SOL Methods commenced buying and selling on Nasdaq World Choose Market beneath the ticker STKE with $94 million in Solana treasury holdings.

The Canadian agency turns into the primary Solana-focused public firm to realize a U.S. itemizing and maintains twin listings on CSE beneath the image HODL.

The Nasdaq debut follows months of preparation, together with a one-for-eight share consolidation, decreasing excellent shares from 176 million to 22 million to satisfy alternate necessities.

We did it

That is validation for the complete Solana Ecosystem!pic.twitter.com/bKGCyZBwV7

— SOL Methods (@solstrategies_) September 9, 2025

Digital Bell Ceremony Bridges Conventional Finance with Blockchain

SOL Methods hosted an revolutionary on-chain bell ringing ceremony at stke.group, permitting contributors to memorialize their participation by means of everlasting Solana blockchain transaction memos.

The celebration included stay X Areas discussions that includes business companions and firm management.

The corporate operates as a “international personal issuer” beneath SEC guidelines, exempting it from sure U.S. regulatory necessities, together with proxy solicitation guidelines and Part 16 filings.

This standing permits continued operation beneath Canadian governance requirements with out requiring a majority of unbiased administrators.

Present capital construction consists of 22 million widespread shares excellent, 12 million warrants, and 5.3 million inventory choices following the consolidation.

The agency rebranded from Cypherpunk Holdings in September 2024, shifting focus completely to Solana blockchain infrastructure and funding.

Now, SOL Methods manages 3.62 million SOL beneath delegation, together with 402,623 SOL from its treasury, valued at C$111.7 million.

File participation consists of 8,812 distinctive wallets staking with the agency, and Cathie Wooden’s ARK Make investments shifting 3.6 million SOL value roughly C$888 million to SOL Methods infrastructure in July.

Institutional Solana Treasury Arms Race Accelerates

SOL Methods faces rising competitors as establishments race to construct large Solana treasuries.

Ahead Industries introduced a $1.65 billion personal placement led by Galaxy Digital, Leap Crypto, and Multicoin Capital to ascertain a digital asset treasury technique centered on Solana.

Kyle Samani from Multicoin Capital will turn into Ahead Industries Chairman following transaction completion.

Galaxy Digital contributes institutional infrastructure, together with buying and selling, lending, and staking companies, whereas Leap Crypto supplies technical experience by means of initiatives just like the Firedancer validator consumer.

DeFi Improvement Company holds 1.27 million SOL valued at $248 million after elevating $122.5 million in debt financing led by Cantor Fitzgerald. The agency added almost 292,000 SOL in latest months.

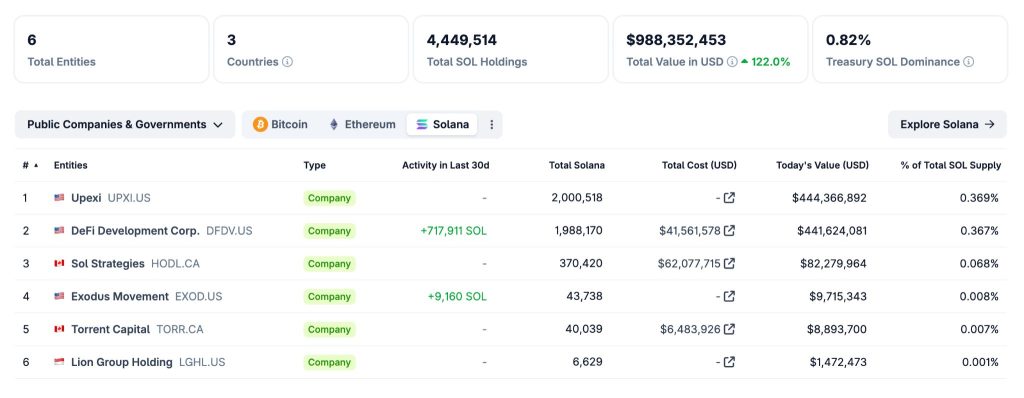

Upexi stays the most important company holder with over 2 million SOL value roughly $444 million, based on CoinGecko.

Simply as we speak, QMMM Holdings reported a 1,736% inventory enhance after asserting plans to construct $100 million crypto treasury focusing on Bitcoin, Ethereum, and Solana.

The Hong Kong-based digital media agency’s “crypto-autonomous ecosystem” combines synthetic intelligence with blockchain know-how.

The 5 largest institutional holders now management over 3.7 million SOL value $726 million, with institutional possession representing roughly 1.55% of the overall circulating provide.

Technical Evaluation Factors to Imminent Breakout

SOL at the moment trades at $216.24 inside a well-defined ascending channel that has guided its advance from $152 to present ranges.

A number of horizontal resistance ranges are marked at $185.78, $204.58, $209.79, $218.60, with projected targets at $245.06.

The 4-hour chart exhibits SOL positioned slightly below $218.60 resistance, testing a key breakout degree following latest progress by means of a number of resistance zones.

The ascending trendline supplies crucial assist round $210-212, sustaining the bullish channel construction.

Stage Concept evaluation signifies SOL stays in “Stage 2 Uptrend” following an prolonged “Stage 1 Basing” interval.

$SOL

Clearly in stage 2 uptrend

Now testing native resistance

Phantom indicator turned bullishpic.twitter.com/fNzk0vQqtO

— Wick (@ZeroHedge_) September 10, 2025

The Phantom indicator exhibits bullish readings regardless of latest consolidation, suggesting underlying momentum stays constructive for continued advances.

Weekly charts verify SOL’s place effectively above the 200-day shifting common at $158.43, validating long-term uptrend integrity.

Notably, some analysts have found a”sluggish grind increased” sample that exhibits constant respect for ascending trendline assist, indicating institutional accumulation offering flooring throughout weak point.

This regular advance with minimal volatility usually precedes explosive strikes as resistance ranges are overcome.

Based mostly on technical proof throughout a number of timeframes, SOL seems positioned for continued bullish momentum towards the $245 goal.

The fast focus facilities on breaking decisively above $218.60 resistance, which might seemingly set off momentum-based shopping for towards measured transfer aims with assist maintained across the $210 – $212 ascending trendline.

The submit SOL Methods Now Buying and selling on Nasdaq as STKE with $94M Solana Treasury Holdings – SOL Breakout Subsequent? appeared first on Cryptonews.