Spot Bitcoin ETFs returned to robust inflows this week, whilst Ethereum funds confronted sharp withdrawals, exhibiting a shifting dynamic between the 2 largest cryptocurrencies.

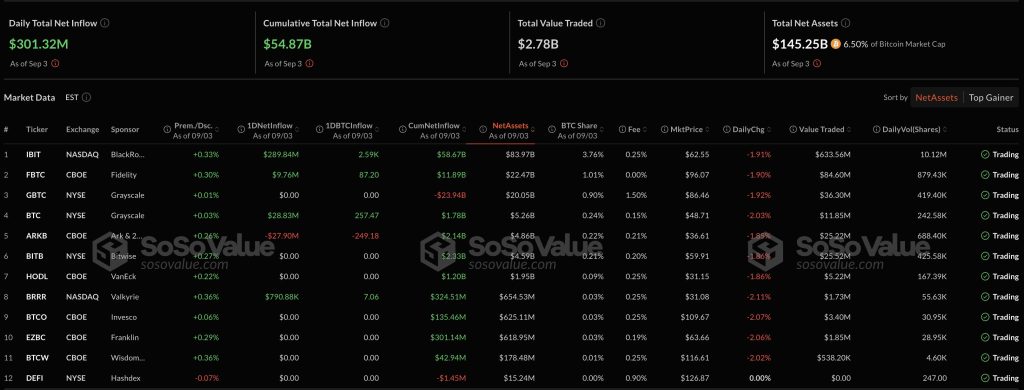

In line with knowledge from SoSoValue, Bitcoin spot ETFs posted a web influx of $301.3 million on September 3, whereas Ethereum merchandise shed $135.3 million.

Bitcoin ETFs Surge Whereas Ethereum ETFs Reverse August Momentum

BlackRock’s iShares Bitcoin Belief (IBIT) led the cost with $289.8 million in recent inflows, bringing its property below administration to $58.6 billion.

Grayscale’s Bitcoin Mini Belief adopted with $28.8 million, whereas Ark Make investments and 21Shares’ ARKB logged the day’s steepest outflow at $27.9 million.

Throughout the sector, Bitcoin ETFs now maintain a mixed $145.2 billion in property, equal to six.5% of Bitcoin’s market capitalization, with cumulative inflows reaching $54.8 billion.

Amongst Ethereum ETFs, each day web outflows have been led by BlackRock’s flagship ETHA fund, which shed $151.9 million. This was adopted by Constancy’s FETH, which added $65.8 million, and Grayscale’s lower-fee Mini Belief, which attracted $62.5 million.

Bitwise logged $20.8 million in recent inflows, whereas different issuers equivalent to VanEck, Franklin Templeton, 21Shares, and Invesco noticed no main modifications.

Regardless of the setback, cumulative inflows throughout all Ethereum ETFs stay constructive at $13.34 billion, with BlackRock accounting for about $13 billion of that whole.

The surge reverses a development from August, when Ethereum funds dominated exercise. ETH merchandise attracted $3.87 billion in inflows final month in contrast with $751 million in Bitcoin outflows.

Buying and selling volumes confirmed the divergence, with Ethereum ETF exercise leaping to $58.3 billion in August, practically double July’s whole, whereas Bitcoin volumes slipped to $78.1 billion.

Ethereum additionally posted a brand new all-time excessive of $4,953 in August, supported by company treasuries holding a mixed $119.6 billion of ETH by the top of the month.

However September is telling a special story. On August 29, Ethereum ETFs logged $164.6 million in outflows, breaking a five-day influx streak that had added $1.5 billion.

Cumulative inflows stay constructive at $13.34 billion, virtually fully concentrated in BlackRock’s ETHA, which accounts for $13.1 billion. Analysts be aware Ethereum traditionally struggles in September, citing $46.5 million in ETF outflows throughout the identical month in 2024.

Bitcoin, against this, gained $1.26 billion that September, benefiting from risk-off positioning.

Whales Scoop Up $620M in Ether as Establishments Increase Publicity

Regardless of the most recent ETF withdrawals, whale and institutional exercise counsel a sustained urge for food for Ether.

Final week, 9 giant addresses bought $456.8 million price of ETH, with 5 wallets receiving transfers from custodian BitGo and others buying cash via Galaxy Digital.

