Hyperliquid shattered income data in August with $106 million earned from perpetual futures buying and selling, marking a 23% improve from July’s $86.6 million because the decentralized change captured 70% market share amongst DeFi perpetuals platforms.

The milestone got here alongside $383 billion in month-to-month buying and selling quantity and an annualized income reaching $1.25 billion, in keeping with DefiLlama.

Lean Crew of 11 Workers Outperforms Monetary Giants Via Automation

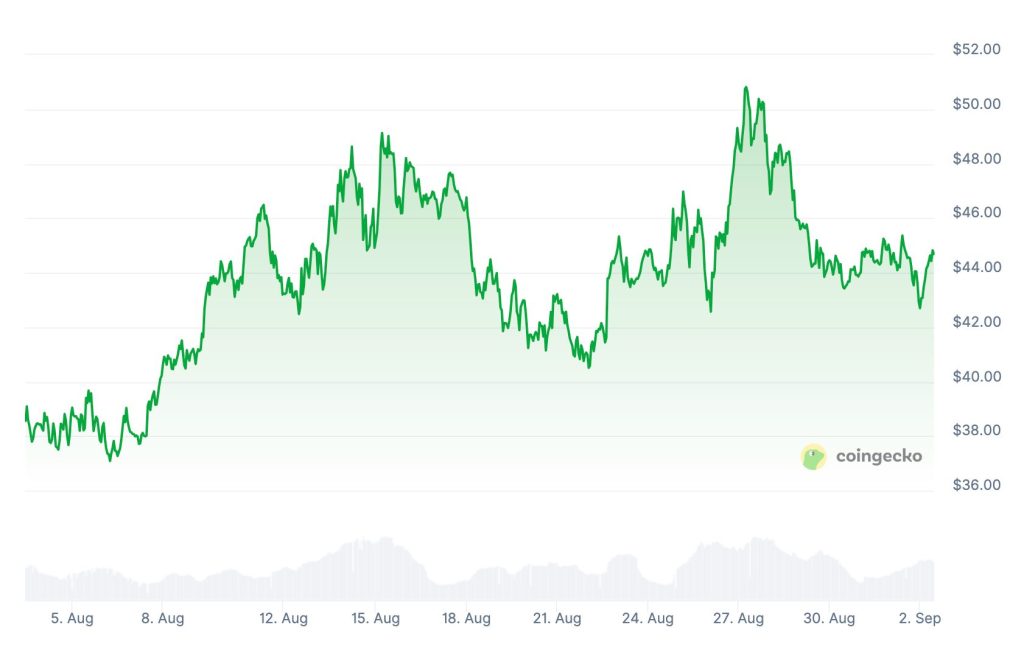

The platform’s HYPE token reached an all-time excessive of $51.12 on August 27, with beneficial properties of over 400% since April.

Not too long ago, Arthur Hayes revealed his boldest prediction but, forecasting that HYPE may surge 126x by 2028 as stablecoin adoption reaches $10 trillion and transforms the decentralized buying and selling infrastructure.

Hyperliquid operates with simply 11 staff whereas processing $330.8 billion yearly, creating effectivity ratios that dwarf conventional cost giants.

PayPal employs 29,000 employees to deal with $1.6 trillion yearly, whereas Visa makes use of 28,000 staff for $13 trillion in quantity.

The change constructed its aggressive benefit on HyperEVM, a customized Layer 1 blockchain that eliminates gasoline charges for trades whereas sustaining totally on-chain order books.

This technical structure attracted merchants from centralized platforms looking for excessive efficiency with out conventional DeFi friction factors.

Technical Innovation Drives 70% DeFi Perpetuals Market Seize

Hyperliquid’s dominance stems from fixing core DeFi buying and selling issues by way of purpose-built infrastructure that eliminates conventional ache factors.

The platform’s HyperEVM blockchain processes trades with out gasoline charges, sustaining full on-chain transparency, whereas making a hybrid mannequin that mixes the efficiency of CEXs with the advantages of DEXs.

The change outpaced Robinhood in buying and selling quantity for 3 consecutive months, producing over $28 million in weekly income whereas processing volumes that exceeded these of established centralized rivals, resembling Bitstamp.

Buying and selling exercise reached $29 billion in 24-hour quantity throughout market volatility durations, with $7.7 million in each day charges throughout peak durations.

DeFi Llama knowledge reveals that the whole worth locked is climbing to $762.57 million from $230.48 million in April, whereas month-to-month DEX quantity has exploded from $57.54 million in March to over $22 billion just lately.

The platform’s cumulative perpetual futures quantity has additionally reached $2.57 trillion.

Institutional adoption accelerated by way of strategic partnerships, together with Anchorage Digital Financial institution custody companies and Circle’s native USDC deployment.

The platform’s lean operational mannequin depends closely on automation and sensible contracts to interchange conventional finance departments.

Settlement, reconciliation, compliance checks, and buyer operations are built-in immediately into the infrastructure, enabling huge scale with minimal staffing necessities.

Arthur Hayes Tasks 126x Returns as Stablecoin Revolution Unfolds

Former BitMEX CEO Arthur Hayes has revealed his most aggressive crypto prediction, forecasting that HYPE may obtain 126x returns by 2028, as Treasury Secretary Scott Bessent’s insurance policies create the biggest DeFi bull market in historical past.

Hayes’ thesis facilities on capturing $34 trillion in international deposits by way of compliant stablecoin infrastructure.

The prediction assumes Hyperliquid will turn out to be the biggest crypto buying and selling venue as stablecoin provide reaches $10 trillion, with each day volumes matching Binance’s present $73 billion throughput.

@CryptoHayes says HYPE may surge 126x by 2028 as $10T stablecoin increase is ready to reshape finance.#Hyperliquid #Stablecoinhttps://t.co/HhuG7nx0RE

— Cryptonews.com (@cryptonews) August 28, 2025

Hayes fashions the change, sustaining its 67% DeFi market share whereas increasing into broader crypto derivatives buying and selling in opposition to centralized rivals.

Hayes nicknamed Treasury Secretary Scott Bessent “Buffalo Invoice” for the anticipated dismantling of the Eurodollar banking system, projecting insurance policies will power $10-13 trillion in international deposits into U.S. Treasury-backed stablecoins.

The technique targets International South retail deposits by way of WhatsApp and social media platforms geared up with crypto pockets performance.

Nevertheless, Polymarket odds for HYPE reaching $100 in 2025 have decreased to 24% from 35% in August, however are anticipated to extend with the anticipated Federal Reserve fee cuts.

Institutional traders, together with Arthur Hayes, collected over 58,631 HYPE tokens value $2.62 million, whereas 21Shares launched exchange-traded merchandise on SIX Swiss Alternate.

Present HYPE metrics embody $44.43 token worth, $13 billion market capitalization, and $364.93 million each day quantity.

The token trades simply 12% under its earlier peak, however stays bullish throughout technical indicators.

Wanting ahead, Hyperliquid’s future progress vectors embody increasing past perpetuals into tokenized belongings, deeper fintech integrations, and potential organizational scaling because the income trajectory attracts funding hypothesis.

The platform continues to function like a funds powerhouse disguised as a startup, processing institutional-grade volumes whereas nonetheless upholding DeFi rules and transparency requirements.

The publish Hyperliquid Smashes Income File with $106M in August, Dominates 70% of DeFi Perps Market appeared first on Cryptonews.