplanet Inc finalized its $1.45 billion worldwide share providing to fund large Bitcoin purchases, issuing 385 million shares at ¥553 every with settlement scheduled for September 16.

The Japanese firm allocates ¥183.7 billion ($1.24 billion) on to Bitcoin acquisitions between September and October 2025.

The Tokyo-listed agency elevated Bitcoin holdings to twenty,136 BTC value roughly $2.25 billion, making it the sixth-largest company Bitcoin holder globally.

Latest acquisitions embody 136 Bitcoin for $15.2 million and 1,009 Bitcoin for $112 million.

*Discover Relating to Willpower of Difficulty Value and Different Issues* pic.twitter.com/DWM3r1oYCC

— Metaplanet Inc. (@Metaplanet_JP) September 9, 2025

Asian Company Treasury Revolution Accelerates

Nakamoto Holdings dedicated $30 million to take part in Metaplanet’s international fairness providing, marking its largest funding and first stake in an Asian Bitcoin-focused public firm.

KindlyMD’s subsidiary inventory surged 77.2% on Nasdaq following the announcement regardless of current month-to-month declines.

Equally, Sora Ventures just lately launched a devoted $1 billion Bitcoin treasury fund backed by $200 million in regional commitments, concentrating on speedy accumulation inside six months.

Simply in the present day, QMMM Holdings reported 1,736% inventory beneficial properties after saying $100 million crypto treasury plans concentrating on Bitcoin, Ethereum, and Solana.

The Hong Kong-based digital media agency’s shares soared 2,300% earlier than closing greater at $207 on Nasdaq.

Japan leads company Bitcoin adoption with a number of Tokyo-listed corporations saying treasury methods.

Authorities coverage adjustments help company crypto adoption, with proposed tax reforms doubtlessly decreasing capital beneficial properties charges from 55% to twenty%.

The Flywheel Impact Faces Premium Compression Challenges

Metaplanet’s financing technique depends on “transferring strike warrants” issued to Evo Fund, making a capital technology flywheel for Bitcoin purchases.

CEO Simon Gerovich designed the mechanism to boost funds at low prices throughout inventory worth appreciation.

The mannequin confirmed indicators of pressure as shares declined 54% since mid-June peaks regardless of Bitcoin gaining 2% throughout the identical interval.

Accumulation charges slowed from 160% development by June to lower than 50% since.

Bitcoin premium compression threatens the technique’s sustainability. The corporate’s market capitalization a number of versus Bitcoin holdings narrowed from eight instances reserves in June to roughly two instances at present.

Because of this, analysts warn that additional premium compression might restrict accumulation capability.

Nonetheless, Gerovich known as most well-liked share issuances a “defensive mechanism” defending frequent shareholders from dilution throughout worth convergence.

Japanese BTC investor Metaplanet has introduced a contemporary buy of 136 BTC, boosting its BTC Yield to 487% YTD 2025.#Metaplanet #BTCAccumulation #BTCYieldhttps://t.co/Q5VbxzEH03

— Cryptonews.com (@cryptonews) September 8, 2025

As of September 8, Metaplanet reported a 487% Bitcoin yield year-to-date by aggressive accumulation from 12,000 BTC at June-end to present ranges.

Inventory efficiency, nevertheless, lagged Bitcoin beneficial properties with shares buying and selling close to four-month lows regardless of reaching 20,000 BTC milestones.

Income Era By way of Choices Technique

The corporate allotted ¥20.4 billion from the providing proceeds to the Bitcoin Earnings Era Enterprise, increasing choices buying and selling operations.

Metaplanet generated ¥1.9 billion in gross sales income from Bitcoin choices throughout Q2 2025.

The choices technique addresses Bitcoin’s yield-free nature by producing revenue by lined name writing and volatility buying and selling.

Administration targets full-year working profitability by amassed choices premiums.

Japan's @Metaplanet_JP Q2 monetary report reveals a 468% Bitcoin yield, turning into the 4th largest international holder with 18,113 BTC value $2.1B, concentrating on 210,000 BTC by 2027.#Japan #Bitcoinhttps://t.co/n5xJXwpgW7

— Cryptonews.com (@cryptonews) August 13, 2025

Q2 monetary outcomes confirmed ¥816 million working revenue on ¥1.2 billion income, largely pushed by ¥1.1 billion in Bitcoin choice underwriting revenue.

The enterprise mannequin supplies recurring income streams past worth appreciation hypothesis.

Shareholder base expanded over 1,000% to 128,000 people because the Bitcoin technique gained worldwide consideration.

The corporate reworked from a struggling resort operator to Asia’s most distinguished company Bitcoin holder.

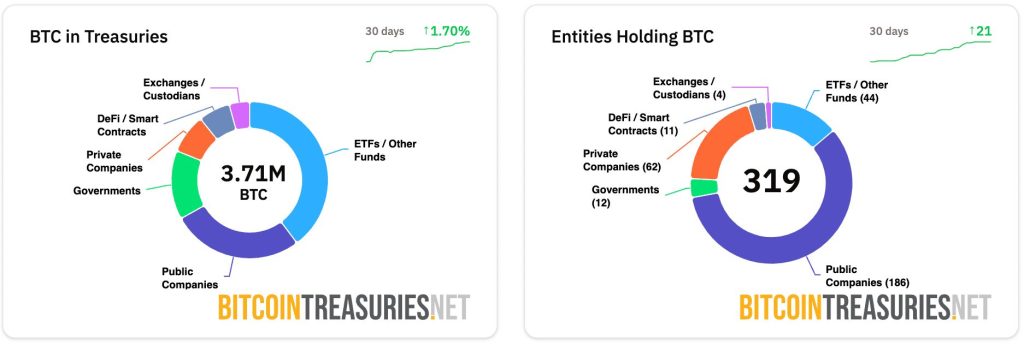

World company Bitcoin motion spans 31 entities controlling over $413 billion in holdings.

Nonetheless, Sentora analysis has just lately warned that almost all contributors received’t survive credit score cycles as a consequence of structural vulnerabilities in rising-rate environments.

Institutional critics argue that idle Bitcoin holdings lack scalability in rising-rate environments with out yield technology capabilities.

Company treasuries more and more face sustainability questions relating to mark-to-market dependency.

For Metaplanet, the worldwide providing worth mirrored a 9.93% low cost to the September 9 reference worth of ¥614, guaranteeing engaging entry factors for abroad institutional buyers.

The settlement proceeds will likely be instantly used for Bitcoin purchases.

Fee completion is ready for September 16, with supply the next day. The timing positions Metaplanet for strategic Bitcoin accumulation by October 2025.

The put up Metaplanet Finalizes $1.45B Share Sale to Fund Bitcoin Purchases, Holdings Hit $2.25B appeared first on Cryptonews.