Lookonchain knowledge added that newly created wallets gathered one other 35,948 ETH, price $164 million, inside eight hours, with tokens sourced from FalconX and Galaxy Digital.

Whales preserve accumulating $ETH.

2 newly created wallets withdrew 34,000 $ETH($151M) from #Binance and deposited it into #Aave.https://t.co/JLrql2eSkIhttps://t.co/wU0XaxBFnJ pic.twitter.com/C9JEa01yJw— Lookonchain (@lookonchain) September 4, 2025

Establishments are additionally lively. Bitmine acquired 14,665 ETH price $65.3 million from Galaxy Digital, whereas three wallets acquired 65,662 ETH, valued at $293 million, from FalconX.

Largest Ethereum company holder, Bitmine bought 80,325 ETH from Galaxy Digital and FalconX, valued at $358 million.#Bitmine #EthereumTreasury #ETHhttps://t.co/UkO379Hnjz

— Cryptonews.com (@cryptonews) September 4, 2025

In the meantime, BlackRock deposited 33,884 ETH, price $148.6 million, into Coinbase Prime. The exercise follows studies that the agency bought $151.4 million in ETH whereas doubling its Bitcoin purchases, illustrating shifting allocations between the 2 property.

Ethereum’s relative power provides context. Over the previous month, Ether has gained 18.5%, whereas Bitcoin has slipped 6.4%. ETH now trades 6.7% under its document excessive, whereas Bitcoin stays greater than 10% off its $124,500 all-time excessive earlier this 12 months

Analysts identified that some long-term Bitcoin holders are taking earnings. A whale who purchased BTC in 2013 at $332 just lately moved 750 cash, price $83.3 million, to Binance. On-chain watchers urged the funds might rotate into Ethereum, echoing earlier transactions the place whales bought Bitcoin to purchase Ether.

One such commerce this month noticed 670 BTC, price $76 million, transformed into 68,130 ETH valued at $295 million. One other long-dormant handle withdrew 6,334 ETH, price $28 million, from Kraken after years of inactivity.

Bitcoin Consolidates as Binance Futures Quantity Hits $2.6 Trillion

Bitcoin (BTC) is buying and selling at $110,778, down 0.7% prior to now 24 hours and 1.9% over the week. The asset stays 10.5% under its $124,500 all-time excessive.

Notably, over the weekend, BTC dropped to $107,400, its lowest stage in seven weeks, earlier than rebounding to $112,000.

Glassnode knowledge reveals the correction cooled the “euphoric part” that started in mid-August, when 100% of Bitcoin’s provide was in revenue.

Sustaining such circumstances sometimes requires robust inflows, which light by late August. Presently, 90% of provide stays in revenue, throughout the $104,100–$114,300 value foundation vary.

Glassnode famous {that a} break under $104,100 might set off one other post-ATH drawdown, whereas a restoration above $114,300 would point out renewed demand.

Quick-term holders noticed earnings collapse from above 90% to only 42% through the decline. Whereas the rebound restored profitability to over 60% of their provide, analysts warned that the restoration is fragile.

Glassnode stated solely a transfer above $114,000–$116,000, the place 75% of short-term holders can be in revenue, might restore confidence for a recent rally.

Resistance stays heavy within the $111,700–$115,500 zone, which aligns with the 50-day and 100-day easy shifting averages.

“BTC has been consolidating under its earlier native vary and has did not retake it,” dealer Daan Crypto Trades famous on X, including that the $107,000 month-to-month low could not maintain if promoting stress intensifies.

Supply: Daan Crypto Trades

In the meantime, Binance futures buying and selling surged to a document $2.62 trillion in August, up from $2.55 trillion in July, in line with CryptoQuant. The spike displays heightened volatility, elevated hedge fund and institutional participation, and rising open curiosity.

Analysts cautioned that whereas robust derivatives exercise signifies liquidity, futures-driven momentum with out steady spot inflows usually precedes sharp corrections.

For now, Bitcoin stays range-bound, with bulls needing to reclaim $114,000 to verify a stronger restoration.

The put up Ethereum ETFs Bleed Amid $301M BTC Influx, But Whales Purchase Extra ETH – Right here’s Why appeared first on Cryptonews.